Highlights:

- Michael Saylor’s Epstein mention refers to a 2010 social dinner attendance.

- No links were found between Saylor and Epstein’s criminal actions or crypto use.

- The DOJ confirms zero blockchain transactions in Epstein’s financial history.

The US Department of Justice (DOJ) released millions of Epstein-related documents on January 31. These files consisted of emails, guest lists, and private notes. One of the names that attracted attention was Michael Saylor. He is mentioned in emails between Jeffrey Epstein and publicist Peggy Siegal in 2010.

Saylor spent $25,000 on a dinner party that was organized for the circle of Epstein elites. Siegal claims that Michael Saylor had a problem with social interaction. She also referred to him as a “drugged zombie,” claiming that he did not interact with guests. Regardless of the cruel statements, there were no legal or financial claims associated with Saylor.

According to Epstein-related documents released by the U.S. Department of Justice on January 31, an email sent by Peggy Siegal on May 8, 2010 stated that Michael Saylor, founder of MicroStrategy, donated $25,000 to a charitable event and, in return, gained the opportunity to be… pic.twitter.com/aom2TaFxuT

— Wu Blockchain (@WuBlockchain) February 2, 2026

Michael Saylor’s Epstein Mention Sparks Discussion

The mention of Michael Saylor in the Epstein files stems from an email dated May 8, 2010. Peggy Siegal wrote that he purchased an invitation for a high-end dinner but kept his distance. Her comments mentioned that he was awkward, and he was unresponsive in conversation.

In another email, there was a reference to an overnight stay at the house of “a guy named Michael Saylor.” The identity of the sender is not, however, disclosed. Meanwhile, none of these messages suggests criminal behavior. Siegal hosted events for Epstein at the time, regularly introducing rich people to their social circles. She alleged that Saylor lacked personality and doubted whether she would “take his money.” Still, the communication seems to have been a one-time affair with no underlying connection.

Michael Saylor got cooked by Epstein’s publicist Peggy Siegel who basically said

“He’s so creepy I don’t even know if I can take his money I don’t even know how to blackmail him he has no personality and doesn’t understand social behavior.”

Michael Saylor was saved by his… pic.twitter.com/kE535vpkxW

— Autism Capital 🧩 (@AutismCapital) January 31, 2026

Crypto Leaders and Epstein’s Network Overlap

Michael Saylor was not the only crypto figure named. There were other participants such as Peter Thiel, Adam Back, Joi Ito, and Kevin Warsh. Kelvin Warsh was recently picked by President Donald Trump as the next Fed chair to replace Jerome Powell in May.

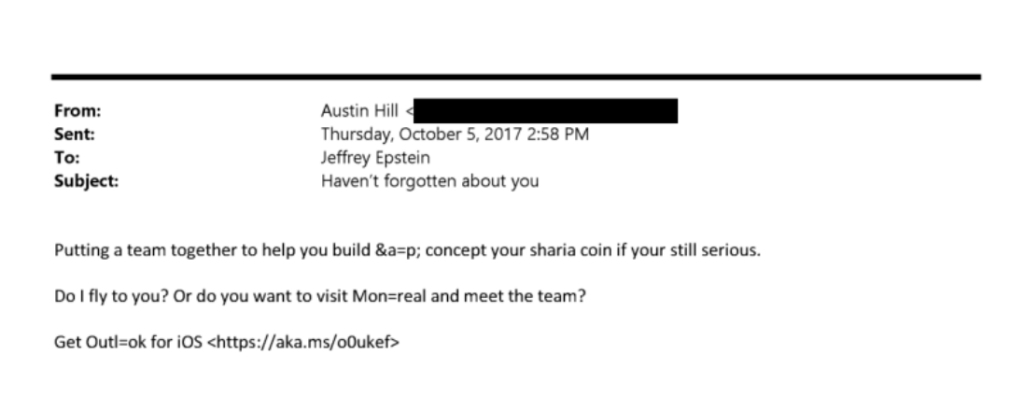

Austin Hill, co-founder of Blockstream, once emailed Epstein and other parties concerning a seed funding round. He said that the round was “10x oversubscribed” and raised allocations. Hill later urged Epstein to suppress funding to Ripple and Stellar, describing them as harmful to Blockstream’s ecosystem.

It is clear that Epstein was curious about crypto. He was briefed on Bitcoin in 2013. Moreover, in 2014, he argued about the identity of Bitcoin with Peter Thiel. He also pitched a Sharia-compliant digital currency to Saudi officials in 2016. He claimed that the Bitcoin creators were enthusiastic about the concept.

However, his view appeared to change by 2017. When questioned, “Do you think it is worth purchasing Bitcoin?” Epstein replied, “No.”

DOJ Finds No Blockchain Crimes in Epstein Files

Although there were a number of links to crypto personalities, the DOJ reported no blockchain abuse. No crypto wallets, laundering, or illegal transfer of tokens were discovered by the investigators. DOJ claimed that Epstein was only interested in it on an intellectual or strategic level. His interaction revolved around investment conversations and personal ideas. Additionally, the records reveal no involvement in digital asset crime.

Meanwhile, Michael Saylor’s Strategy has continued with its accumulation of Bitcoin. The company has announced the acquisition of an additional 855 BTC at about $75.3 million at an average price of $87,974 per coin. It now owns more than 713,000 BTC. However, its stock has plummeted by more than 60% from its peak, recently reaching a low of $138.80.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.