Highlights:

- Bitcoin’s sharp fall below $90K sparks caution but also renewed buying interest

- Winklevoss said the sub-$90K level may be the last buying opportunity.

- BitMine and Bitwise executives see early signs of a market bottom forming soon.

Bitcoin’s fall below $90,000 drew fresh attention across crypto spaces. CoinGecko reported a brief dip to $89,300 on Tuesday. This move put the coin almost seven months behind in price progress. A drop of more than 29% from the high above $126,000 on Oct. 6 added pressure on the market. The sharp decline added pressure across trading platforms and heightened caution among both long-term holders and short-term traders.

Winklevoss Says Bitcoin Drop Could Offer Final Buying Opportunity

Gemini co-founder Cameron Winklevoss told investors that the dip below $90,000 could be the last chance for entry before a potential recovery. He highlighted that this slide reopened discussions around the cyclical patterns observed in cryptocurrency markets.

This is the last time you'll ever be able to buy bitcoin below $90k!

— Cameron Winklevoss (@cameron) November 18, 2025

BitMine and Bitwise Executives Predict Market Bottom This Week

Tom Lee, chairman of BitMine, spoke about factors behind the current market weakness during a CNBC interview on Monday. He mentioned that effects from the October 10 liquidation event were still being felt. He also referred to uncertainty over whether the US Federal Reserve would reduce interest rates in December. Lee talked about his discussion with Tom Demar of Demar Analytics. He suggested there were early signs that a market bottom might be forming. According to Lee, Demar believed the bottom could appear sometime this week.

Matt Hougan, chief investment officer at Bitwise Asset Management, echoed Lee’s view. He pointed to market anxiety over the economy, artificial intelligence valuations, and US President Donald Trump’s tariffs as contributing factors to the recent decline.

Hougan described the current prices as a rare entry point for long-term investors. “I think we’re nearing a bottom. I look at this as a great buying opportunity for long-term investors. Bitcoin was the first thing to turn over before this broader market pullback,” he said.

Tom Lee expressed confidence that Bitcoin could recover lost ground and possibly reach a new record high before year-end. He linked this potential rise to a rally in the stock markets, which he believes could support the cryptocurrency. Lee indicated that he remained bullish on stocks until the end of the year. He noted that the weakness seen in early November was expected. He added that a strong market rally could help push Bitcoin toward an all-time high.

Bitcoin Whales Accumulate as Small Holders Exit Amid Market Drop

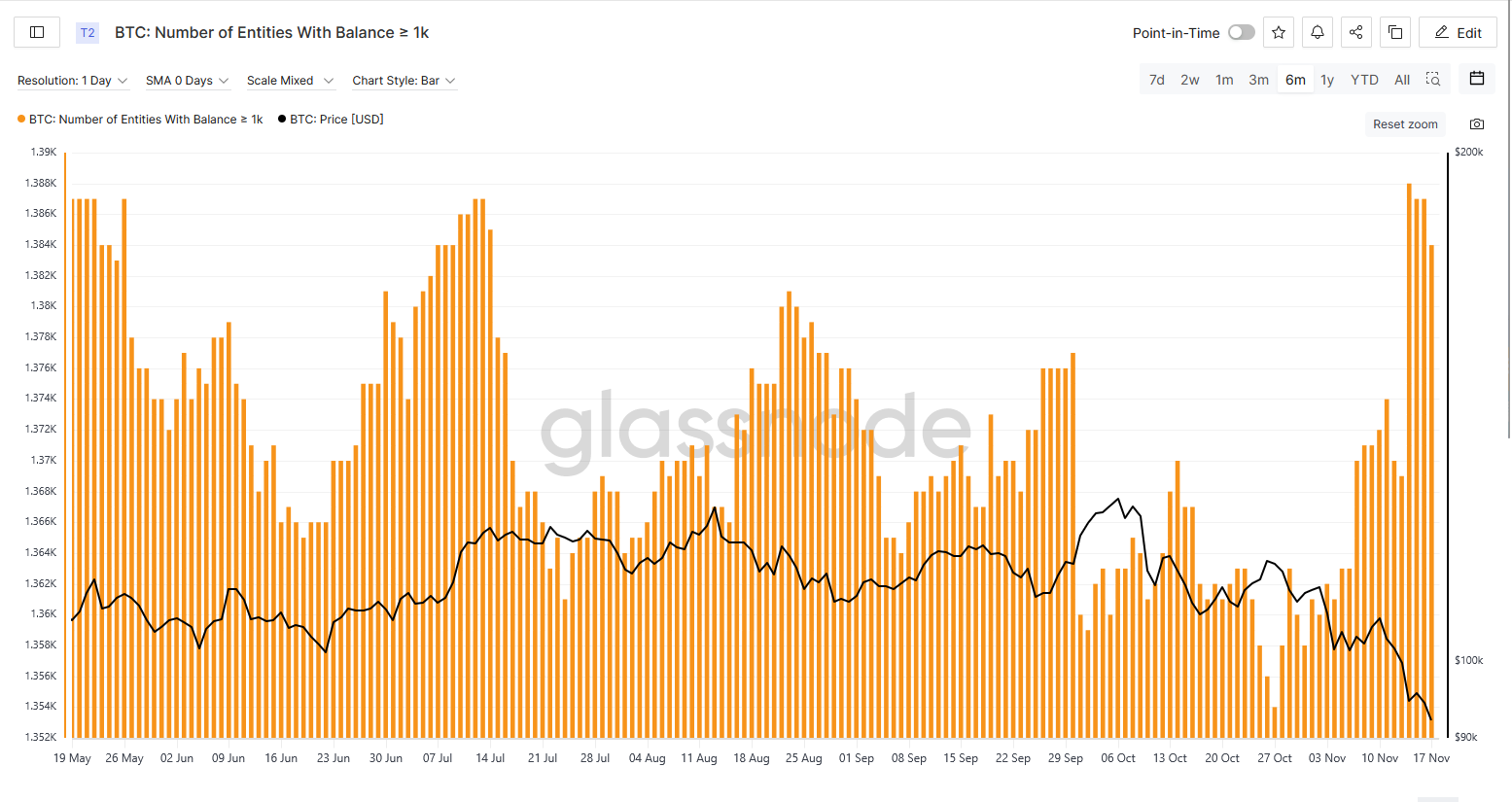

Bitcoin whale wallets have been growing as the crypto market faced pressure this week. Glassnode data shows whales have been adding more coins since late October. Wallets holding over 1,000 BTC started rising noticeably on Friday. The number of whale wallets had dropped to a yearly low of 1,354 on Oct. 27, when Bitcoin traded near $114,000. By Monday, this number climbed 2.2% to 1,384. This level has not been reached in the last four months.

At the same time, Glassnode data show that small Bitcoin holders with 1 BTC or more have been affected by the recent price drop. The total number of these wallets fell from 980,577 on Oct. 27 to a yearly low of 977,420 on Nov. 17.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.