Highlights:

- The Aave price has surged 9% to $206, as bulls build momentum in the market.

- The derivatives market also supports bullish sentiment, with the bulls eyeing $296 in the long term.

- The technical outlook supports a bullish bias as they target $230-$238 zones in the short term.

Aave (AAVE) price is above $206, marking a 9% rise in the past 24 hours. This rally comes following Aave V4’s new liquidation engine for keeping the lending markets safe. Besides, the derivatives also support bullish sentiment, with the technical target of the pattern indicating a potential rally towards $296.

Introducing Aave V4's new liquidation engine. https://t.co/gmFD8ksq8U

— Stani.eth (@StaniKulechov) December 11, 2025

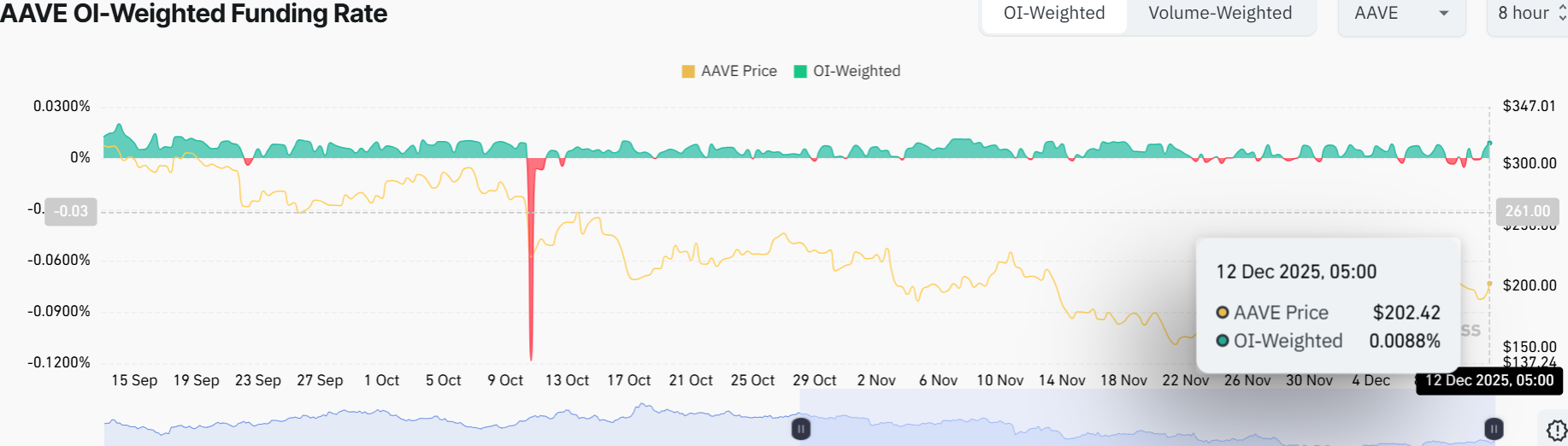

The data on the funding rate provided by Aave on the derivatives side also indicates the presence of a rally. CoinGlass data on OI-Weighted Funding rate indicates that the volume of people who are betting on the price of Aave further falling is smaller than those who are betting that it will rise.

The metric has inverted to a positive rate at 0.0088% on Thursday, meaning that longs are paying shorts. As can be seen in the chart, when the funding rates flip from negative to positive, the Aave price soars.

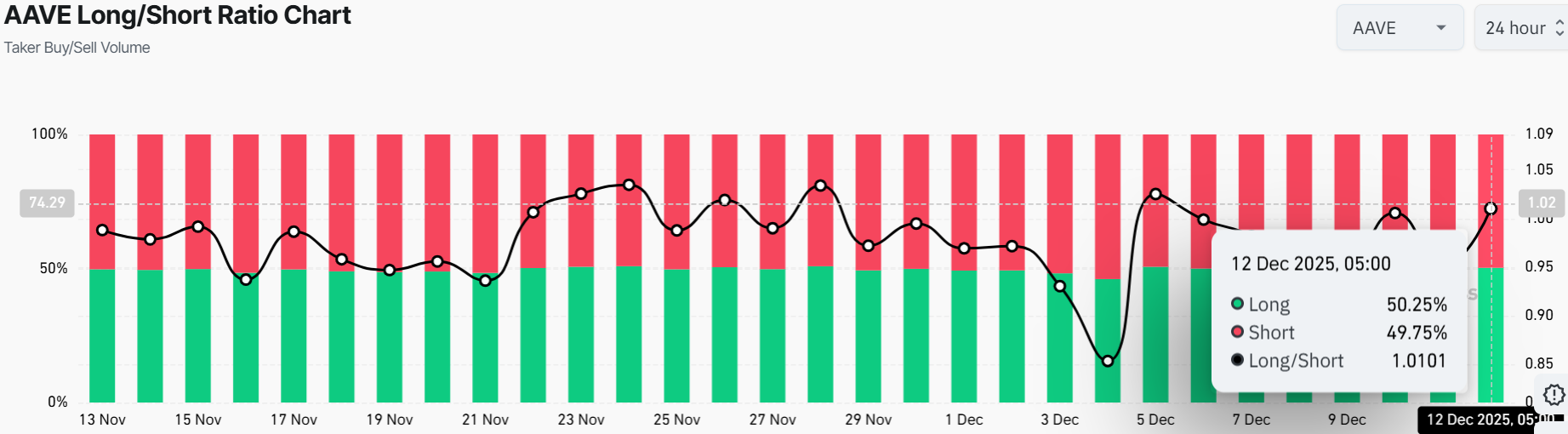

Also, the long-to-short ratio of Aave stands at 1.01 on Thursday, almost at the end of the monthly high. This is a ratio that is greater than one, which means that the markets are bullish since the number of traders who bet on the asset price to increase is high.

Aave Price Eyes Breakout Above Falling Channel

The AAVE/USD chart shows the token’s price action trading above the 50-day SMA at $196. However, the bulls are eyeing the immediate resistance aligned with the 200-day SMA at $261. Currently, the token is hovering around $206, testing the upper trendline of the falling channel.

The Relative Strength Index (RSI) sits at 58.34, indicating rising buying pressure in the market, which may see the bulls step up above 70+. The MACD also supports the bullish outlook in the market, as the signal line has flipped below the MACD line. The positive technical outlook further reinforces a potential breakout in the Aave market soon.

The next target for the AAVE price is $230-$238, if the bulls break out of the channel, and the current support holds strong. However, investors should be cautious, as a rejection at the $230 resistance level could send the Aave price to the next immediate support at $196. A dip below this level could see the token test the $170.

In the short term, as long as the Aave price holds above $196, the bulls could continue the upswing towards $230-$238. Long-term, it’s all about holding the support zones and pushing past $238, which may cause the AAVE token to reclaim the $261 mark before year’s end. In summary, the Aave price action shows promise, supported by bullish indicators and its position above $196. If the bullish momentum builds and they overcome the $261 barrier, a rally towards $296 could be possible soon.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.