Highlights:

- The XRP price has bounced off the short-term support at $2, currently exchanging hands at $2.09.

- The XRP Spot ETFs have extended inflows, suggesting steady institutional demand.

- Crypto analyst Ali Martinez has predicted a potential 16% breakout in the XRP price.

The XRP price has bounced off short-term support at $2.00 and is trading at approximately $2.09. Institutional investors have remained committed to the cross-border payment token under the spot Exchange Traded Funds (ETFs) in the United States (US). Since its launch on November 13, the demand for the XRP spot ETFs has not fluctuated.

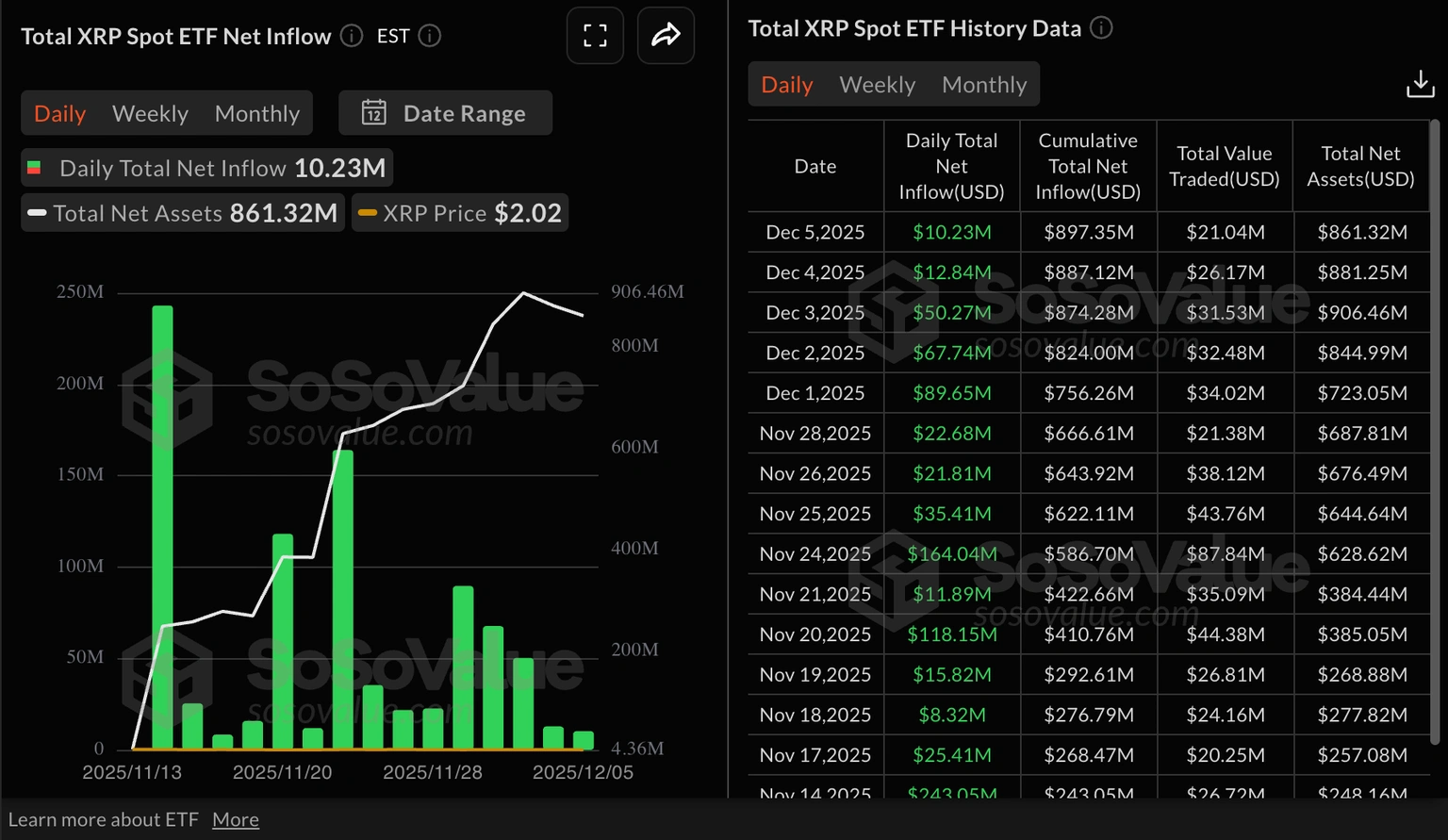

According to SoSoValue data, XRP ETFs listed in the US recorded about $10 million in inflows on Friday. This further extended the inflow streak up to 15 days, and the cumulative inflow volume was recorded to be $897 million, with net assets at $861 million.

In the US, four XRP ETFs exist, comprising Canary Capitals XRPC, Grayscale GXRP, Bitwise XRP, and Franklin Templeton XRPZ. Further, the constant inflows in ETFs drive up the purchase, which serves as one of the reasons to believe in XRP and a bullish perspective.

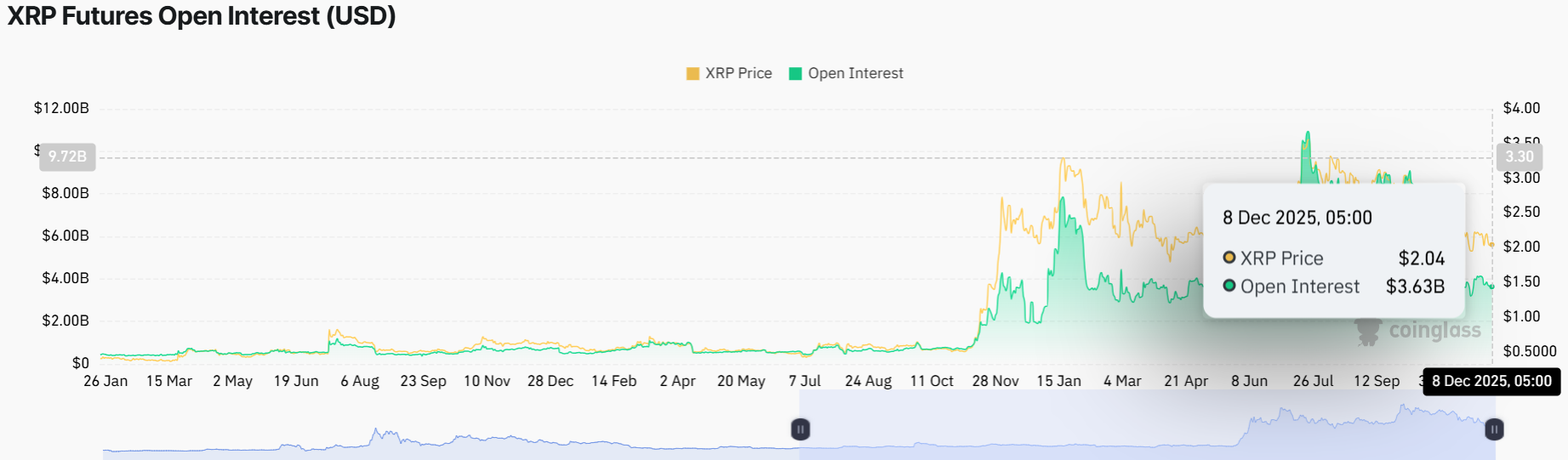

In the meantime, the retail demand has been suppressed recently. According to CoinGlass data, the XRP futures Open Interest (OI) is valued at $3.63 billion, which is a little higher than $3.59 billion on Sunday.

The derivatives market is trailing the same levels of the OI it had before the October 10 deleveraging incident (OI of $8.36 billion) and its record high of July 22 (OI of $10.94 billion). Despite the slight climb in OI, the investors are still sidelined, awaiting a breakout.

XRP Price Aims for a Breakout Above the Triangle

The XRP price chart has all the hallmarks of a potential bullish reversal. The chart shows the altcoin is currently trading at $2.09, as the bulls target a breakout above the triangle pattern. The 50-day Simple Moving Average (SMA) sits at $2.28. The price is hovering just below that level, indicating potential breakout from the triangle, with eyes on the next big move above the $2.60 resistance zone.

The Relative Strength Index (RSI) at 45.20 is neutral-to-bullish as it is on the way up, signalling that buying pressure for the XRP price is rising and there’s room to run. The MACD has also made a bullish crossover, reinforcing the potential breakout.

The upper resistance for the XRP price sits at $2.28, while support holds strong at $2.00. The breakout target is $2.60, which is a potential 24% pump from here if the bulls charge past $2.28. Meanwhile, popular crypto analyst Ali Martinez has predicted a potential 16% breakout in the XRP price. However, this will only manifest if the altcoin breaks out of the triangle.

$XRP is set up for a 16% move once it breaks out of this triangle. pic.twitter.com/Ym5wkactTj

— Ali (@ali_charts) December 8, 2025

On the other hand, if support at $2.00 cracks, we might slide back to $1.93 or even $1.82. Investors should keep an eye on volume, which is up 96%, indicating heightened market activity.

Looking ahead, the next few weeks could push the XRP price to $2.28 or higher if bullish sentiment holds and the whole crypto market flips positive. In the long term, if the bulls hold above $2.60 resistance, a breakout to $2.82-$3.00 isn’t off the table by year-end.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.