Highlights:

- Bitnomial has announced the launch of the first regulated Aptos futures contract in the US.

- The derivatives platform plans to roll out perpetual and other options in the future.

- Bitnomial described the new futures contract as a step closer to actualizing an Aptos spot ETF.

Chicago-based crypto derivatives exchange Bitnomial has introduced the first fully regulated futures product for the APTOS (APT) token in the United States. The exchange announced the move in an X–post on January 14, eliciting widespread reactions from market participants.

The new rollout will make trading APT futures easily accessible to American investors. Until now, trading APT futures has been limited to offshore cryptocurrency exchanges like Binance Futures and Bitget. These trading platforms are not regulated in the US, limiting Americans’ participation. Bitnomial noted that the goal of its latest offering is to provide a trusted market that allows traders to manage risk and have a better understanding of APT price movements.

The newly launched APT futures contracts will expire monthly. Meanwhile, depending on whether a trader is buying or selling, they can settle either in APT tokens or in US dollars. In addition, traders will be allowed to post either crypto or dollars as margins through Bitnomial’s clearinghouse. The exchange noted that Retail traders will soon be able to access the futures contracts via Botanical, Bitnomial’s trading app for individual users. The derivative platform also confirmed plans to roll out APT perpetual contracts and options later on.

🚨 @Bitnomial announces the launch of the first-ever U.S. Aptos (APTS) futures on Bitnomial Exchange, LLC on Jan. 14

A regulated futures market is a prerequisite for spot crypto ETF approval under the SEC's generic listing standards. Today is one step closer to a U.S. Aptos ETF. pic.twitter.com/GEV8EbTYgY

— Aptos (@Aptos) January 14, 2026

Aptos ETF Edges Closer

In its X post, Bitnomial highlighted the significance of its latest move beyond futures trading. According to the exchange, US regulators often require a strongly regulated futures market before approving a spot crypto ETF. “Today is one step closer to a US Aptos ETF, as the listing satisfies the last major substantive SEC requirement for the approval of an Aptos ETF, which could be approved in as few as 6 months,” the exchange added.

The above approach paved the way for major cryptocurrency ETFs, including Bitcoin (BTC) and Ethereum (ETH). Futures markets help regulators to monitor trading activity through data-sharing agreements, which form part of the key requirements for approval by the US SEC.

Reacting to the development, Solomon Tesfaye, Aptos Labs Chief Business Officer, stated that Aptos was not built for hype cycles and speculation. Instead, it was developed with security, compliance, and stability as its central components. “This isn’t just a product launch; it is the formal embedding of Aptos into the regulated US financial infrastructure,” Tesfaye added.

The largest derivatives exchange in the US, CME, already offers futures for Bitcoin, Ethereum, Solana, and XRP. In addition, it provides pricing data for digital assets, including APT. However, it does not offer direct APT futures trading. On its part, Bitnomial focuses on cryptocurrency markets. It also operates a regulated exchange and clearinghouse built specifically for digital assets. Over the years, it has been the first US platform to introduce new regulated crypto products. Some of these products include XRP futures and physically settled Solana futures.

Over the past 12 months, we have seen increasing regulatory clarity in the U.S. towards digital assets that is fundamentally rewiring the global financial system and giving traditional financial services firms the confidence to fully engage with web3 ecosystems. In July, the…

— Solomon Tesfaye (@SolomonTesfaye_) January 14, 2026

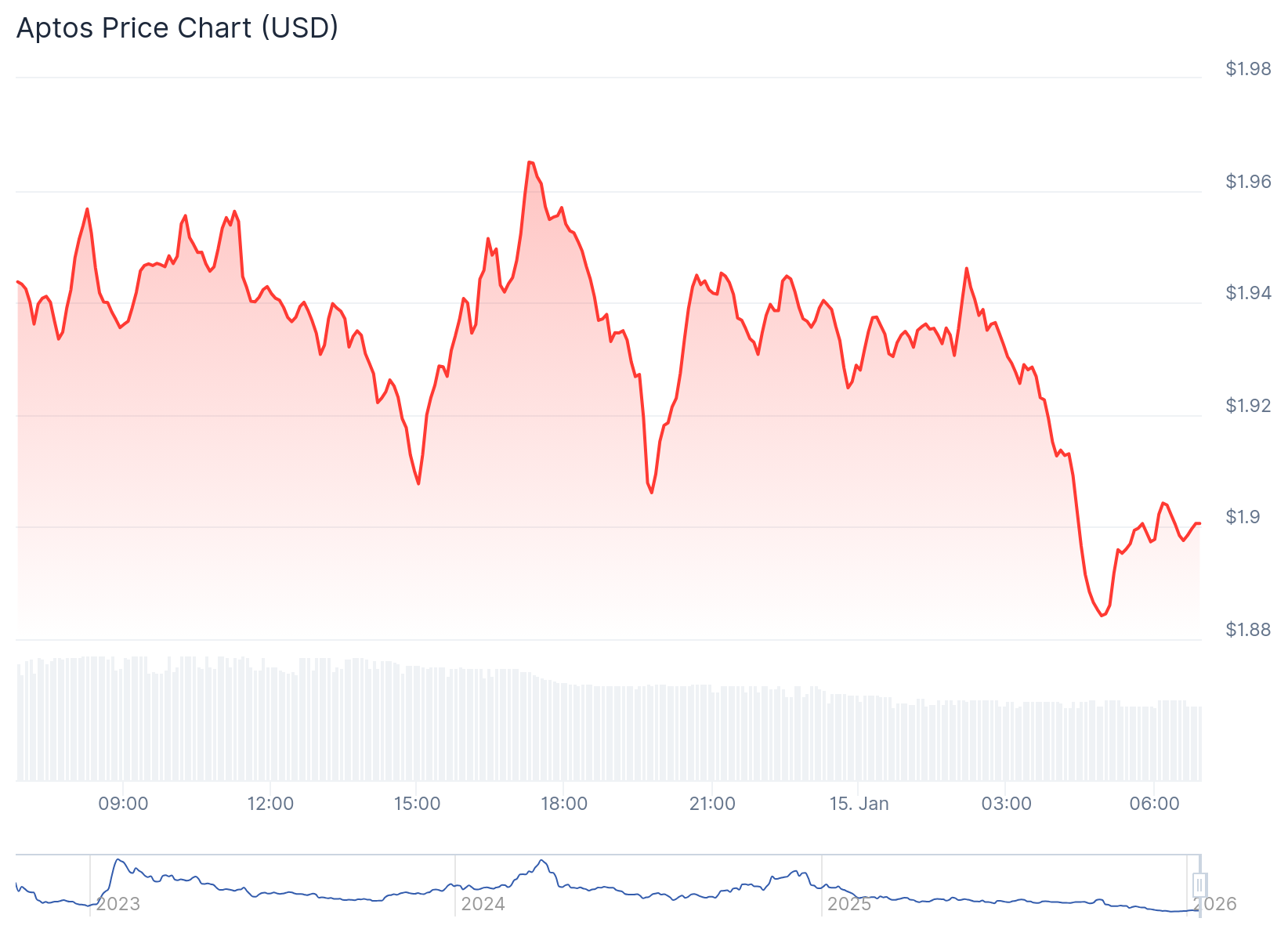

APT’s Price Drops Slightly as Bitnomial Rolls Out First Aptos Futures Contract

At the time of writing, APT is changing hands at $1.90, following a 2.2% decline in the past 24 hours. It has a trading volume of $106.79 million and ranks as the 77th most valuable cryptocurrency with a market cap of $1.45 billion. APT’s week-to-date and month-to-date price change variables reflect spikes of about 2.2% and 21.2%, respectively.

However, the asset is 79% down year-to-date. Despite APT’s price decline, “Fear & Greed Index” remains neutral at 48. Volatility and supply inflation remain high at 7.44% and 36.47%, respectively.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.