Highlights:

- The Stellar price has slipped below the $0.22 mark, as the bearish grip mounts in the crypto market.

- On-chain data and derivatives market signal a drop in activity as bearish bets increase in XLM.

- The technical outlook shows mixed signals, but a break above $0.24 mark would ignite a bullish rally.

Stellar (XLM) price is below $0.22 as the asset has been in a downward movement. The bearish grip is gaining more momentum with the open interest declining and short bets increasing. Moreover, the Stellar TVL has plunged, adding to the bearish sentiment in the Stellar market. Technically, XLM risks further downside to $0.20 level if the bulls don’t regain control.

According to statistics provided by crypto intelligence tracker DefiLlama, XLM has dwindled to 1.62% standing at $174.76 million. This slip in TVL means that the chain is becoming less active, hence reduced activity within the ecosystem.

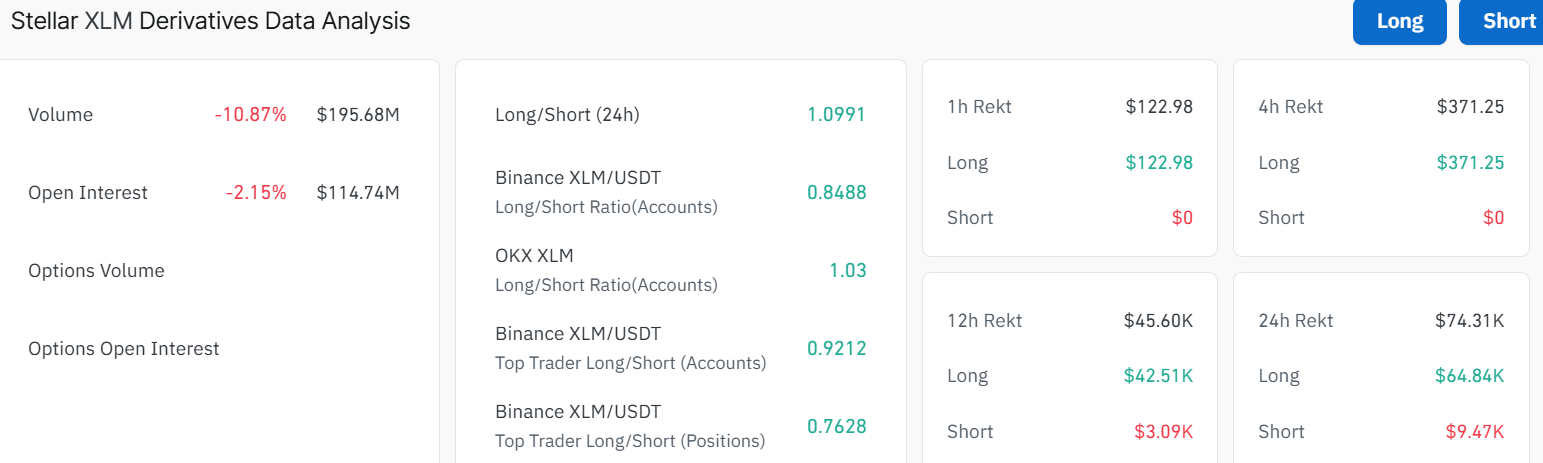

On the other hand, the derivatives data at Stellar have a bearish projection. The Open Interest (OI) in the futures contracts of XLM decreased to $114.74 million on Wednesday, marking a 2.15% plunge in the past 24 hours. This decline in OI indicates declining investor involvement and indicates a negative perspective. Notably, the volume has slipped to $195.68 million, suggesting a reduction in market activity.

However, the long-to-short ratio of Coinglass in XLM is 1.0991 on Wednesday, which is the highest within a month. The fact that the ratio is above one indicates that there is bullish sentiment building, with more traders betting on the price of the XLM to rise.

XLM Risks Further Downside to $0.20

The technical picture for Stellar is growing more bearish. If the asset trades below this period($0.21), then XLM risks further downside to $0.20 during this holiday. On the daily chart, Stellar is still in a wide falling channel, but recent candles look heavy, and sellers are pushing the price. The $0.2477 level matches XLM’s 50-day simple moving average (SMA), which acts as resistance, cushioning the bulls against further upside.

Meanwhile, momentum indicators point to growing weakness. To start with, the RSI (Relative Strength Index) is around 39.08, a bearish reading that suggests bears are in charge and there is room for a continued drop. The MACD (Moving Average Convergence Divergence) has, however, crossed positive, showing some renewed strength in the market.

Looking ahead, if the Stellar price fails to reclaim and hold above $0.24, more downside could be ahead. If selling pressure persists, the channel’s lower boundary, currently near $0.20-$0.19, will likely be tested next.

On the upside, if the Stellar price quickly recovers and reclaims $$0.24 zone, it could begin to stabilize. Key resistance lies at this level and again at $0.32, where many traders will be watching to see if bulls can return in force. In the meantime, only a break above the $0.24 level will trigger a bullish outlook. However, with the trading volume slipping and on-chain weakness dominating the headlines, sentiment remains cautious for now.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.