Highlights:

- NYSE has approved Grayscale’s Dogecoin and XRP ETFs to launch on its platform.

- Eric Balchunas confirmed that the ETFs have been cleared to start trading at the first NYSE session on November 24.

- The analyst hinted that Grayscale’s Chainlink (LINK) ETF may launch about a week later.

Digital asset management firm Grayscale has received approval from the New York Stock Exchange (NYSE) to list new Dogecoin (DOGE) and XRP exchange-traded funds (ETFs) ahead of their anticipated debut. The approval was confirmed in a regulatory letter sent to the United States Securities and Exchange Commission (SEC), which Bloomberg ETF analyst Eric Balchunas shared on his X handle on November 21.

He also confirmed that Dogecoin and XRP ETFs will start trading at the first NYSE session on Monday, November 24. The Bloomberg ETF analyst ended his tweet by mentioning that Grayscale’s Chainlink (LINK) ETF may launch about a week later. Franklin Templeton’s XRP ETF is also slated for November 24. These funds track XRP’s price through the CME CF XRP-Dollar Reference Rate, offering investors exposure without direct ownership.

Grayscale Dogecoin ETF $GDOG approved for listing on NYSE, scheduled to begin trading Monday. Their XRP spot is also launching on Monday. $GLNK coming soon as well, week after I think pic.twitter.com/c6nKUeDrtI

— Eric Balchunas (@EricBalchunas) November 21, 2025

With the regulatory body’s approval, Dogecoin and XRP ETFs will officially debut on a major United States exchange. Notably, Grayscale will offer shares of its Dogecoin ETF to regular investors via its regulated trust platform. This allows eligible investors to gain from Dogecoin’s price movement without having to buy or hold the token themselves.

XRP ETFs Mark Debut with Impressive Statistics

Balchunas called Grayscale’s XRP ETF launch a key win amid growing demand for XRP funds. Meanwhile, Bitwise’s XRP ETF debuted on Thursday on NYSE Arca under the market ticker XRP. According to a Crypto2Community report, the ETF’s first session saw heightened activity despite the turbulence in the broader crypto market.

Bitwise’s XRP ETF attracted almost $26 million in trading volume at the end of its first trading day, marking one of the best opening days among over 900 ETFs that launched this year. The debut closely followed Canary’s Capital XRP ETF (XRPC), which began trading on November 13, with record demand from investors, attracting over $59 million in trading volume on the first day.

Describing Bitwise’s XRP ETF debut, James Seyffart, another Bloomberg ETF analyst, stated:

“With a bit over 3 hours left in trading, Bitwise’s XRP ETF is almost at $22 million in trading today. Quite impressive for the second product to market a full week after CanaryFunds’ XRPC, which is the number one launch by volume this year.”

🚨 JUST IN:

Grayscale’s $DOGE and $XRP ETFs go live on the NYSE this Monday.

Both coins are still 81% and 50% below their ATHs.

Can Wall Street wake them up? 👇 pic.twitter.com/KWO2Aslo8Q

— Wise Advice (@wiseadvicesumit) November 22, 2025

XRP and DOGE Price Reactions as NYSE Approves Grayscale’s ETF Products

At the time of press, the crypto market is 1.8% down in the past 24 hours, with a market cap of $2.969 trillion and a trading volume of $267.096 billion. Bitcoin (BTC) now trades below $85,000, while Ethereum is slightly hanging above $2,500, summing up the market’s bearish state.

On its part, Dogecoin dipped 5.4% in the last 24 hours, trading at $0.1385 with a market cap of $20.85 billion and a trading volume of $3.48 billion. Despite its medium supply inflation, DOGE’s volatility remains high at 9.11%, while its “Fear & Greed Index” reflects extreme fear at 14.

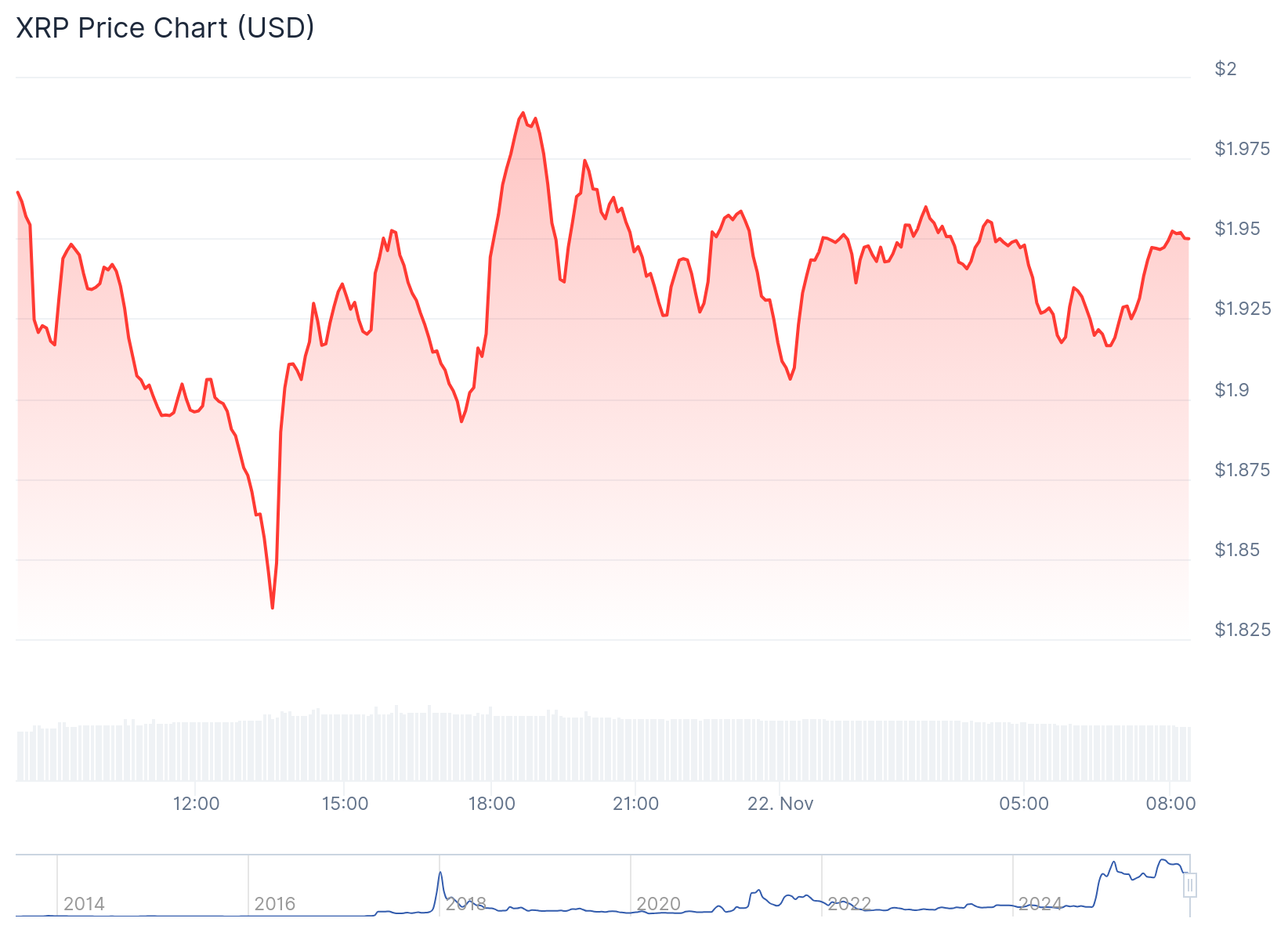

XRP dropped by a slight 0.7% in the past 24 hours, trading at $1.95, with a market capitalization of $117.28 billion and a trading volume of $8.1 billion. Despite its slight short-term decline, other extended interval price change variables showed remarkable dips. For context, XRP dropped 14.6% 7-day-to-date and 18.7% month-to-date.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.