Highlights:

- Ethena price is showing strength, as it is up 3% to trade at $0.24, with the trading volume up 6%.

- The derivatives market outlook shows an increase in open interest and volume, showing positive sentiment.

- The ENA technical outlook shows a potential breakout above $0.28 in the short term, as the MACD flashes a buy signal.

The Ethena price is showing signs of recovery, up 3% to $0.24. The daily trading volume has notably spiked 6% to $156 million, indicating growing trading activity. The rising optimism in the Ethena derivatives market, indicated by heightened Open Interest, shows renewed interest in the market. Meanwhile, according to popular analyst Ali Martinez, the Ethena price has flashed a buy signal, which may see further price increase in the short term.

Ethena $ENA just got a TD Sequential buy signal! pic.twitter.com/sk2kVqfKOp

— Ali (@ali_charts) November 24, 2025

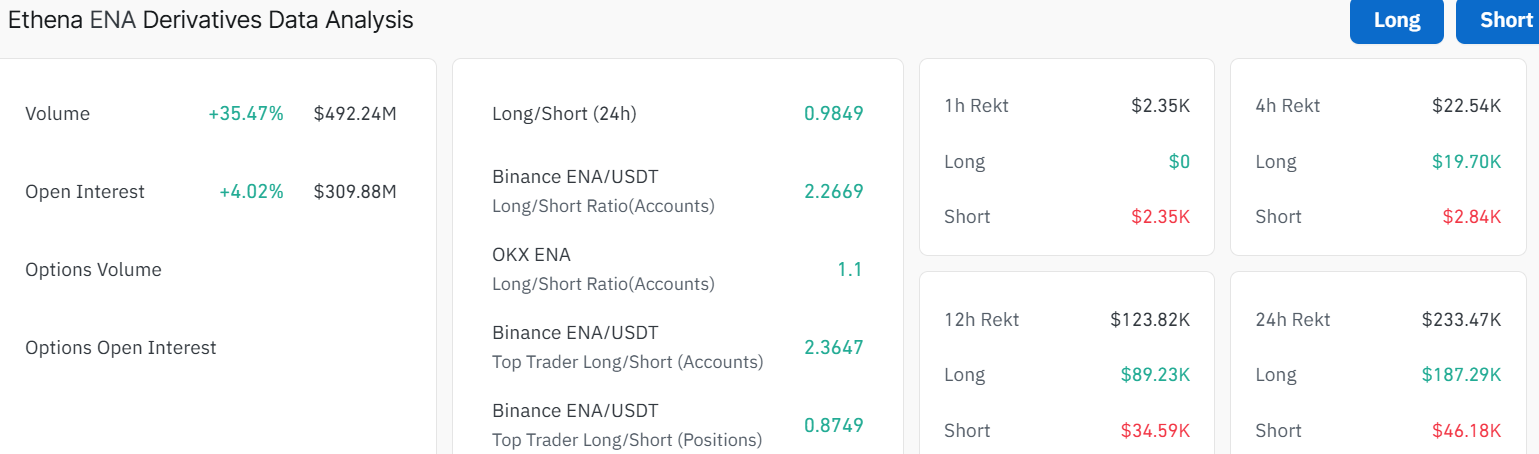

Meanwhile, the trading volume and the open interest of the Ethena(ENA) derivatives market have shown phenomenal growth. The price volume of Ethena has surged by 35% to $492.24 million, and the open interest has improved by 4% to 309.98 million.

This growth is a good sign of sentiment in the market and the ongoing confidence in ENA assets. As the market on the derivatives side of the Ethena marketplace continues to gain momentum, the risk/reward ratio is something that investors are taking into greater consideration. The long/short ratio stands at present 0.9849, which means that the market is balanced.

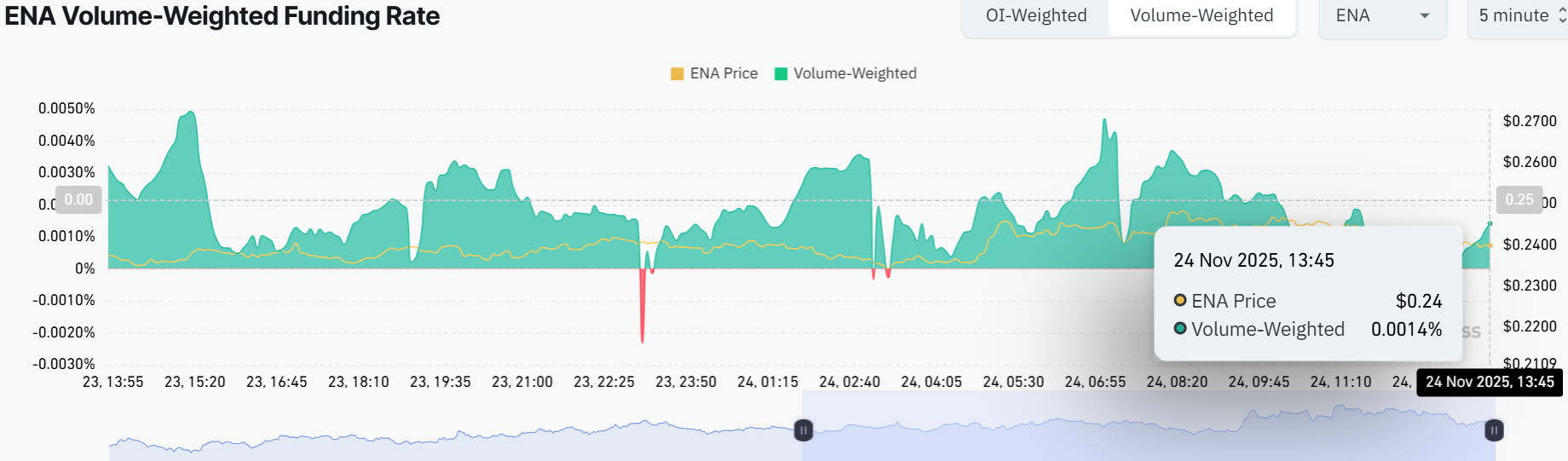

Additionally, the OI-weighted funding rate of the Ethena price is positive, standing at 0.0014%. This means that buyers will not mind long-term positions. Further, the traders are now betting on the Ethena price to surge, which may cause a recovery above $0.28.

Ethena Price Poised for a Breakout Above $0.28

Ethena price currently trades at $0.24 and has strong support around the $0.23 level. Meanwhile, the bears have established strong resistance zones around the 50-day moving average at $0.38 and the 200-day SMA at $0.46, preventing major upsides.

The MACD indicator hints at mild bullish momentum, with the MACD line sitting slightly above the signal line. This calls for traders and investors to rally behind the ENA token unless it changes. Meanwhile, RSI holds steady at 31.46, indicating that the coin still has room to run higher. If the bulls initiate a buy-back campaign, a spike above 50 may ignite a bullish rally.

Looking at the bigger picture, if Ethena’s price falls below $0.23 support zone, traders should look at the next support at $0.16. However, with the positive MACD and strong derivatives market data, the current level might be a good buying opportunity. Traders should look for a clear break above $0.28, which may open the door for further upside.

If the price keeps going up, reinforced by the buy signal from the MACD, more buyers may come in and push the Ethena price toward $0.38 resistance. While the price is still testing important levels, the outlook for ENA looks hopeful as buyers aim to break above $0.28 towards $0.38 or even $0.46 resistance zones in the coming days.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.