Highlights:

- XRP price has dwindled 4% to $2.06 as the derivatives market shrinks.

- XRP has hit the highest fear level since October, according to Santiment data.

- The XRP technical outlook shows mixed signals as bulls eye a rebound to $2.26-$2.30 resistance.

The Ripple (XRP) price is down 4.32% currently trading at $2.06, as the daily trading volume has plummeted to $3.26 billion. The cross-border payment token has hit its highest fear level since October, as per Santiment data. According to popular crypto analyst, The DustyBC, the last time these levels of fear emerged, the XRP price rallied 22%.

🚨 $XRP just hit its highest fear level since October. The last time we saw these levels of fear, the price rallied 22% afterward. Per Santiment pic.twitter.com/55xSdCEKRJ

— DustyBC Crypto (@TheDustyBC) December 5, 2025

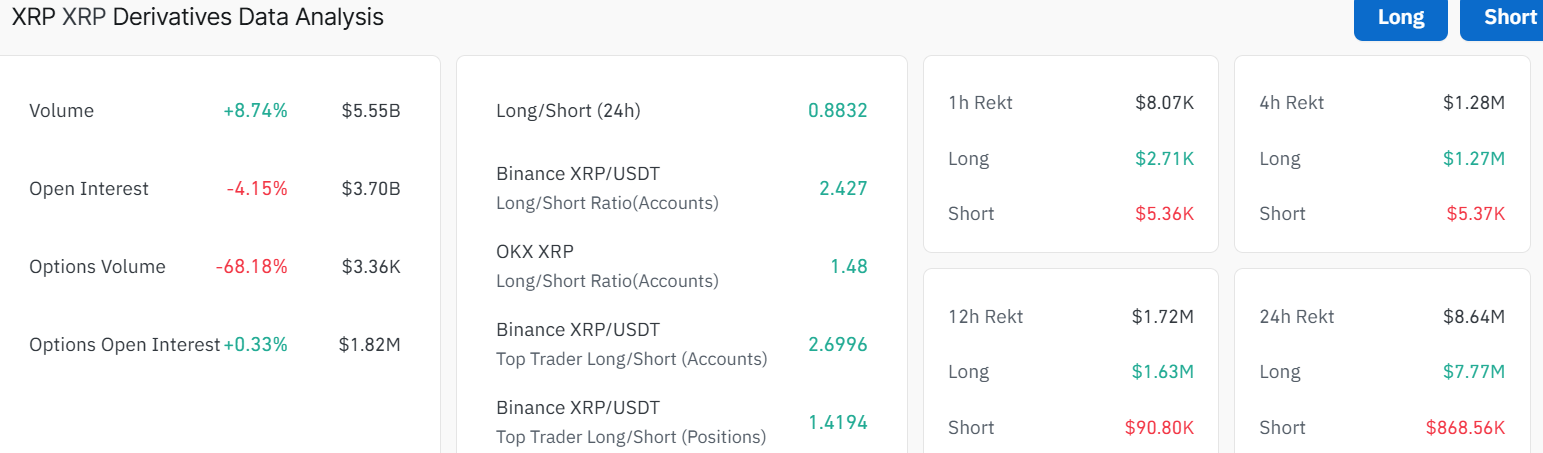

According to CoinGlass data, the XRP Future Open Interest (OI), which represents the amount of outstanding futures contracts, stands at $3.70 billion, down 4.15%. The Open Interest should progressively increase to back the risk-on mood, as the investor expands its risk exposure.

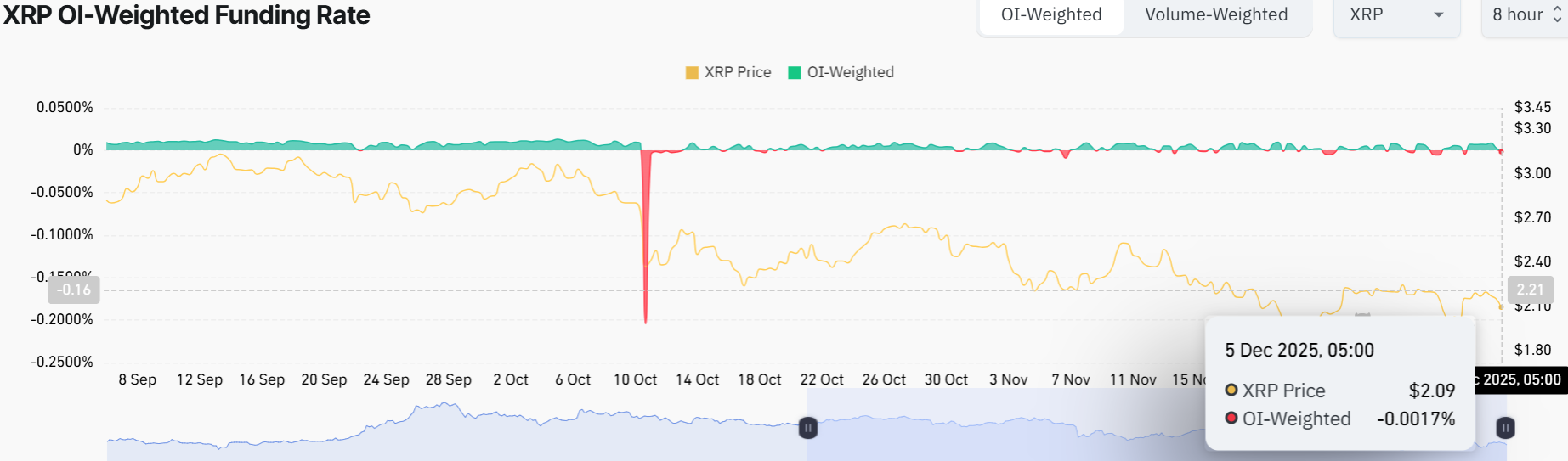

On the other hand, the OI-Weighted Funding rate is a composite statistic of XRP perpetual futures contracts on various exchanges. It always determines the weighted average of the funding rates. Often, the positive rates show that traders are aggressively buying into the long positions. A decrease in the OI-weighted rates of funding is a negative outlook for the XRP price. Currently, it stands at -0.0017% indicating some bearish outlook in the market.

XRP Price Shows Signs of a Bullish Reversal

The XRP/USD trading pair shows signs of a possible bullish reversal after holding strong above the $2.00 support level. The token is trading around $2.06, within a falling wedge pattern, marking a 4% drop over the past 24 hours. The chart also highlights how the $2.30 zone(50-day SMA) and $2.61(200-day SMA) are strong resistance levels, cushioning the bulls against further upside. This outlook shows that the bears are in control as the bulls struggle to break above the pattern.

Traders are now watching the $2.26 immediate resistance, which acts as a barrier. If the XRP price can break above this level, XRP could make a run toward its next target near $2.30. Technical indicators also support the potential for another move higher.

The Relative Strength Index (RSI) is sitting around 42.40, which shows that the market is in a neutral state. This means XRP is not overbought and still has room for more upside momentum. The RSI is also consolidating, meaning that the bulls may break out if the momentum builds soon.

The MACD indicator is also above the orange signal line, showing a bullish crossover. In other words, the traders are at liberty to rally behind the XRP token unless the MACD changes. If bullish momentum builds, XRP could first retest the $2.26 level and then aim for $2.30. A breakout above $2.30 barrier would signal that buyers are firmly in control and could open the door for further gains.

On the downside, if the downtrend continues and the $2.00 support fails, XRP may face selling pressure that could send it back toward the $1.93 zone. This zone has acted as a longer-term base of support. However, according to Santiment data, the XRP price has hit the highest fear level. If the bulls capitalize on these sentiments, a rebound towards $2.26-$2.30 could be imminent soon.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.