Highlights:

- Quant price has risen 7% to $89, as its volume skyrockets 84%.

- On-chain metrics show an increase in whale accumulation in QNT tokens, hence increased demand.

- The technical outlook indicates a potential surge towards $101 resistance zone.

The Quant price is up 7% to $89 in the past 24 hours, as it is heading to the upper band of a range of consolidation. The daily trading volume has also soared 84% indicating heightened trading activity. Meanwhile, the near-term recovery is matched with a rise in demand by whales and a risk-on trade by derivatives traders.

The emergence of major wallet investors(whales) is usually preceded by a price spike or smart money. Santiment data indicate that the investors who own 10,000 to 1 million QNT tokens now are 57.83% of the on-chain supply, compared to 56.98% as of October 1. That shows an increase of 130,000 QNT in the holding, to 8.61 million. As the confidence of whales increases, the retail segment will be followed by a rise in demand for QNT. This may soon see the Quant price rise in the coming days.

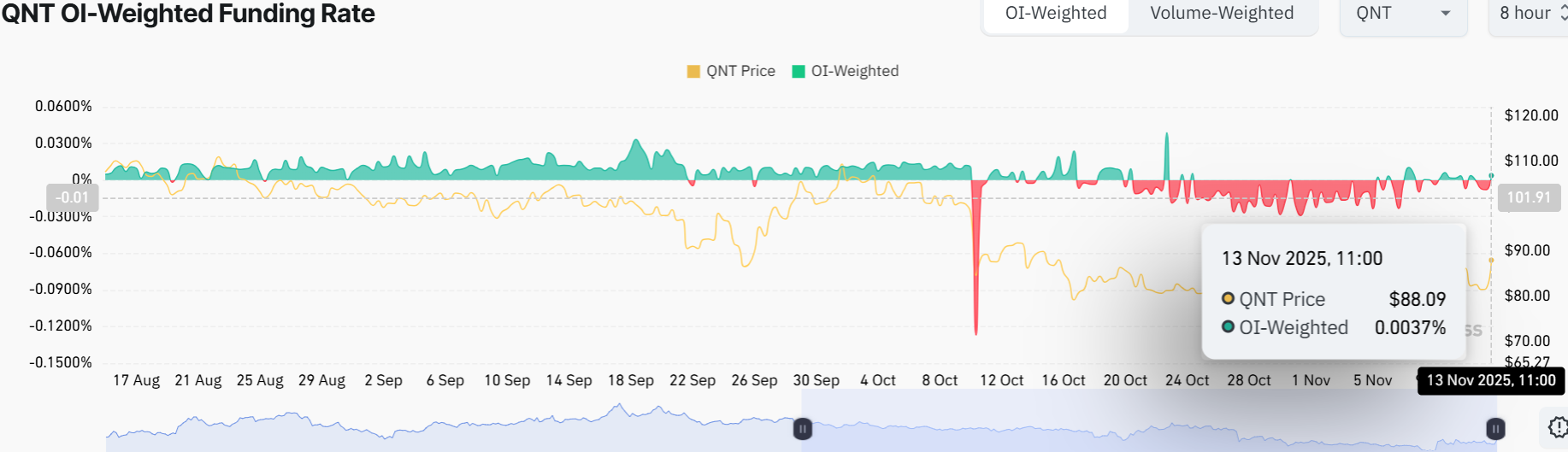

To support the change of retail sentiment, derivatives data show that there has been an increase in traders who are buying long positions. The CoinGlass OI-weighted rate of funding is a rate that monitors the total funding rates of exchanges to determine the trades that are crowded. The positive rates mean that the bulls are paying a premium to the bears. This is to enable offsetting the leverage-induced imbalance, and the spot prices and vice versa.

The OI-weighted funding rate in the case of Quant is 0.0037% which is mostly bullish. The positive funding rate further boosts the bullish sentiment in the Quant market.

Quant Price Poised for a Breakout to $101

On the Quant 1-day chart, the token price has been oscillating between $78-$89 range. However, the bulls have managed to flip the 50-day SMA($88.74 into a major support floor, igniting a potential bullish rally. The Quant price is currently within a consolidation channel, as the bulls aim to break out towards $100 soon.

Zooming into the indicators, the Relative Strength Index (RSI) is at 56.35. This indicates that the token is neither overbought nor oversold. Meanwhile, a position above 50 is a green light for bulls to keep pushing, though a pullback isn’t off the table if it hits 70.

The Moving Average Convergence Divergence (MACD) shows a bullish bounce. This is evident as the MACD line bounces from the signal line (orange) and soars higher, signaling more upside potential. In the short term, the Quant price could move up to that next resistance level at $101, from here, if the support zone holds. The breakout and momentum suggest investors could still gain if they enter now, but timing is key.

If it dips back to the 50-day SMA around $88, that could be a prime buy zone for the risk-takers. In the long term, if the token keeps the hype alive, there might be a test at $107-$116 by year-end, especially with the crypto market turning bullish.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.