Highlights:

- Grayscale’s S-1 filing aims to introduce an AAVE spot ETF.

- The proposed ETF will charge a 2.5% fee and list on the NYSE Arca.

- Coinbase will act as the custodian and prime broker for the ETF.

Grayscale Investments submitted an S-1 registration for the AAVE spot ETF with the U.S. Securities and Exchange Commission (SEC) on February 13, 2026. The filing contained Accession No. 0001193125-26-051643 and was accepted by the SEC the same day, at 16:48:32 Eastern Time. This filing marks a turning point for cryptocurrency ETFs, as Grayscale continues to expand its products in the crypto space.

Grayscale Moves to Launch AAVE Spot ETF

Grayscale, a pioneer in digital asset management, has previously introduced several digital assets into the market. The AAVE ETF follows products, such as Bitcoin and Ethereum spot ETFs, approved by the SEC in recent years. The company currently aims to offer investors direct exposure to AAVE.

The AAVE spot ETF intends to make the cryptocurrency more accessible to traditional investors. AAVE is a decentralized finance (DeFi) protocol known for its lending platform, where users are able to lend and borrow cryptocurrencies. AAVE, as the native token of this protocol, is the governance system of the decentralized autonomous organization (DAO) that powers it.

🚨 JUST IN: GRAYSCALE HAS JUST FILED FOR AN S-1 AAVE ETF pic.twitter.com/HFvUzA95Fg

— Coin Bureau (@coinbureau) February 13, 2026

Furthermore, the Grayscale AAVE ETF will impose 2.5% sponsor fees based on the net asset value (NAV). This fee will be paid by investors using AAVE tokens. Grayscale will engage Coinbase as a prime broker and a custodian for the ETF. This consequently guarantees a trusted infrastructure for managing the assets. Grayscale is also planning to list the ETF on the NYSE Arca, a well-known ETF trading platform.

Grayscale’s Push in the Evolving Crypto Market

Grayscale is competing with other companies like Bitwise, which filed for an AAVE ETF in December 2025. This Bitwise AAVE ETF submission led the firm to beat Grayscale with submissions covering 11 separate funds. Analysts consider this Grayscale’s latest move as an effort to remain competitive in a fast-changing digital asset market.

On December 30, Bitwise submitted applications to the U.S. SEC for 11 cryptocurrency ETFs, including the Bitwise AAVE Strategy ETF, Bitwise UNI Strategy ETF, Bitwise ZEC Strategy ETF, Bitwise CC Strategy ETF, Bitwise ENA Strategy ETF, Bitwise Hyperliquid Strategy ETF, Bitwise…

— Wu Blockchain (@WuBlockchain) December 31, 2025

Meanwhile, Grayscale recently submitted S1 applications for other tokens. In December, it revised its filing to convert its existing Avalanche Trust into a spot ETF. During the same period, the firm updated the S1 filing seeking approval for the Grayscale SUI Trust. These filings indicate the company continues to meet the demand for cryptocurrency exposure and DeFi-related investment products.

In addition to its efforts, Grayscale is also facing competition from other European products, including the 21Shares AAVE ETP and Global X AAVE ETP. These investment vehicles enable investors in Europe to gain exposure to AAVE tokens.

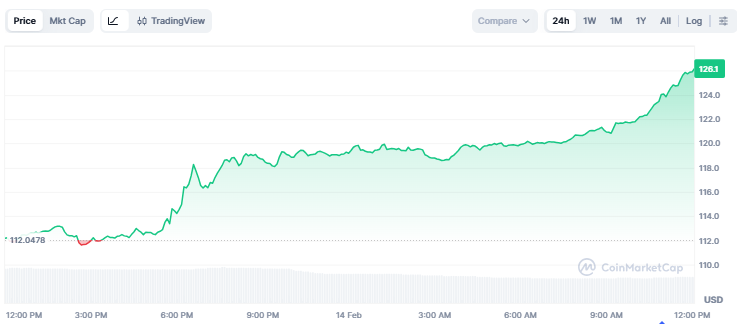

AVAX Price Action

AVAX has seen a positive price response following the announcement of the filing. The token has surged by 12%, pushing the price to $126 over the last 24 hours. The altcoin has, however, declined by 30% on the monthly chart following the broader market downturn. Moreover, its market capitalization and trading volume stand at $1.9 billion and $350 million.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.