Highlights:

- The Bitcoin price has already regained the lost levels above $91,000, with its daily trading volume up by 183%.

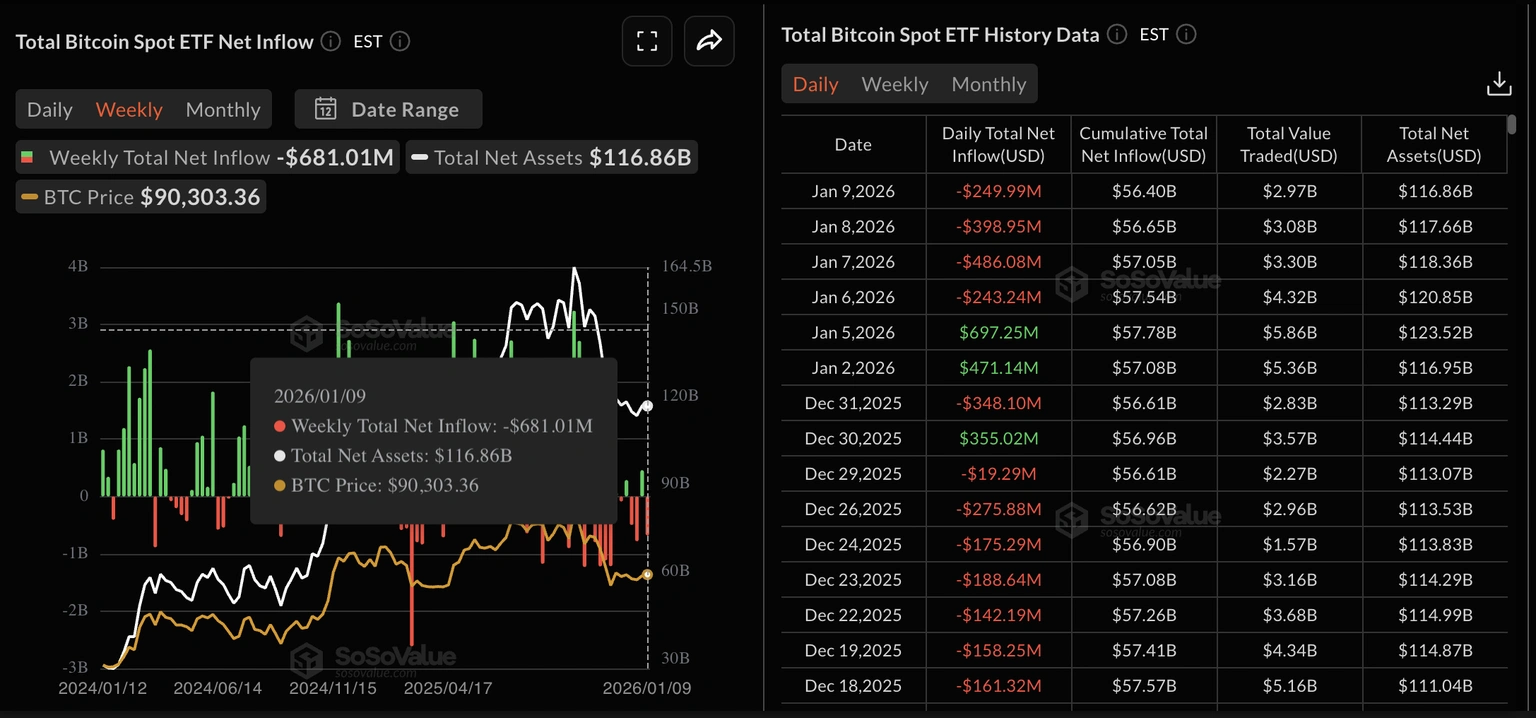

- Outflows from U.S. BTC ETFs totalled approximately $680 million over the last week, indicating a decline in demand.

- The technical outlook indicates that the Bitcoin price eyes $94000, provided that the 50-day SMA (89,597) holds.

Bitcoin price (BTC) has reclaimed the $91,000 mark and remains above the 50-day Simple Moving Average (SMA) at $89,592. Meanwhile, weak institutional demand is indicated by a persistent outflow from U.S. spot Bitcoin Exchange-Traded Funds (ETFs), which may depress market sentiment. The derivatives market, by contrast, exhibits a selling bias, with more short positions.

Bitcoin remains at risk amid geopolitical tensions between the US and other nations, including Venezuela and Greenland. Moreover, the US Supreme Court’s next decision on tariffs will be announced on Wednesday, as U.S. President Donald Trump has called for a 10% reduction in credit card rates by January 20.

TRUMP:

WILL NO LONGER LET CREDIT CARD COMPANIES TO CHARGE 20-30% INTEREST RATES

JAN 20 WILL CALL FOR ONE YEAR CAP OF CC INTEREST RATES TO 10% pic.twitter.com/pHn6JN4UqK

— Wall St Engine (@wallstengine) January 10, 2026

The flow of BTC ETFs is a sign of the weakened institutional support. According to Sosovalue, Bitcoin spot ETFs recorded an outflow of $681.01 million over the past week, with four consecutive days of outflows.

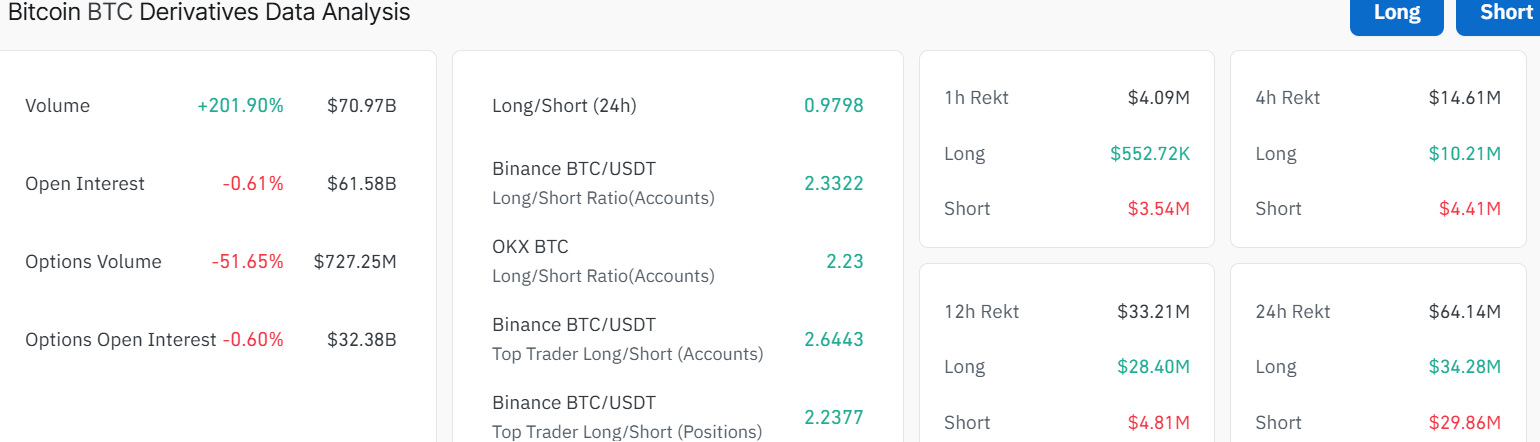

On the other hand, the derivatives side shows capital inflows into Bitcoin futures, indicating a decrease in demand. According to CoinGlass data, BTC futures Open Interest (OI) has increased by 0.61% over the past 24 hours, reaching $61.58 billion. This indicates a slight decline in investor demand, as capital is exiting the market.

The long-to-short 24-hour ratio is at 0.9798, which implies that there are fewer active long positions. However, the volume rose 201% to $70.97 billion, indicating intense market activity, as the Bitcoin price eyes $94000 immediate resistance level.

Bitcoin Price Eyes $94000 Rebound

On the BTC/USD 1-day price chart, Bitcoin is holding above the key support level at $89,597. This support zone lies near recent lows and is closely monitored by traders.

If Bitcoin price falls below this area, the next major support is at $87,287- $84,184, as indicated by prior consolidation on the chart. The 50-day Simple Moving Average (SMA) is at $89,597, while the 200-day SMA is at $106,179. The 200-day SMA, located well below the price, serves as a longer-term buffer against further upside.

Technical indicators indicate that Bitcoin is cooling off after the recent surge that saw it reach $94,200 on January 5. The Relative Strength Index (RSI) is at 55.00, meaning the coin is neither overbought nor oversold, which could signal room for more consolidation before the next large move. The MACD indicator has, however, flipped positive, indicating rising momentum and a possible risk of further upside.

If Bitcoin stays above the $89,597 support and buyers step in, the Bitcoin price could eye $94,000 rebound and even higher resistance near $100,000 in the next few weeks. However, if sellers push below the immediate support aligned with the 50-day SMA, Bitcoin may retest deeper supports around $87,000- $84,184 before bulls return.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.