Highlights:

- The XRP price is down 14% to trade at $1.35 today.

- The derivatives market shows a drop in open interest as retail demand weakens on XRP ETFs.

- The weak technical signals a deeper downside to $1.33, limiting XRP’s recovery potential.

Ripple (XRP) is actively falling, and it is trading down at $1.35 on Thursday, as risk-off sentiment is being experienced in the crypto market. The remittance token is down 14% today, burdened by huge volatility, retail investor flight, and waning institutional appeal.

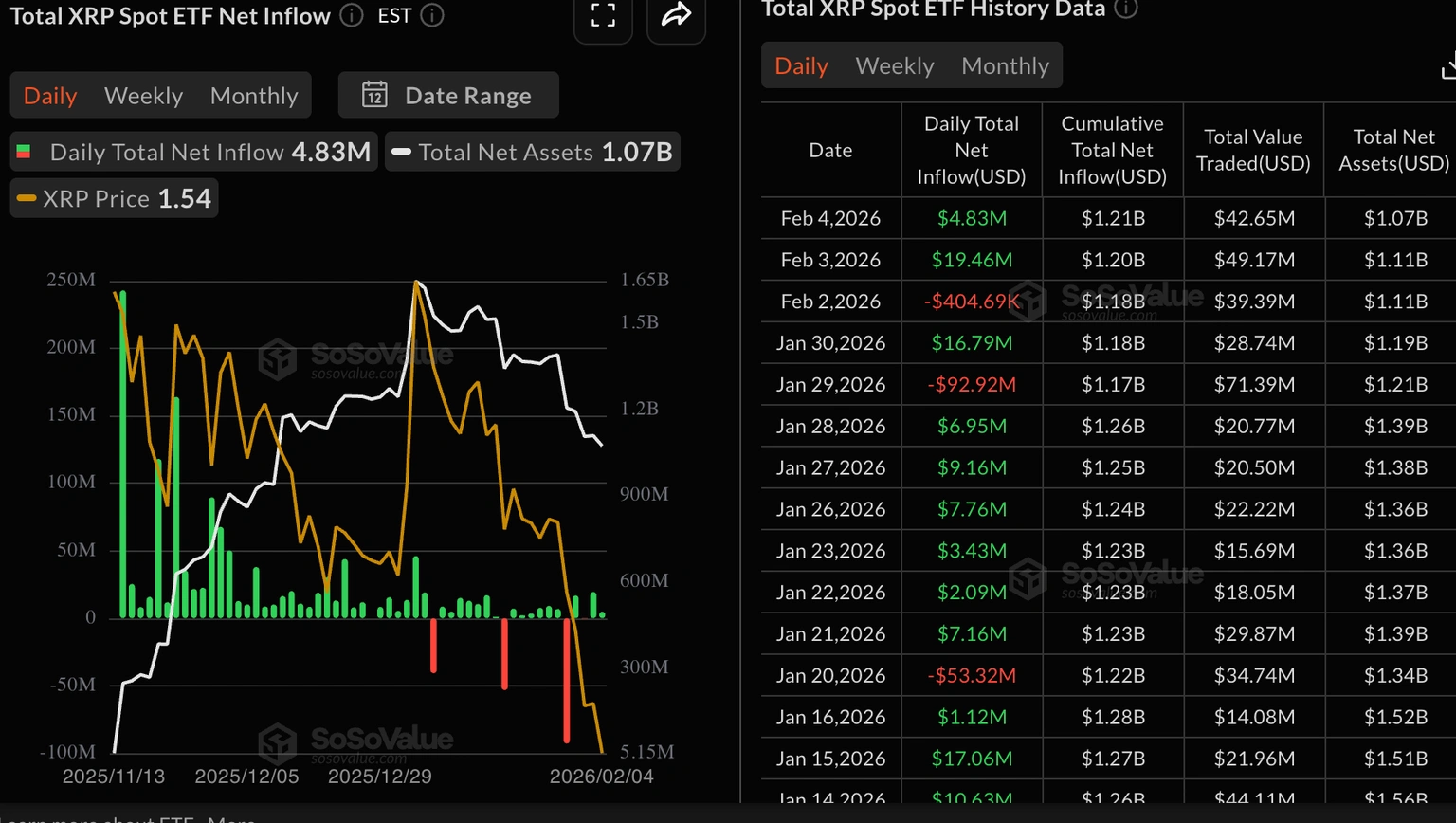

In the meantime, XRP spot Exchange-Traded Funds (ETFs) demand fell on Wednesday, and inflows of almost $5 million were recorded. Mild as it was, this was a second day of inflows after an approximate of $19 million that was posted on Tuesday. The cumulative inflow is at the moment, $1.21 billion and the assets under management are also at 1.07 billion.

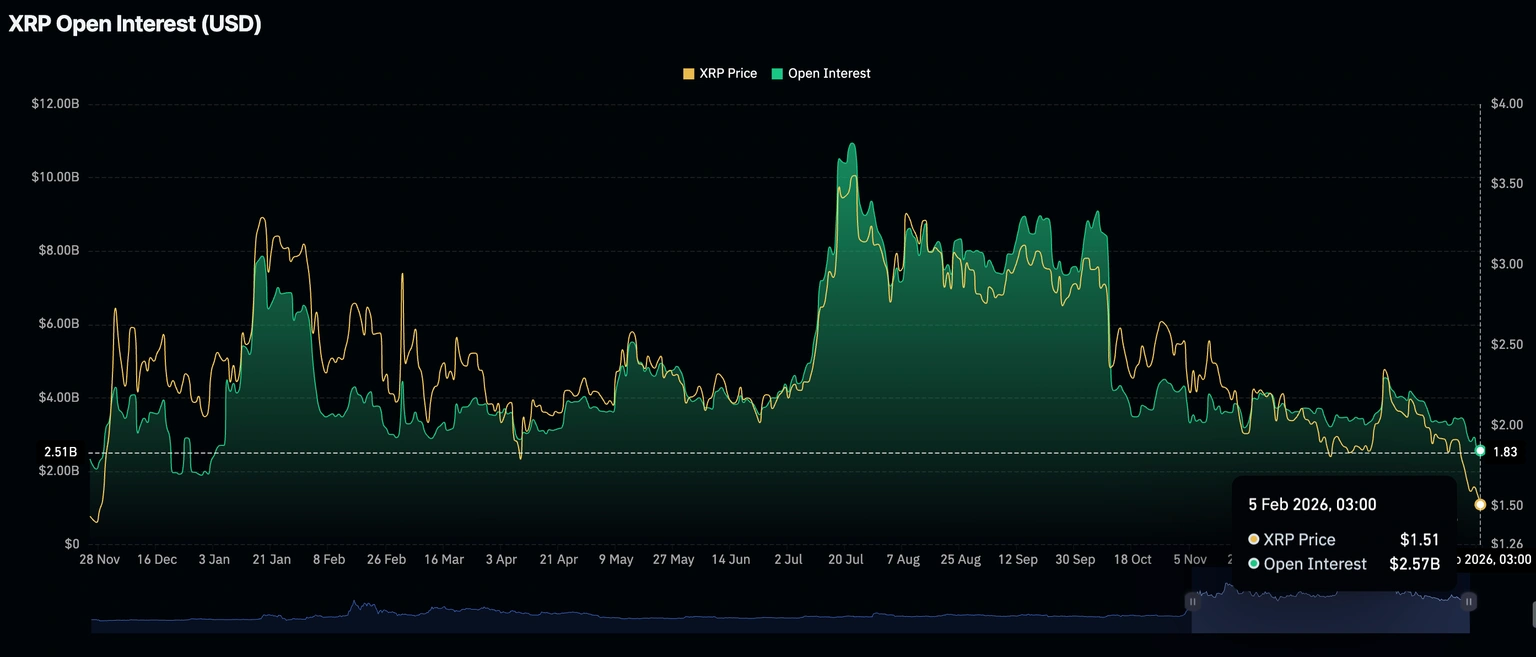

The picture is bearish in the XRP derivatives market, with futures Open Interest (OI) declining to $2.57 billion on Thursday, as compared to $2.61 on Wednesday. According to CoinGlass data, on July 22, the OI recorded a record $10.94 billion before the crash on October 10 that liquidated more than $19 billion of leveraged crypto assets.

In case the derivatives market sell-off is not over, with the traders closing their positions but failing to open new ones, recovery in the XRP market may be a dream. The downturn in the XRP may reach the October 10 low of $1.25.

XRP Bears Target $1.33-$1.25 Levels

A quick look at the XRP/USD daily price action has been very choppy, as the whole crypto market faces an intense sell-off. The daily chart shows the price is currently at $1.35, down nearly 28% over the past seven days. The altcoin is also sitting under both the 50-day Simple Moving Average (SMA) at $1.91 and the 200-day SMA at $2.47, which are both crucial reference points for long-term traders.

If price remains below the $1.91 area, the next likely support sits at the $1.33-$1.25 range, which is a previous strong demand zone. These levels also coincide with an oversold reading on the daily Relative Strength Index (RSI). On the upside, recovering the $1.91 would be the first sign of strength on the bull’s side, while any break above this level could open the door for a move back to $2.00-$2.47.

Meanwhile, the momentum indicators are still bearish. The RSI is under 50 currently at 20.70, showing extremely oversold conditions in the Ripple market. Additionally, the MACD is in the negative territory, with the histograms increasing in size and in red. This shows that the sellers are having the upper hand, and there are no signs of a reversal yet.

Looking ahead, the XRP price could stay volatile as the bulls show no strength. However, if buyers hold the $1.91 zone and push past resistance, the price may recover toward $2.00 quickly. But further heavy selling risks are evident in the market, as the XRP bears target $1.33-$1.25 long-term retracement levels.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.