Highlights:

- XRP price has continued to drop, currently exchanging hands at $2.06, down 2% over the past week.

- The XRP ETFs have recorded about $17 million in inflows, showing steady investor confidence.

- The 50-day SMA holds firm as support at $2.01, as XRP bulls eye a rebound to $2.34.

The Ripple (XRP) price is at its lowest level in three days, dropping to $2.06, a 2.6% decrease in a day. The sell-off spreads across the crypto market, as Bitcoin (BTC) heads toward $95,000 and Ethereum (ETH) nears support at $3,300.

In the meantime, XRP derivatives have been weak, falling to $3.98 billion on Friday, down from $4.08 billion the previous day. The OI reached a high of $4.55 billion on January 8, two days after XRP surged to $2.42. The prices may be pushed down by further reduction if the OI keeps dwindling.

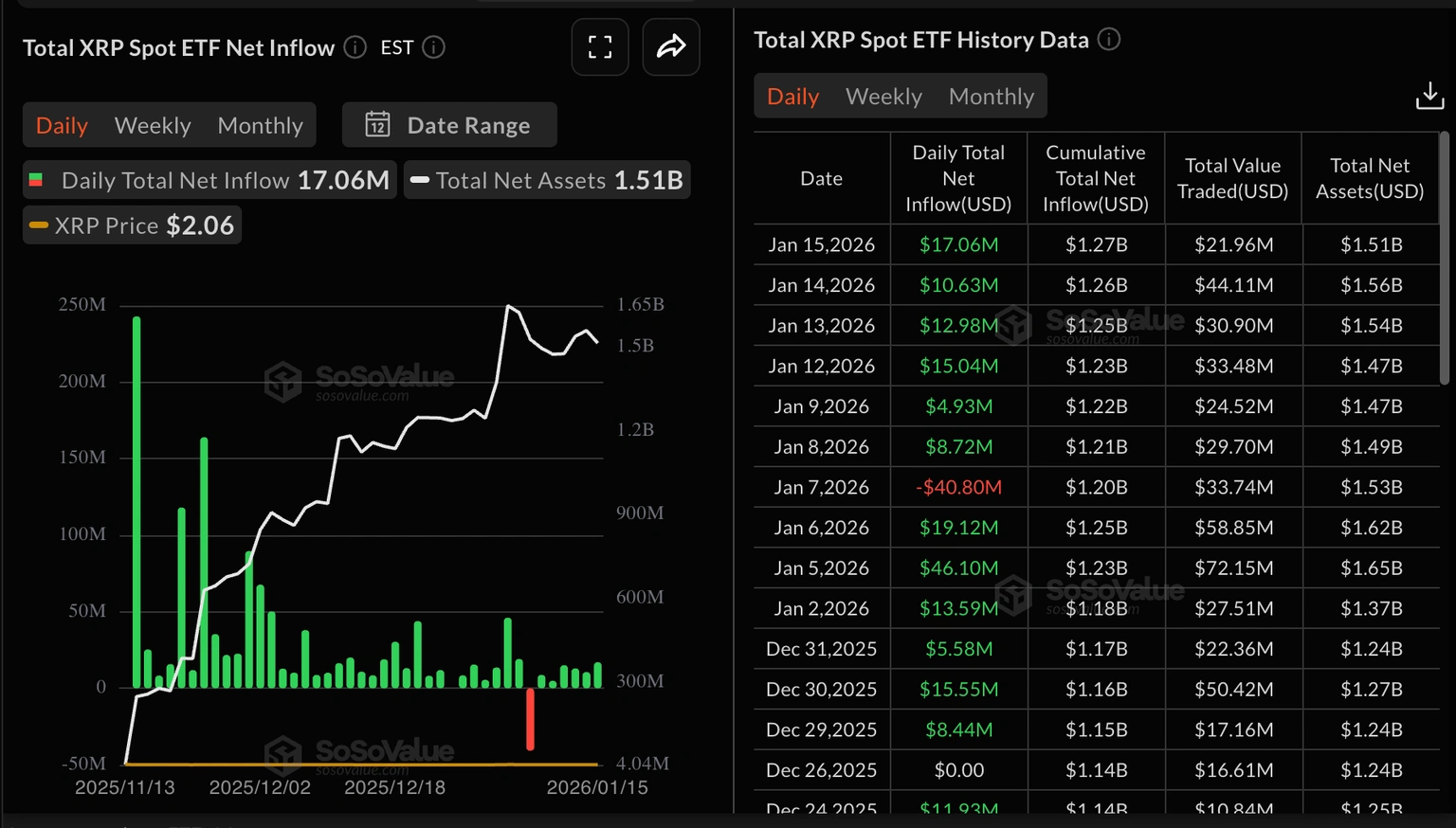

On the other hand, institutional sentiment is rather positive, as evidenced by consistent inflows into XRP spot Exchange Traded Funds (ETFs).

The XRP ETFs traded in the US posted inflows of up to $17 million on Thursday, compared to nearly $11 million on Wednesday, according to SoSoValue data. The cumulative inflow reaches $1.27 billion at one point, while net assets stand at $1.51 billion, indicating sustained investor confidence.

XRP Price Risks Further Downside to $2.01 Amid Mixed Signals

XRP/USDT has been in a steady downtrend for the third consecutive day, currently trading at $2.06. XRP is trading above the upper line of the falling pattern, as the bulls find strong short-term support at $2.01. The price is encountering strong resistance at $2.56, which aligns with the 200-day SMA. The 50-period SMA sits at $2.01, acting as a support floor and preventing further downside. Any upside recovery may see the bulls face an immediate resistance at $2.34.

The RSI stands at 51.71, slightly above neutral, showing a tug-of-war, but leaving room for further upside. The Moving Average Convergence Divergence (MACD) is flattening but remains bullish, suggesting traders rally behind the XRP token. A break below $2.01 could push the XRP price toward the next major support at $1.82. On the upside, a successful bounce above $2.34 could attract buyers toward the levels at $2.56 physiological barrier.

Volume has decreased by 30% to $2.52 billion, suggesting selling in the market. Traders should remain cautious, as XRP is showing mixed signals and is at risk of false breakouts. In the meantime, the swing traders may look for a reversal confirmation through a break above $2.34 or a sustained hold above the 200-day SMA. Conversely, failure to defend the $2.01 safety net could accelerate the decline toward $1.82 and possibly the psychological support near $1.60.

XRP remains bearish in the short term, but the medium-term neutral outlook suggests a potential relief rally. Key levels to monitor include resistance at $2.34- $2.56 and support at $2.01- $1.82. Meanwhile, XRP traders should watch for a volume surge and RSI signals of trend continuation before entering new positions in the market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.