Highlights:

- The Pepe price has soared over 20% in the past week, to trade at $0.0000045 mark today.

- On-chain and derivatives market shows a potential upside towards the $0.0000050 mark.

- The technical outlook shows bullish strength, as momentum indicators turn positive.

PEPE price is holding steady at $0.0000045 on Monday, after gaining more than 20% last week. The positive outlook is supported by on-chain and derivatives data, which suggest additional gains in the future, with whale accumulation rising alongside long bets. Technical forecasts indicate that PEPE might check its short-term resistance at $0.0000050 in case the bullish performance continues in the market.

According to the Supply Distribution data from Santiment, the PEPE price looks promising, as whales are buying the frog-themed memecoin amid current price declines. The metric shows that the amount of PEPE tokens accumulated by whales with between 100,000 and 1 million tokens (red line), between 1 million and 10 million (yellow line), and between 10 million and 100 million (blue line) has been 11.82 billion since February 11.

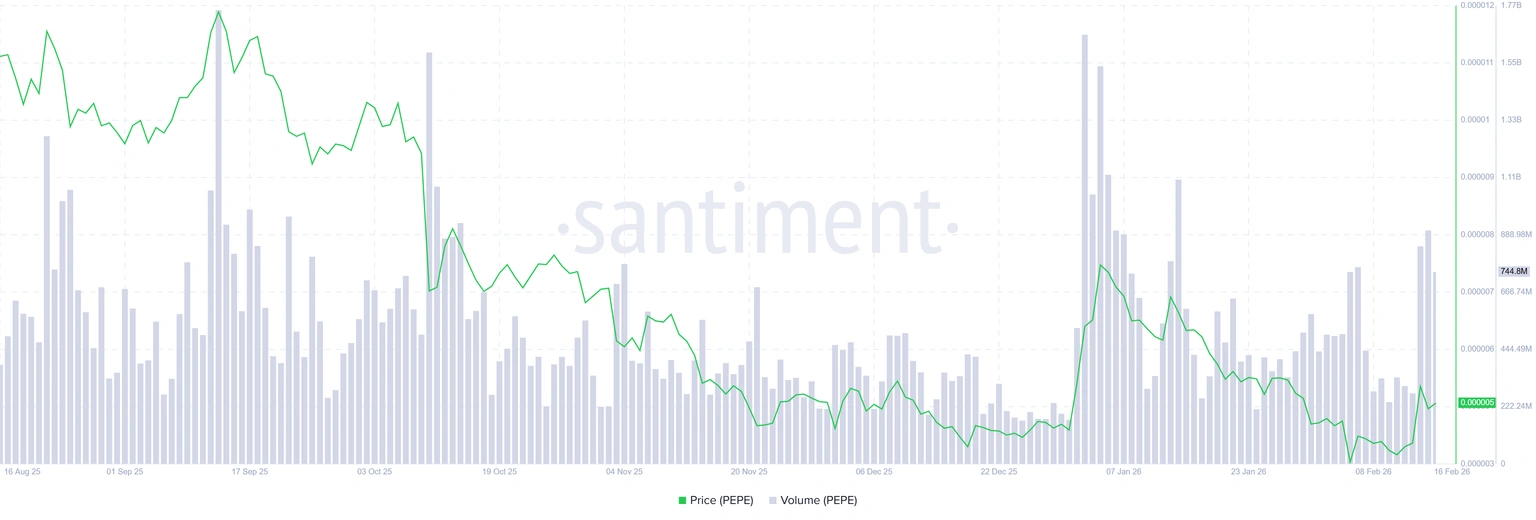

According to Santiment data, the trading volume (the total trading volume of the entire exchange applications on the chain) in the Pepe ecosystem was $905.99 million on Sunday. On Monday, the meme coin recorded about $744.80 million, the highest and the lowest point respectively since mid-January. This increase in volume signifies that traders have become interested in the meme coin, and this increases confidence in the PEPE price.

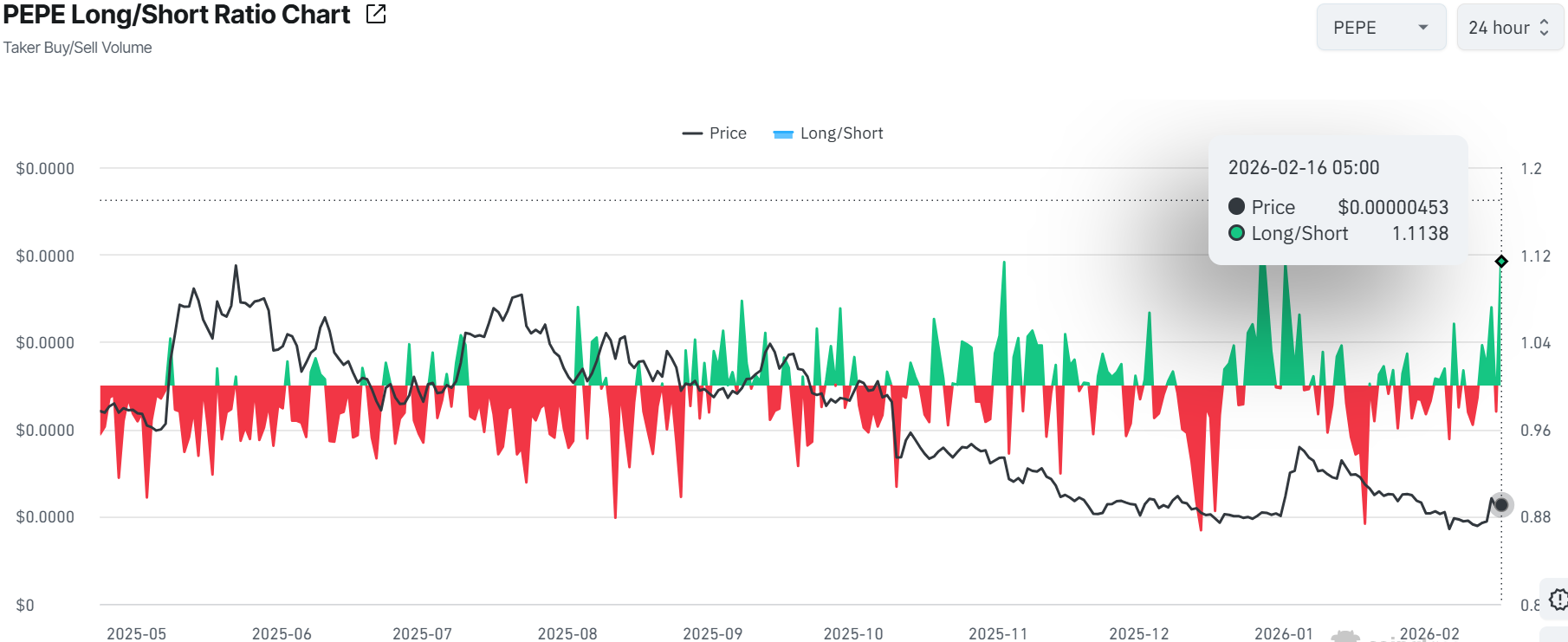

On the derivatives market, PEPE’s long-to-short ratio sits at 1.138 on Monday, a high since the beginning of the month. This is a ratio of more than one, which shows that traders are expecting the PEPE price to go up.

PEPE Price Eyes $0.0000050 Resistance Zone

Looking at the technical side, PEPE’s daily chart signals a crucial moment for traders and investors. After rebounding from lows near $0.0000027, PEPE is showing signs of further upside as it breaks above the falling channel. The price, however, still holds below both the 50-day and 200-day simple moving averages (SMA) at $0.0000050 and $0.0000070, respectively.

Buyers have defended the $0.0000043-$0.0000036 support zone. If this range holds, technicals suggest a potential push toward the immediate resistance at $0.0000050, triggering a short-term bullish outlook.

The short-term indicators offer a mixed-to-bullish outlook. The Relative Strength Index (RSI) is at 52.09, which is neutral but leaves room for more upside if momentum builds. The MACD (Moving Average Convergence Divergence) has flipped above the orange signal line, but still sits below in the negative territory. This indicates that bearish pressure is weakening, and buyers could regain control soon.

Looking at the bigger picture, if bulls keep the price above $0.0000043 and buyers respond to any short dips, PEPE price could climb toward the $0.0000050 area quickly. However, a drop below $0.0000043 might trigger short-term selling and see PEPE retest support closer to the $0.0000036 zone, before new buyers step in. In the meantime, traders should be cautious, as the market shows mixed sentiment.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.