Highlights:

- The Cronos price has spiked 7% to $0.11, as bulls aim for a breakout above the falling wedge.

- The CRO DeFi TVL has spiked 2% indicating growing confidence in the Cronos chain.

- The technical outlook shows a potential breakout to $0.17 if the $0.10 psychological level holds.

The Cronos price has surged 7% to $0.1109, despite its daily trading volume slipping 15%. Meanwhile, the derivatives data reveal that there is a rise in optimism among traders, with the bullish positions increasing. On the other hand, CRO’s rise in Total Value Locked (TVL) on the Cronos blockchain indicates that more users are becoming more confident on-chain.

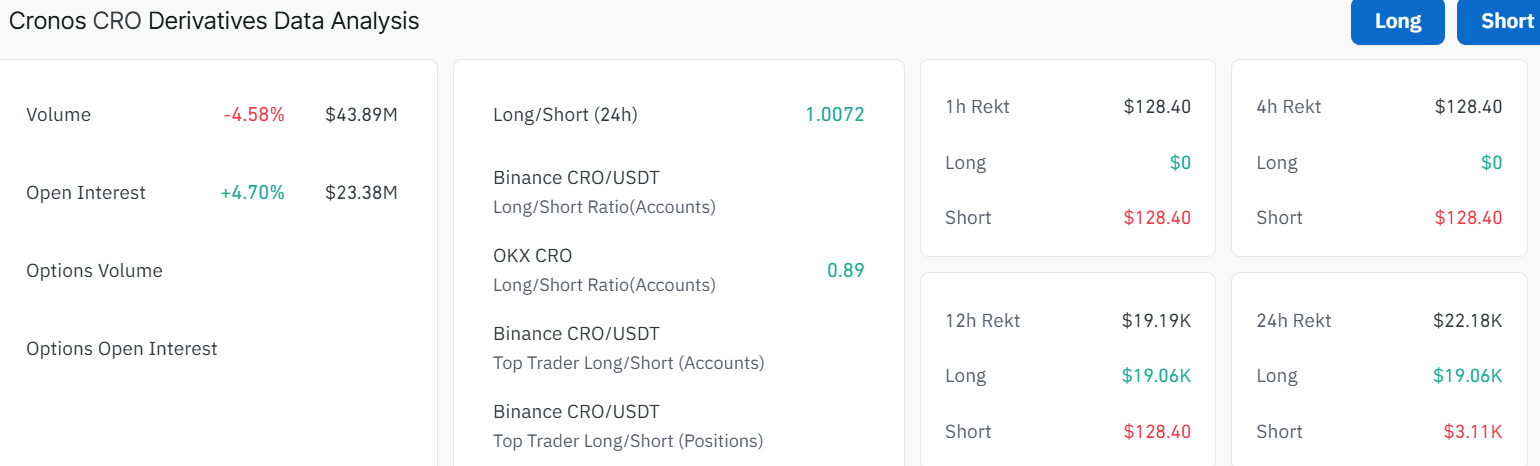

The demand for Cronos is building up in the retail segment, with traders expecting a price rebound of the Cronos price. According to CoinGlass data, the Open Interest in CRO futures has grown by 4.70% in the past 24 hours, and currently, it is at $23.38 million. This implies accumulation of long positions as Cronos gears towards the potential breakout rally. Additionally, the long-to-short ratio sits at 1.0072, implying that the bullish sentiment is building in the CRO market.

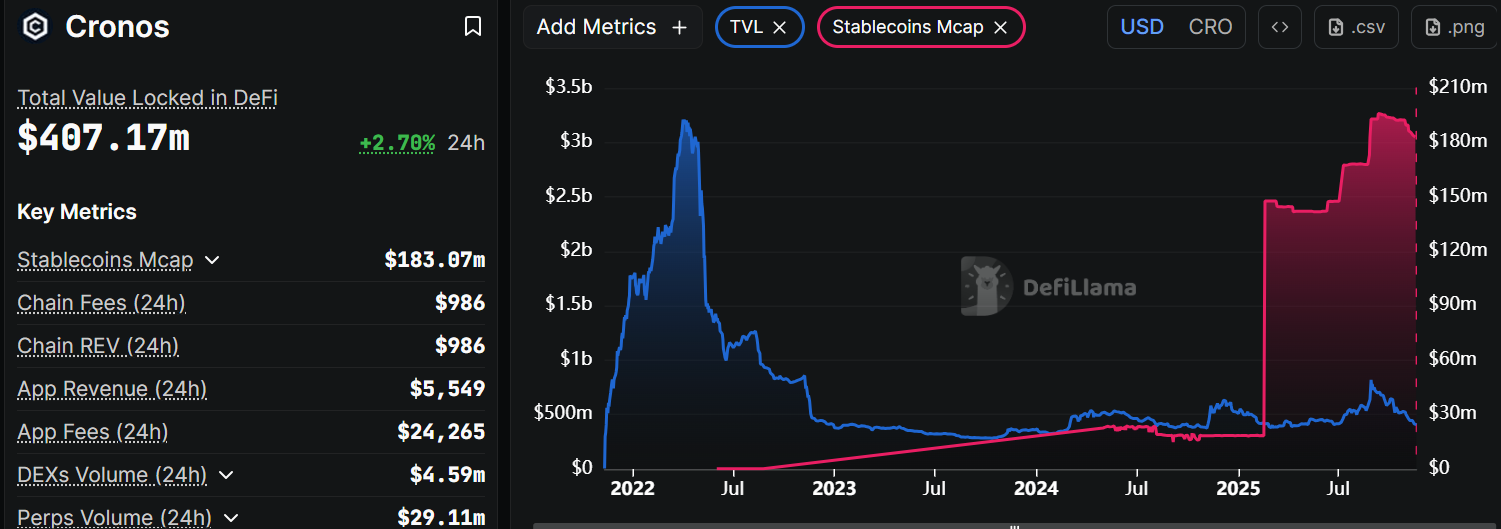

According to DeFiLlama statistics, on-chain Cronos adoption is gaining momentum. The retail demand has increased by 2.70% to place Cronos at a TVL of $407.17 million. It also indicates positive confidence in the Cronos digital assets, as it is receiving inflows, and the capitalization of the stablecoin market is more than $183 million. This shows a substantial increase from the $18.39 million on January 1, which is an indication of good liquidity.

Cronos Price Hints at a Potential Breakout Above the Falling Wedge

The chart shows Cronos’ price action over the past several months, and it’s been a rollercoaster. After a solid uptrend earlier this year, the price took a dip, testing and breaking below the 200-day(0.1446) and 50-day($0.1507) Simple Moving Averages (SMAs).

Currently, the Cronos price is showing a potential breakout, as the bulls have established a strong support around $0.10. Zooming into the chart, a falling wedge pattern is observed, from which the price usually breaks out to the upside. CRO is currently testing the upper boundary of the wedge, and if it manages to break out, paired with the recent 7% jump, it could signal the bulls are back in complete control.

The Relative Strength Index (RSI) is at 36.44, rebounding from the oversold territory, suggesting bearish momentum may be slowing. In such a case, a potential short-term rebound could emerge. Meanwhile, the Moving Average Convergence Divergence (MACD) shows a bearish crossover, with the MACD line edging below the signal line (orange).

Looking ahead, if Cronos price breaks and holds above $0.14 and $0.15 resistance, it could end up testing resistance near $0.17-$0.20 in the short term. A break past $0.20 might then send it cruising toward $0.23 mark. However, traders will want to watch out for a pullback if the price faces rejection at the 200-day or 50-day SMAs. Support lies around $0.10, and a deeper dip could test $0.075.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.