Highlights:

- Bitfarms has announced plans to exit Bitcoin mining and shift focus to AI and HPC data centres.

- The mining company said it plans to complete the conversion by December 2026.

- Bitfarms has also partnered with an American data-centre infrastructure company to provide materials for the upgrade.

Global Bitcoin (BTC) mining company, Bitfarms, has unveiled plans to convert its Bitcoin mining site in Washington State into a centre for Artificial Intelligence (AI) and high-performance computing. The company announced the decision in a press release on November 13, as BTC slipped below $100,000.

According to the press release, Bitfarms plans to complete the conversion in December 2026. The Washington site currently runs on 18 MW of power for Bitcoin mining. Bitfarms stated that it will upgrade the facility with racks rated for 190 kW each and liquid-cooling systems built for high-density AI workloads. This makes it suitable for powerful chips like GB300 GPUs.

$BITF mgmt says the Moses Lake GPU cloud site (18 MW) alone could generate more NOI per year than Bitfarms has ever made from #Bitcoinmining.

They’re planning to wind down mining and reinvent as a North American HPC/AI infrastructure play. Do you buy the pivot? 🤔 pic.twitter.com/FluSTfITQN

— Cindy Feng (@itsCindyFeng) November 14, 2025

Bitfarms Partners with American Firm to Provide Materials for the Upgrade

The Bitcoin mining company noted that it has already signed a binding agreement worth $128 million with an American data-centre infrastructure company. This collaboration deal covers all IT hardware and other building materials required for the anticipated upgrade. Upon completion, the new facility will run very efficiently, with a PUE between 1.2 and 1.3. Beyond support for Nvidia’s GB300 GPUs, the site will use a modular design for phased expansion.

Speaking on the planned initiative, Ben Gagnon, Bitfarms’ Chief Executive Officer (CEO), reiterated the company’s commitment to establishing more AI/HPC infrastructure across its sites. He added that most of the company’s wider plans will focus on Nvidia’s upcoming Vera Rubin GPUs. Additionally, Bitfarms may choose a GPU-as-a-Service or cloud-based business model for the Washington site.

The CEO stated:

“While our focus is on developing infrastructure to support Nvidia’s next generation of Vera Rubin GPUs across most of our portfolio, with nearly a billion dollars in cash, unused credit facilities and Bitcoin and numerous potential GPU financing options available, we believe there are compelling reasons to consider pursuing a GPU-as-a-Service or Cloud monetization strategy specifically at Washington.”

Despite contributing less than 1% of its full developmental portfolio, Bitfarms believes that AI and high-performance computing will generate more revenue than Bitcoin mining. With the additional income, Bitfarms hopes to cover its operational costs and debt. The capital could also support future building plans, as the company gradually exits Bitcoin mining through 2026 and 2027.

Bitfarms Posts Q3 Loss Amid Plans to Exit Bitcoin Mining

On November 13, Bitfarms also released its financial report for the third quarter (Q3) of this year. The report showed that the company lost $46 million, compared to the $24 million recorded in 2024, translating to a loss of 8 cents per share, which was significantly below analysts’ expectations of a 2-cent per share loss. Notably, revenue jumped 156% year-over-year to $69 million but missed the 172% growth analysts had predicted.

Bitfarms $BITF Q3: a tough quarter vs. a massive strategic pivot. 📉📈

The Miss:

▪︎ EPS: -$0.08 (Expected: -$0.02)

▪︎ Revenue: $69.2M (Expected: ~$84.7M)The Pivot:

But the real story is the war chest and the hard pivot from a pure-play miner to an HPC/AI infrastructure… pic.twitter.com/0vHWC3kvmt— Karol Kozicki (@k2__investment) November 13, 2025

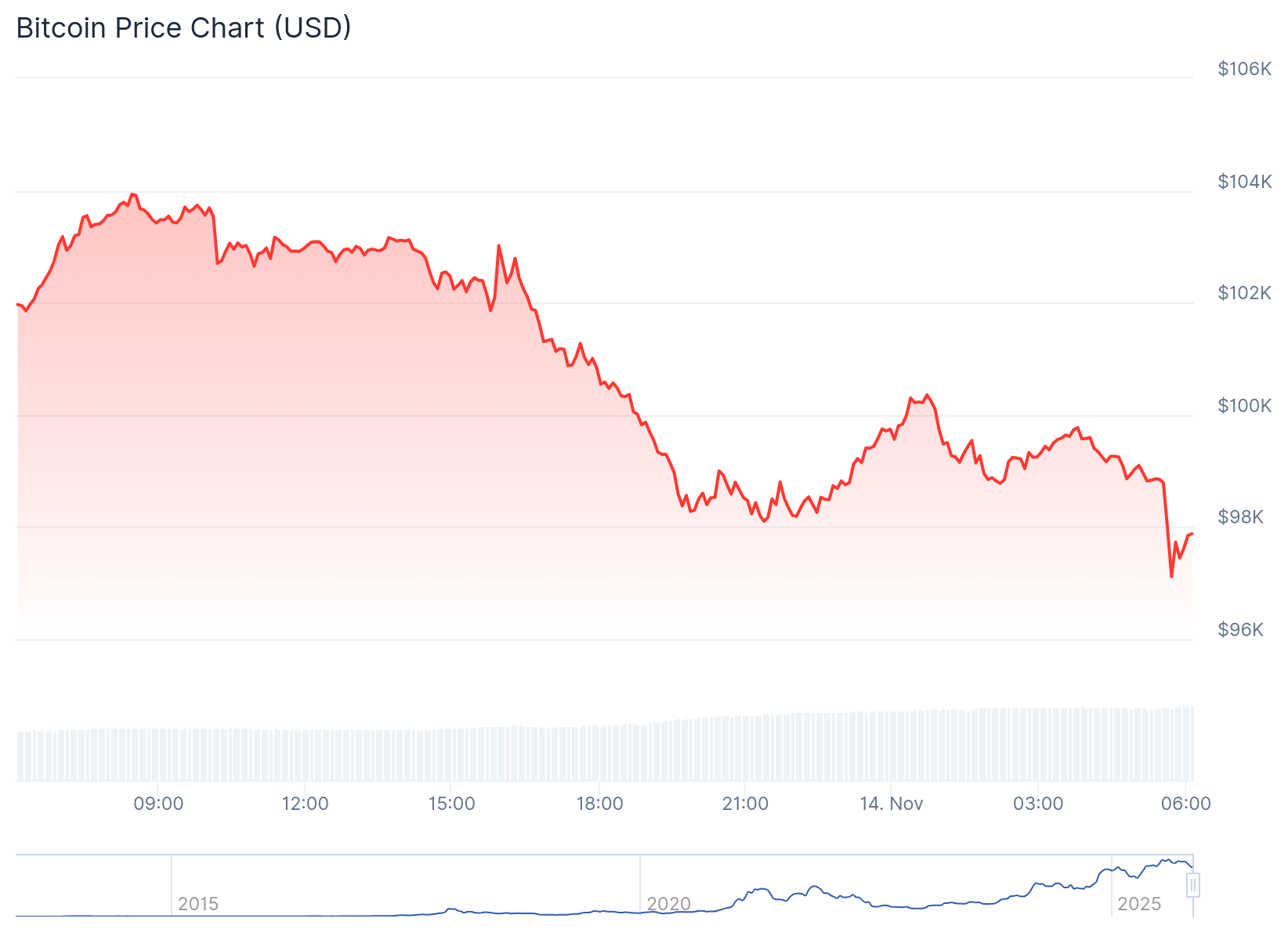

The company reported that it earned 520 BTC, worth an average of $48,200 per BTC. Currently, Bitfarms holds 1,827 BTC. Meanwhile, Google Finance data showed that the company’s shares took a 17.98% hit today, closing the trading day at $2.60. Similarly, Bitcoin dropped 3.2% in the past 24 hours, trading at $97,839, with a trading volume of $103.47 billion and a market cap of $1.97 trillion. BTC’s 7-day-to-date price change variable reflected a 2.8% decline, with price extremes fluctuating between $98,191.19 and $106,562.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.