Highlights:

- The price of Decentraland is on a good run, currently exchanging hands at $0.169, marking a 16% rise in the past week.

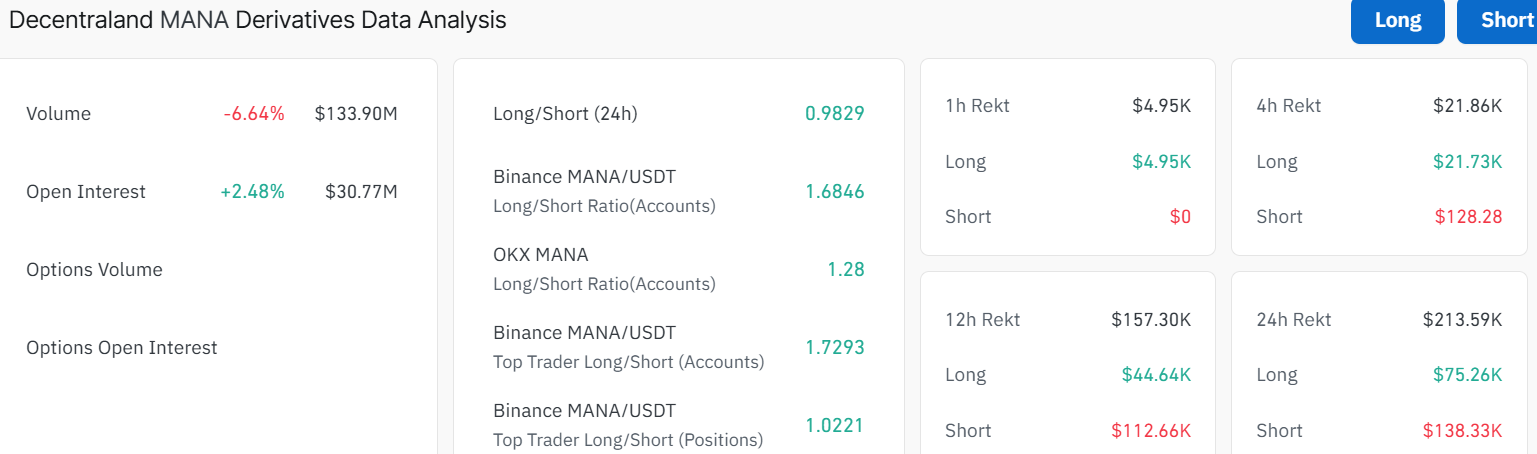

- The derivatives data are very high, suggesting an influx of funds into the MANA market.

- The technical forecast indicates the potential for Decentraland’s price to rise to $0.18- $0.23 as bulls gain strength.

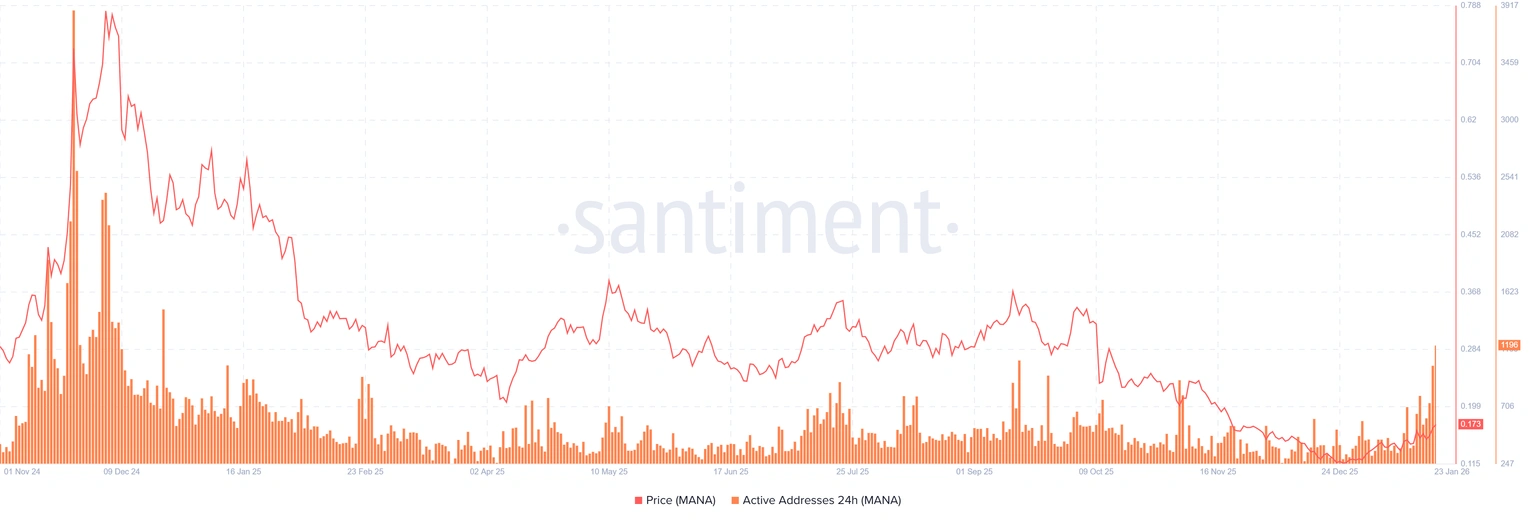

Decentraland (MANA) is trading at $0.169, going up 16% in the last week. The on-chain and derivatives data are supporting this rally. This is coupled with the fact that the Open Interest (OI) has hit a 3-month high, and active addresses per day are increasing. The tide favours the bulls, and this can take MANA to a higher place in the short run.

The CoinGlass data indicate that the OI of the exchange-traded Decentraland futures is at $30.77 million on Friday. This is a better improvement of $20.99 million than the previous day, which was the highest since October 16. The rising OI is an indicator of new funds entering the market and of increased purchases. This may also help in the continuous surge in the price of the MANA token.

Notably, the Santiment Daily Active Addresses index is a daily network activity index. An increase in the metric’s growth indicates it is more widely used. Conversely, if the addresses are low, then the metric is low and hence not demanded. Friday’s 1,196 Daily Active Addresses for MANA are up 562 from Monday. It means demand for Decentraland use is rising, which is encouraging for the MANA price.

Decentraland Price Eyes Further Upside as Support at $0.139 Holds

The daily chart of MANA/USD shows a bullish trend, with momentum steadily increasing. The MANA token is trading at an average of $0.169, in a continuous recovery following the consolidation phase. It can be observed that the large support zone lies at $0.139, which coincides with the 50-day SMA. MANA has broken the important psychological support level of $0.139, which is currently serving as short-term support. The above level is significant for maintaining the bullish trend over the next few days.

On the positive side, the chart shows a clear resistance point at approximately $0.23 that the bulls are failing to break. This region has turned its back on price and may eventually decelerate any further advancement. If the MANA token continues to gain momentum, rising above $0.18 and with high volume, it will most likely retest the resistance area($0.23). A breakout above it would pave the way for a further rise towards $0.24-$0.28.

RSI is approximately 63.79, indicating strong buying power in Decentraland. At the same time, the MACD is indicating a bullish crossover, and the signal line is cutting below it. This also strengthens the bullish grip, which requires additional traders to support MANA. On a broader perspective, MANA is considered bullish as long as the price is above the 50-day SMA.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.