Highlights:

- Jupiter price has increased 14% to trade at $0.21 today.

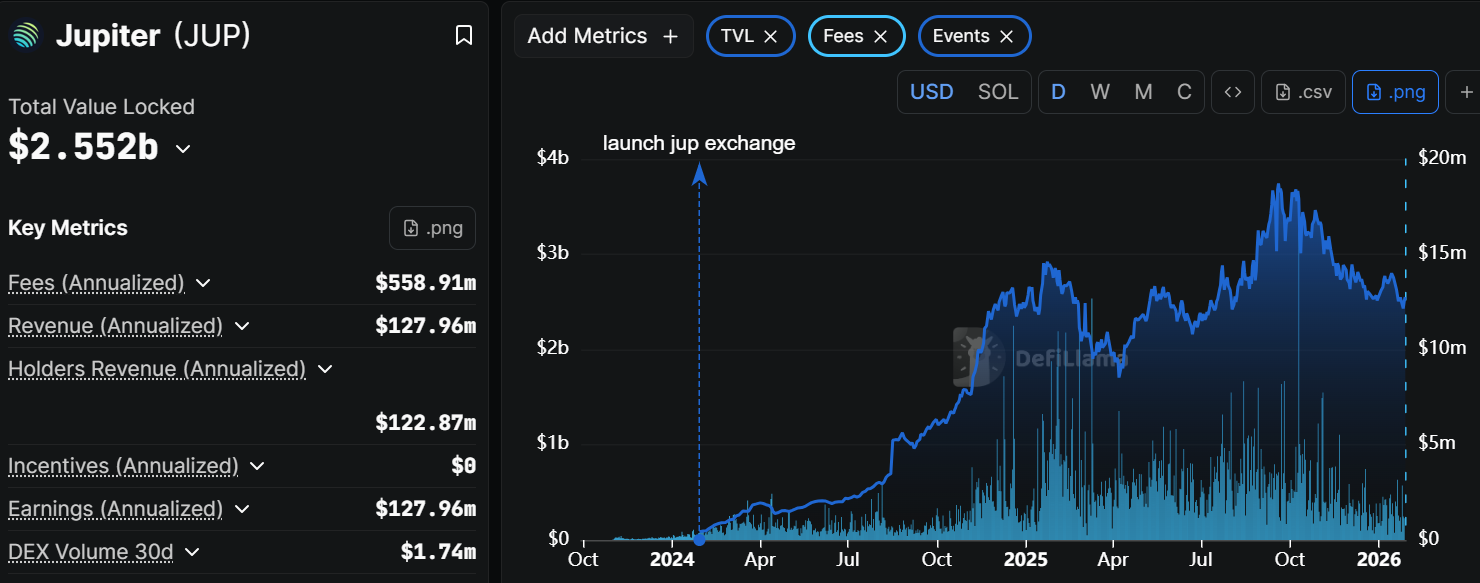

- JUP TVL shows a slight increase to $2.552 billion, indicating growing investor interest.

- The derivatives markets signal a spike in open interest as JUP bulls target $0.37 resistance.

Jupiter (JUP) continues to recover, recording a whooping 14% gains on Wednesday. The Decentralized Exchange (DEX) powered by Solana is celebrating the integration with Coinbase amid the consistent demand on the network, which is shown in the rise of its TVL. Moreover, the retail interest in Jupiter is providing its futures Open Interest with an upward bias as the investor confidence rises.

According to the enhanced network demand, the Total Value Locked (TVL) of Jupiter is at $2.552 billion since it was $2.505 billion on Tuesday. This implies that the number of users depositing funds on the platform has grown.

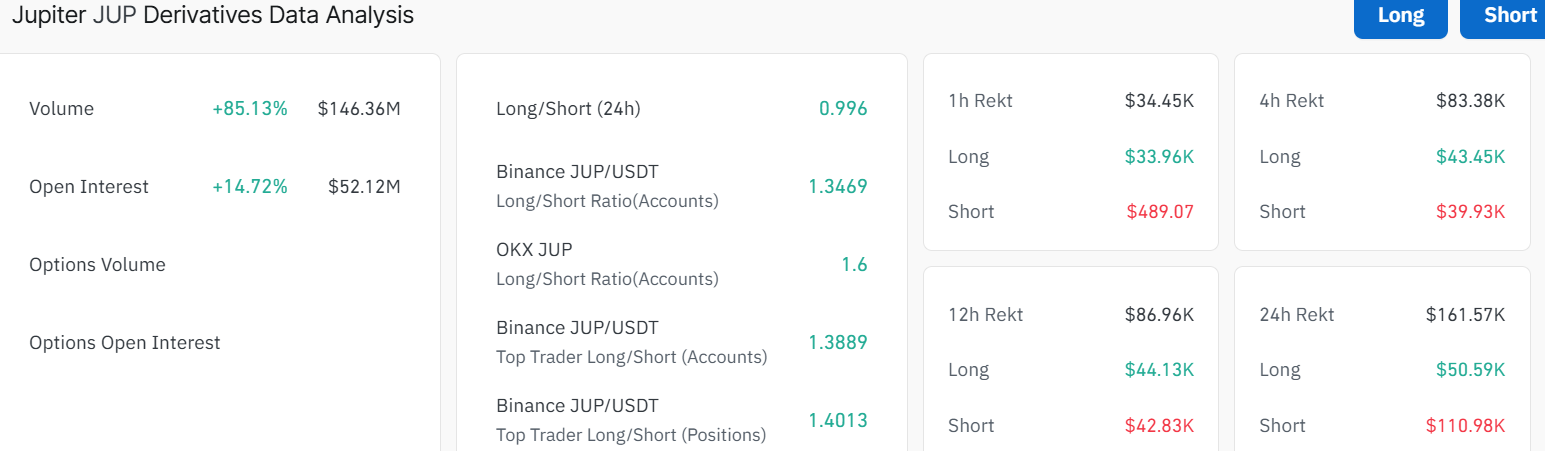

At the same time, Jupiter futures in the derivatives market are experiencing capital inflows as a bearish positional wipeout occurs. According to CoinGlass, JUP Open Interests (OI) has gained by 14% in the past 24 hours, and it is standing at $52.12 million. This means the value of the contract outstanding is growing despite the traders putting more money into it.

Meanwhile, the volume has notably increased by 85%, indicating heightened market activity. The long-to-short ratio sits at 0.996, as bullish momentum is building.

Jupiter Price Eyes $0.37 Zone as Bulls Show Strength

Looking at the price chart, the Jupiter price is holding above an important support level and remains in a consolidation channel. The daily chart shows JUP trading just above the 50-day simple moving average at $0.20, while the 200-day SMA($0.37) acts as the immediate resistance.

The $0.20 price is acting as the major support area, backed up by the 50-SMA. If the price dips near this level, new buyers may tend to step in quickly, pushing it higher. Falling below the $0.20 zone could open up a retest of the next big support around $0.15, aligning with the lower boundary of the channel. The immediate resistance is currently visible near $0.37, with a break above this barrier possibly triggering a move towards the $0.45.

Technical indicators are also signalling optimism in the JUP market. The RSI (Relative Strength Index) is at 56.76, which suggests price is neither overbought nor oversold. This leaves room for movement in either direction, but the bulls are having the upper hand. The MACD (Moving Average Convergence Divergence) sits close to neutral but is gently turning up, a clue that bulls could start to dominate if the trend strengthens.

Looking at the bigger picture, Jupiter price shows a potential upward trend with a clear support area at $0.20 and a resistance at $0.37. As JUP trades between these lines, the outlook stays positive as long as support levels hold. If the token can break out above the upper resistance, the next main target is $0.45-$0.50. Conversely, if the price stumbles or if profit-taking hits the market, traders should watch the $0.20-$0.15 support levels for signs of support and long-term buying activity.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.