Highlights:

- The new fund will support DeFi projects that build strong tools for institutions seeking secure onchain access.

- DWF Labs has launched a focused push to back liquidity and risk tools that can handle large trades and protect order flow.

- The firm is targeting builders who create real utility as more institutional liquidity moves toward onchain markets.

Crypto market maker and Web3 investor DWF Labs announced a new $75 million fund that targets decentralized finance projects built for institutional needs. The firm shared the update on Wednesday through a detailed post on X. It said the fund will back projects with strong value propositions and clear paths to large-scale adoption.

DWF Labs Launches $75M Fund for Next-Gen DeFi Infrastructure@DWFLabs has launched a $75M investment fund aimed at advancing core DeFi infrastructure, with a focus on perpetual DEXs, decentralized money markets, and yield-bearing or fixed-income protocols across @ethereum,… pic.twitter.com/sxZEcDdByE

— ME (@MetaEraHK) November 27, 2025

DWF Labs said the initiative will prioritize dark-pool perpetual DEXs, decentralized money markets, and yield-bearing asset products. The company has recorded significant gains in these sectors with additional liquidity flowing on-chain. It also said these tools can improve order flow protection and support large trades without creating market pressure. Its team views these factors as critical for institutions exploring new digital asset strategies.

The fund will support projects built on Ethereum, BNB Chain, Solana, and Base. These chains continue to attract developers who focus on infrastructure upgrades. DWF Labs said it will also provide liquidity provisioning, TVL support, and access to exchange partners. This support targets founders who want to accelerate adoption and strengthen market depth during volatile conditions.

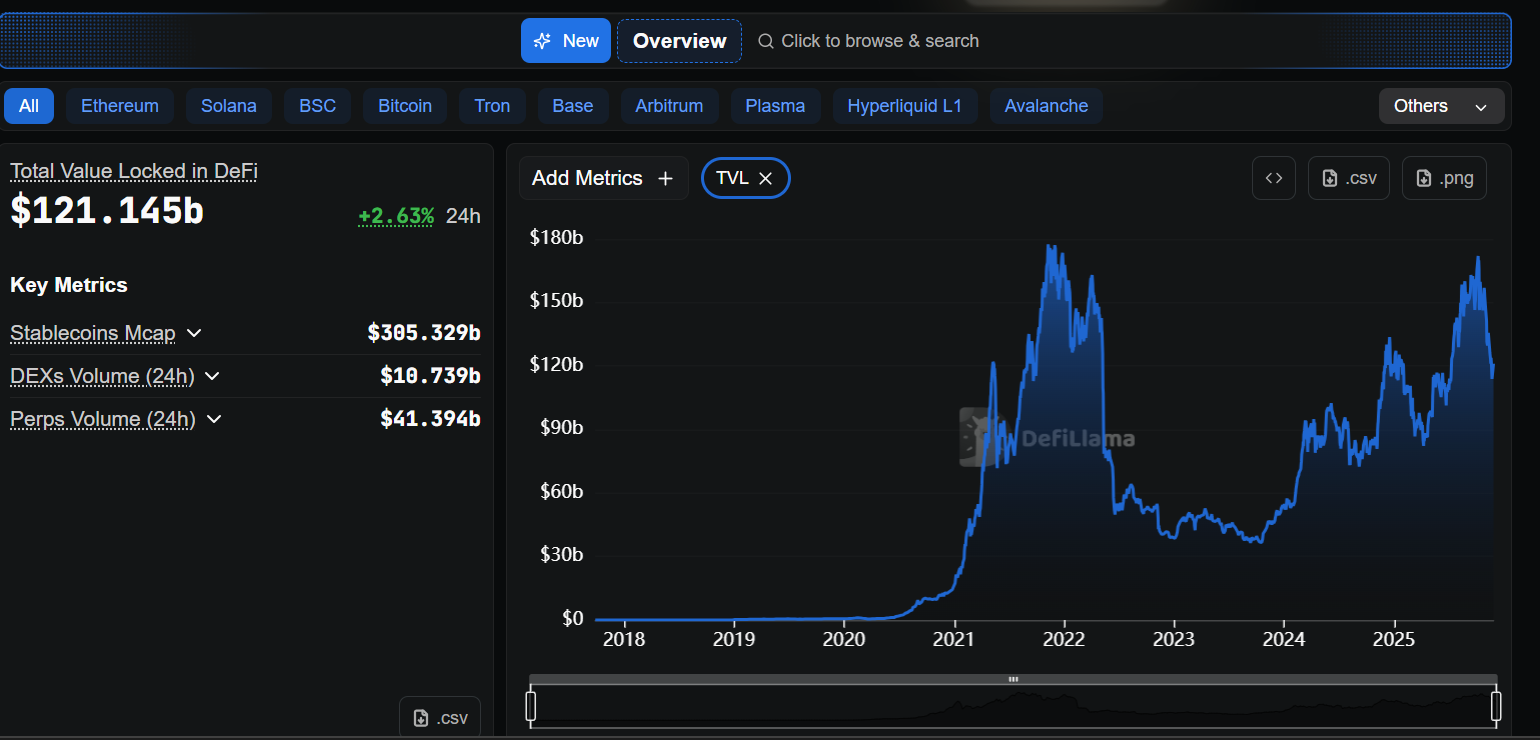

At the same time, DeFi continues to show resilience despite recent market shifts. DefiLlama data indicate that there is over $121 billion of aggregate value locked in all the protocols. Analysts say this trend reflects strong interest from institutions seeking consistent yield and transparent credit markets.

DWF Labs Launches Strategic Push Into Liquidity and Risk Tools

DWF Labs framed the new fund as a direct response to structural gaps in liquidity, settlement, and on-chain risk management. Managing partner Andrei Grachev said that the market currently requires the tools able to operate and process large transactions as well as secure sensitive order flow. He further stated that these tools facilitate transparency in yield generation, and they can enable institutions to enter the sector with greater confidence.

The company has experienced rapid growth since 2022 and has created a portfolio of over 1,000 blockchain projects. However, the firm’s structure has attracted industry scrutiny. Market watchers often highlight the overlap between its venture and market-making operations.

DWF Labs said it operates a lean global team with experts in trading, research, engineering, and product development. It also said it works on obtaining more licenses and auditing its operations. Grachev noted that the firm wants to support fair and orderly markets as DeFi expands.

Market conditions create a challenging backdrop for new funds. Crypto venture activity fell sharply during the first half of this year. The Block Research reported only 856 deals by August, compared to 1,933 deals during the same period last year. However, the activity hit $4.6B in Q3. DWF Labs said this environment offers a chance to support strong builders who remain active despite slow funding cycles. It aims to back teams with practical solutions and working products.

Crypto VC activity hit $4.6B in Q3.

Second-strongest quarter since the FTX collapse in late 2022.

VC's buying the dip. 👇 pic.twitter.com/URFKIqxKkc

— Crypto Rover (@cryptorover) November 26, 2025

Multi-Layer Support Model Extends to Founders Across Key Ecosystems

DWF Labs said it will support founders with MVPs who focus on scalable DeFi infrastructure. It noted that dark pools can reduce market pressure during large trades. It also said these tools can help institutions manage sensitive flows. The firm remains open to projects that build outside its core chains.

DWF Labs said its support extends beyond investment and can include market access, listings, and legal guidance. It also said it views the coming DeFi cycle as one shaped by real utility and stronger institutional liquidity.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.