Highlights:

- The Shiba Inu price has crashed to $0.0000067, marking a slight 0.19% drop today.

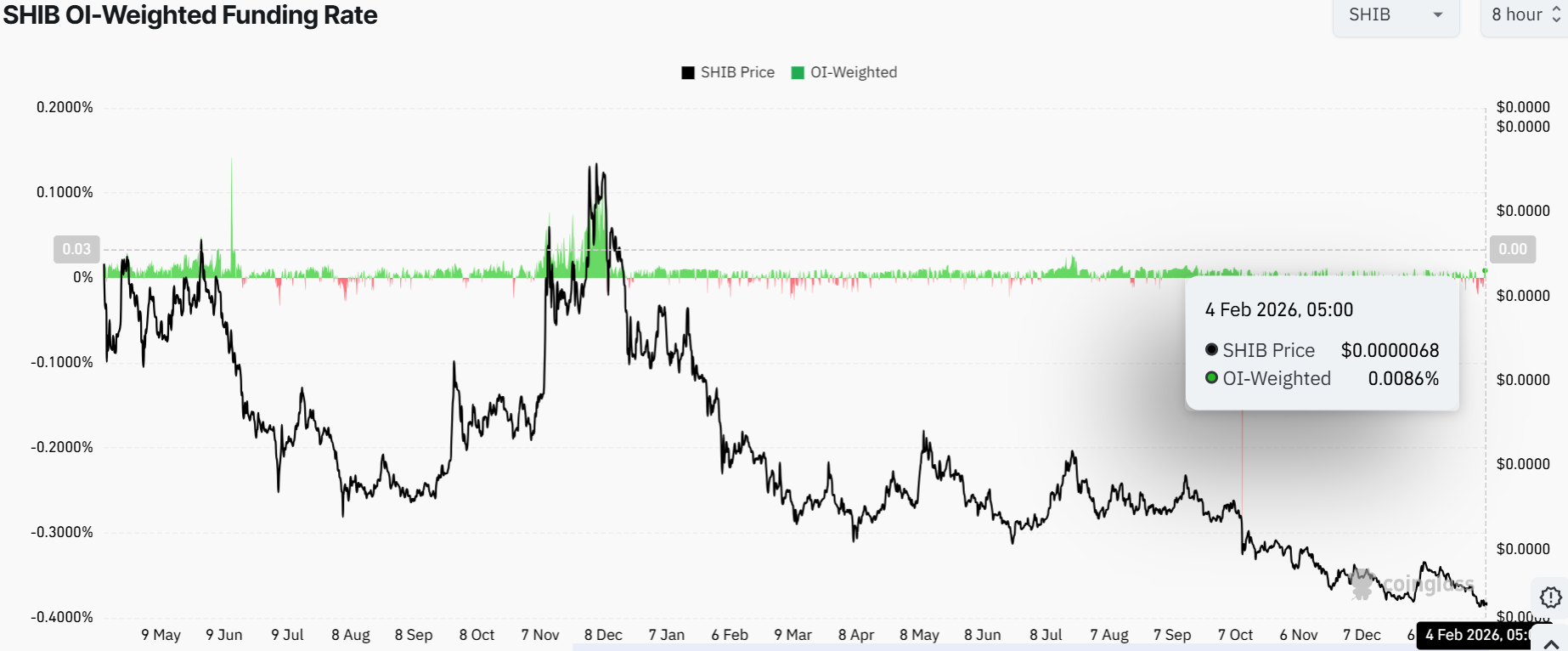

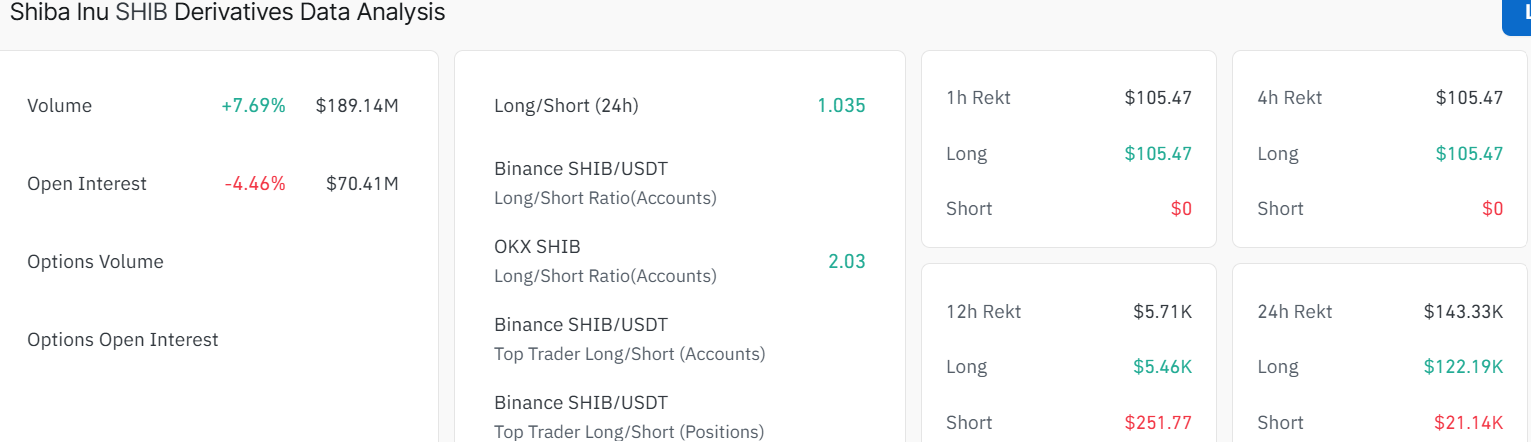

- The derivatives market shows mixed signals as the OI slips while the funding rate flips positive.

- The technical outlook for SHIB recovery stalls as the bearish grip intensifies.

Shiba Inu (SHIB) is stable in price, exchanging hands at $0.0000067, as it is rejected at one of the key resistance areas. The derivatives statistics suggest that traders are mixed, which is another limitation to the possibility of a price rebound.

Meanwhile, the derivatives market is showing a cautious SHIB market. The data provided by CoinGlass indicates that the SHIB funding rate turned positive on Wednesday, with the current standing at 0.0086%. This means long trades are covering the shorts, and that there is a possibility of a bullish tone.

The long-to-short ratio has, however, surged past 1 at 1.035 on the same period, which is an indication of an increase in the number of long bets. However, the SHIB open interest has decreased by 4.46% to $70.41 million, showing a flow of money out of the market. Such deviation in OI emphasizes increasing doubt in the derivatives market, causing the SHIB recovery stall and undermining optimistic beliefs of a rally.

SHIB Price Recovery Stalls as Bearish Grip Mounts

The Shiba Inu price is trading at $ 0.0000067 after a prolonged bearish move. On the daily timeframe, the memecoin is consolidating below the key moving averages that have guided price action to the recent levels. However, recent candles suggest a potential bullish reversal attempt from the current price levels if bulls regain stamina. The SHIB/USDT pair topped out near the 50-day SMA($0.0000077) resistance zone, where strong selling pressure emerged. That rejection at the 50-day SMA marked the start of a steady downtrend in the SHIB market.

Currently, SHIB is bouncing from the lower channel support, which also aligns with a key horizontal support level around $0.0000067-$0.0000063. This zone strengthens the area as an important demand zone for buyers. Historically, similar reactions from such zones have led to short- to medium-term relief rallies.

The RSI is currently around 35.78, which is below the neutral 50 level but above deep oversold conditions. This indicates bearish momentum is weakening. Additionally, RSI has started to flatten and is slightly upward, often an early signal that selling pressure may be fading. On the other hand, the MACD has plunged below the signal line, indicating intense selling pressure. Its move into the negative territory further reinforces the bearish sentiment in the SHIB market.

Looking ahead, a sustained hold above this zone increases the probability of a reversal rather than a continuation breakdown. A bullish confirmation would require the meme coin to break and close above the immediate resistance at the $0.0000077, followed by a reclaim of the $0.0000091-$0.00001 resistance zone. On the downside, failure to hold above the 50-day SMA would invalidate the bullish reversal setup and expose the Shiba Inu price to deeper losses toward $0.0000063.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.