Highlights:

- 21Shares XRP ETF will soon start trading on Cboe BZX after securing approval from the US SEC.

- The ETF will trade under the ticker TOXR, expanding investors’ access to XRP.

- The custodians for the 21Shares’ XRP ETF include Coinbase Custody, Anchorage Digital Bank, and BitGo Trust.

21Shares, one of the leading cryptocurrency exchange-traded fund (ETF) service providers, has secured approval from the US Securities and Exchange Commission (SEC) for its XRP ETF. The approval came after the company filed a Form 8-A with the SEC. According to the SEC filing, Cboe BZX will list the ETF once the exchange completes its final certification.

Coinbase Custody, Anchorage Digital Bank, and BitGo Trust will serve as the crypto custodians for the 21Shares’ XRP ETF. Additionally, BNY Mellon will handle cash custody, administration, and transfer agent duties, while Foreside Global Services will oversee the trust’s marketing operations. To initiate the ETF, 21Shares US LLC will purchase the initial seed basket of 10,000 shares.

JUST IN: The SEC has approved 21Shares’ Form 8-A, clearing the way for the 21Shares Spot $XRP ETF ( $TOXR ) to list on the Cboe BZX Exchange.

Another regulated $XRP product entering the market✅‼️ pic.twitter.com/xQ1QXNi931

— XRP Update (@XrpUdate) November 20, 2025

21Shares XRP ETF approval comes a few days after Crypto2Community reported that the countdown for the ETF approval had started. According to the report, the SEC has a 20-day window to review the company’s Form S-1 application, submitted on November 7. This suggests that the ETF will likely become effective on or around November 27.

Several ETFs Set to Launch this Month

The rapid approval could be linked to the SEC’s updated processes for ETF approvals after the US government shutdown. Unlike other asset management firms, 21Shares has not yet shared its management fee or whether its XRP ETF will offer a fee waiver. For context, Bitwise, Franklin Templeton, and Grayscale have released their fees, with Franklin’s XRP ETF (XRPZ) setting the lowest fee at 0.19%.

Bitwise’s XRP ETF is set to start trading on the New York Stock Exchange (NYSE) on November 20, under the market ticker “XRP.” Meanwhile, Grayscale and Franklin Templeton will launch their XRP ETFs on November 24. These products aim to offer investors exposure to XRP’s price, using the CME CF XRP-Dollar Reference Rate as their pricing benchmark.

🚨 🚨 BREAKING NEWS:

The US SEC has approved 21SHARES Form 8-A to launch Spot XRP ETF on the Cboe BZX Exchange with ticker (TOXR). 📃 🪙 💰 🇺🇸

BOOOOOOM! 🔥 🔥 🔥 🔥 🔥 #XRP #RLUSD #XRPETF 💎 💎 💎 💎 💎 💎 💎 💎 💎 💎 pic.twitter.com/W2q6BQlRar

— Kenny Nguyen (@mrnguyen007) November 20, 2025

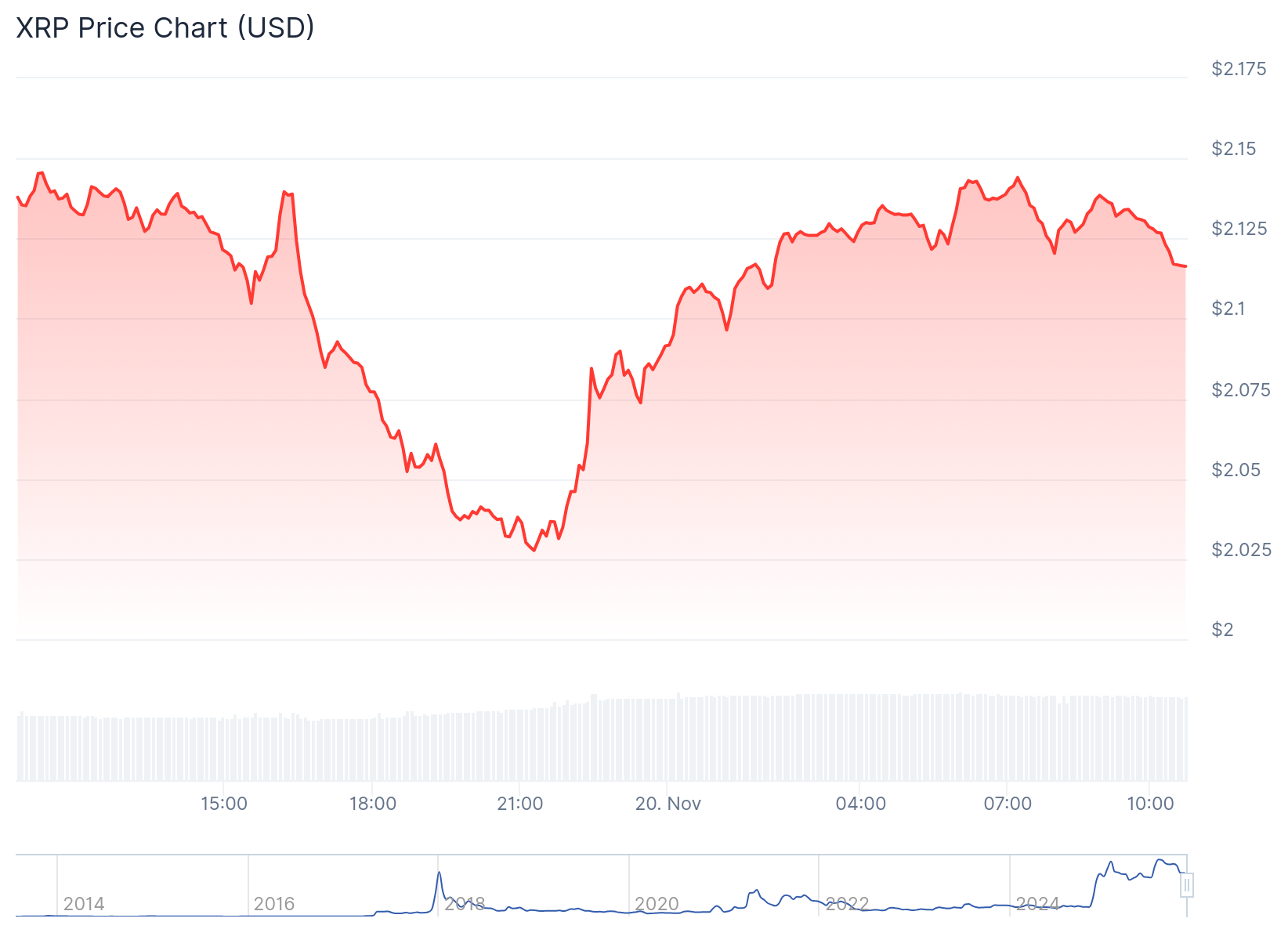

XRP Remains Below $2.5 Despite Several ETF Approvals

At the time of writing, XRP is trading at $2.13, following a 1% decline in the past 24 hours, with a trading volume of $6.07 billion and a market cap of $128.2 billion. In the past week, XRP dropped 14.4%, with price extremes fluctuating between $2.04 and $2.50.

XRP’s 14-day-to-date and month-to-date price change variables reflected declines of about 8.4% and 12.2%, respectively, highlighting the token’s recent price struggles.

Coincodex’s data shows XRP’s high volatility and supply inflation at 6.03% and 5.7%, respectively. Risk assessment metrics show that XRP has outperformed 95% of the top 100 cryptocurrencies, including Bitcoin (BTC) and Ethereum (ETH). XRP also has high liquidity based on its market cap, with a 96% upswing in the past year. However, the asset is currently trading below its 200-day Simple Moving Average (SMA). It has shown only 12 profitable days in the past month with a yearly inflation rate of 5.7%.

21Shares Shows Interest in Other Crypto ETFs

On October 20, Crypto2Community reported that 21Shares has updated its S-1 filing for a Dogecoin (DOGE) ETF, which will trade under the market symbol “TDOG.” The move pushes toward SEC approval for the Dogecoin ETF. In September, 21Shares launched dYdX ETP, expanding institutional investors’ access to decentralized derivatives. The product is already trading on Euronext Paris and Amsterdam under the market ticker DYDX.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.