Highlights:

- Axie Infinity price surged 4% to trade at $2.46, as bullish momentum builds.

- The Santiment data shows a surge in whale accumulation and trading volume, indicating confidence among investors.

- The technical outlook shows a positive surge as AXS bulls target $2.70-$3 soon.

The Axie Infinity (AXS) price is up by 4.52% and is valued at $2.46 at the time of writing on Thursday, as it has gained more than 118% in a week. Whale accumulation and volume are also increasing, further reinforcing the bullish price action. Technically, the bulls are in control, as they build momentum targeting $3 soon.

According to the Supply Distribution data of Santiment supports a positive future of Axie Infinity on a rapid whale acquisition. The metric reflects that the total number of whales that have possessed 100,000- 1 million AXS tokens (red line), 1 million- 10 million AXS tokens (yellow line), and 10 million- 100 million AXS tokens (blue line) have amassed a total of 100.56 million tokens from January 12 to Thursday.

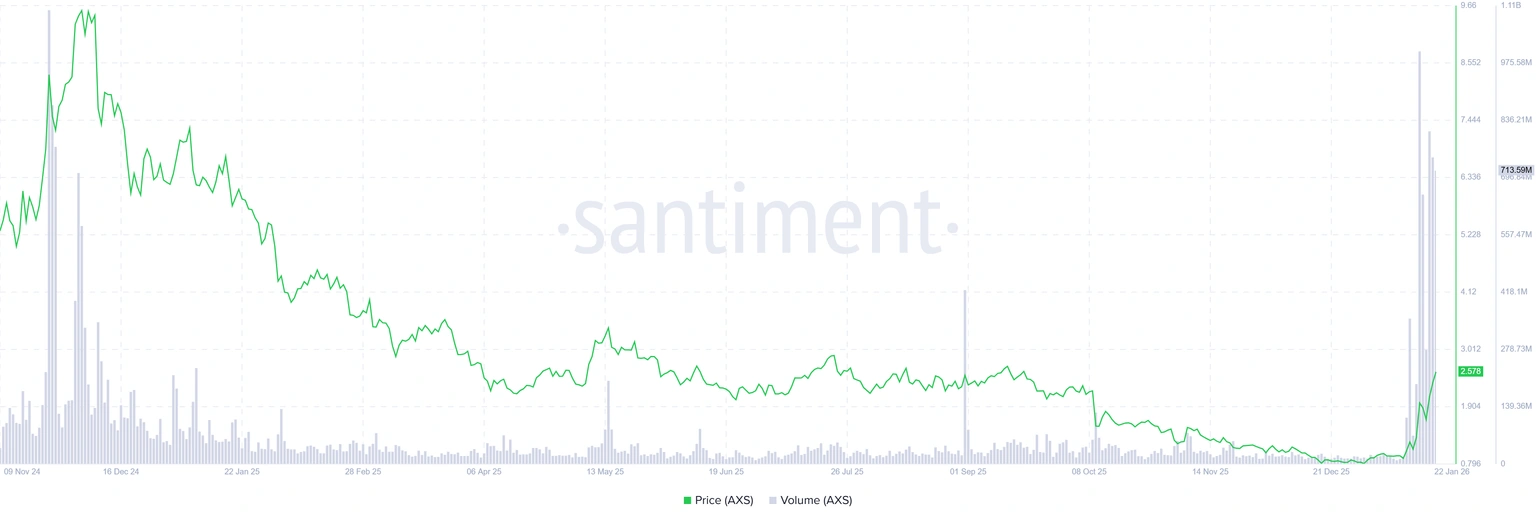

On the other hand, Santiment data show that the trading volume (the total trade volume created by all exchange applications on the chain) in the AXS ecosystem has been at an all-time high. Since January 17, it was at $1 billion on January 17 and around $713.59 million on Thursday.

The increase in this volume shows that the interest and liquidity of traders in Axie Infinity are on the rise, and this increases the bullish perspective of the AXS token.

AXS Bulls Target $3 as Momentum Builds

Looking at the daily price chart, AXS has broken through multiple key resistance levels as the bulls take control. The token is currently trading at $2.46, up from last week’s low near $0.84 and far above its 50-day simple moving average (SMA) at $1.08. This marks a bullish sign, as tokens trading above the 50-day and 200-day SMAs usually attract trend-following buyers.

Momentum indicators strongly favour the bulls in the AXS market. The Relative Strength Index (RSI) is at 78.52, showing that the price is in the overbought region. In this instance, traders should be cautious, as a pullback could occur, allowing the bulls to sweep through liquidity. The MACD is bullish, with both lines moving into positive territory, signalling that buyers have control in the market.

The next critical resistance comes at $2.70, which marks a region where selling pressure could increase. If the Axie Infinity price can break cleanly above this area on strong volume, technical traders expect a run towards $3 and possibly higher.

Conversely, initial support sits at $2.06-$1.78, which aligns with the 200-day SMA, with further downside protected by the recent rally base near $1.08. Any short-term dips towards these zones are likely to attract new buyers. According to the daily technical outlook above, the AXS bulls now forecast short-term upside, with ranges between $2.70-$3 cited as reasonable targets.

However, with the overbought RSI, traders should be very cautious, as a pullback could be imminent before a strong leg to the upside. If the Axie Infinity price fails to hold above $2.06, the price may retrace towards $1.72, where buyers will watch for renewed support.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.