Highlights:

- The XRP price is facing a heightened bearish grip, slipping 9% to $1.93.

- The derivatives market shows a drop in open interest, signalling a loss of confidence among traders.

- The technical outlook shows a potential downside towards $1.84 as the bears take control.

The XRP price is trading in the red, currently at $1.93, marking a 9% drop. The cryptocurrency market is facing a heightened bearish grip, led by Bitcoin, which is currently trading below $85,000. Over the last 48 hours, XRP has been experiencing volatility, with a significant share contributed by the massive sell-offs of whales. According to Ali Martinez, the amount of XRP sold during this time was 190 million, which has caused the cryptocurrency’s price to start decreasing drastically.

190 million $XRP sold by whales in the last 48 hours! pic.twitter.com/nB0P7jADCx

— Ali (@ali_charts) November 20, 2025

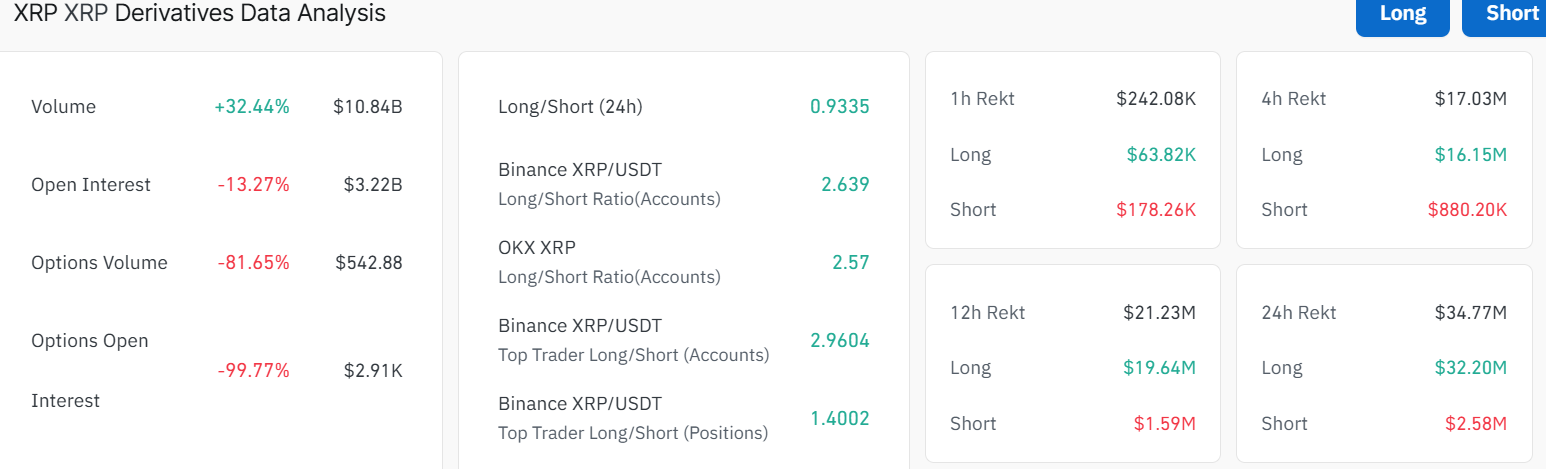

The extreme drop in the XRP price is consistent with higher volume in the XRP trading as depicted in the XRP derivatives. The statistics indicate that the volume of trading has grown by 32.44% to $10.84 billion. This volume expansion indicates that even at lower prices, traders are still actively trading the asset. The open interest has, however, declined by 13.27%, which implies a loss of confidence in the overall market.

Meanwhile, as the whales are dumping their holdings, other traders are hesitant to follow suit. This has led to an increase in some short positions, as evidenced by the widening gap between long and short trades.

Additionally, based on the options market, we have seen an astounding 81.65% reduction in options volume. This steep decline is reflective of reduced hedging and a lack of interest among traders in responding to price movements. This could be an indication that there is less confidence in XRP price recovery following such a dramatic price adjustment.

XRP Price Might Continue the Downtrend Towards $1.84 Support

The XRP/USD 1-day chart indicates that the XRP price is currently bearish. The 200-period Simple Moving Average (SMA) at $2.62 has become a significant resistance level. Meanwhile, the 50 SMA at $2.45 is also acting as a shaky resistance level.

Examining the indicators, the Relative Strength Index (RSI) at 31.47 is approaching oversold territory, suggesting that selling pressure is intense. However, if it dips below 30, a quick buy-back strategy could send the XRP price to $2.23 before a bounce-back rally.

Meanwhile, the Moving Average Convergence Divergence (MACD) shows a bearish crossover, with the signal line slicing below the MACD line (blue). In the short term, XRP price may test the $1.83 support level if the bears continue their campaign. A break below the immediate support could drag it to the recent low of $1.64, where bargain hunters might swoop in.

However, if bulls reclaim the $2.23 resistance, the XRP price could see a rebound toward $2.45, especially if market sentiment flips and the entire market turns green again. The $2.23-$2.45 zone will be a key point to watch. If buyers hold onto it, XRP will likely return to a bullish trend.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.