Highlights:

- Litecoin is trading at $69, down 8% over the past week.

- Santiment data shows that whales are offloading LTC as social dominance declines.

- The technical outlook shows LTC risks further downside to $67-$63 as the bears take control.

Litecoin (LTC) is trading below $70 at $69, down 8% over the past week. The pessimistic mood is reinforced by whales selling LTC, which puts pressure on sellers. Technically, momentum indicators show weakness, indicating an additional correction in the coming days.

According to the Supply Distribution data of Santiment, Litecoin will have a bearish future as the whales are decreasing their exposure. The measure represents that the number of whales with 1 million to 10 million (yellow line) LTC tokens has lost 1.08 million tokens since January 12. During the same period, whales holding 100,000 to 1 million tokens (red line) have accrued 0.78 million LTC. This shows a change of positions amongst the key holders, where the whales of the top tier are exposing themselves less. On the contrary, the supply is absorbed by medium-sized whales, which tend to hold higher up and contribute to downside risks for Litecoin in the near future.

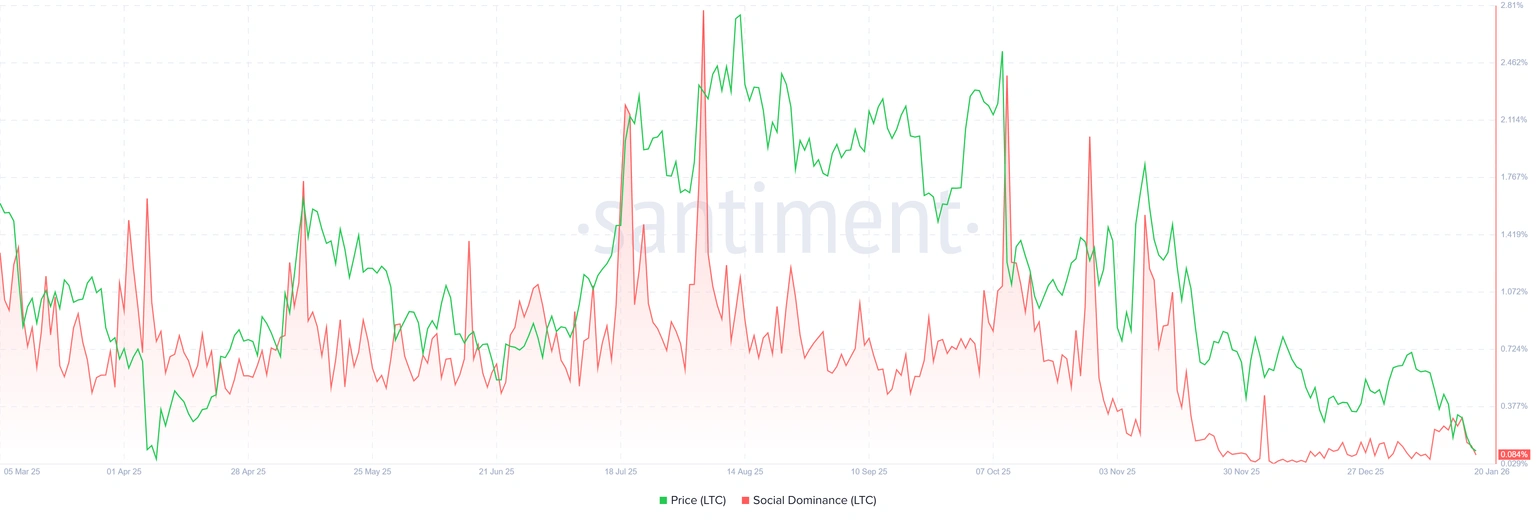

Moreover, Santiment also has a Social Dominance measure for Litecoin, indicating negative sentiment towards the token. The index gauges the proportion of LTC-related conversations in the cryptocurrency space. It has been moving down since Saturday, and on Thursday it stood at 0.084%, close to its lowest level since early January. The fall represents a decline in market interest and a deterioration in the sentiment of LTC investors.

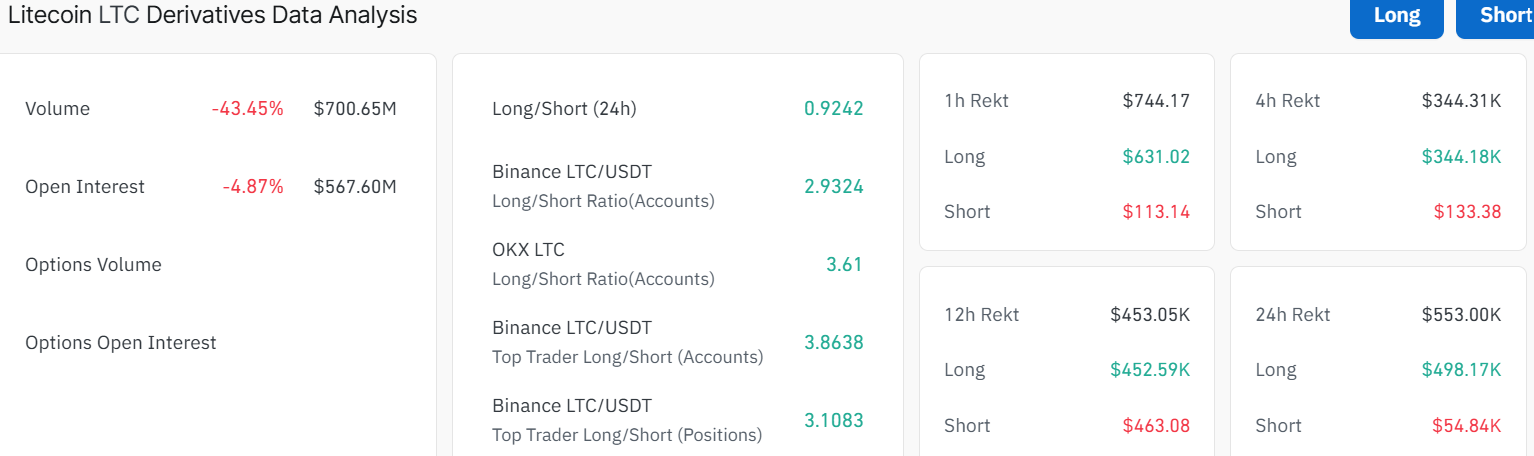

On the other hand, the negative sentiment is manifested in the derivatives market. According to Coinglass data, LTC open interest has plunged 4% to $567 million, while volume has decreased 43%. This recent decrease indicates a decline in market activity, as money is flowing out of the LTC market. This signals LTC risks further downside to $67.

LTC Risks Further Downside to $67-$63 Support

The daily LTC/USD chart shows continued volatility, along with clear zones where price is likely to find support. At present, the LTC token is trading at $69 as the bears take control of the market. There are several critical technical levels in play, as the immediate support lies between $67 and $63. Further, the key resistance lies in the $78-$98 band. If the price rises above $78, a move to $85 becomes likely, and then possibly to $98 or even higher.

The Relative Strength Index (RSI) shows rapid swings, as it has dropped to 34.52. This area is known as sales saturation, suggesting any continued dip could soon reverse upward as traders buy oversold conditions. The MACD indicator hints at a sell signal, reinforced by its plunge below the signal line.

Looking at the bigger picture, if volatility continues and LTC breaks below $67, downside risk could emerge. This could see the token seek further support around the $63 level. However, as long as the price holds above the immediate resistance at $78, it could recover and push back toward the $85-98 resistance area.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.