Highlights:

- The XRP price has surged 3%, trading at $2.51, as its trading volume has increased by 46%.

- The recent surge comes amid the certification of Nasdaq of Canary Capital to trade on the Spot XRP ETF (XRPC).

- The technical outlook shows a potential rally to $3 if the bulls overcome the resistance zones.

The XRP price has spiked by 3% today to $2.51, outperforming the broader cryptocurrency market. The daily trading volume has notably soared 46% to $5.9 billion, suggesting rising investor confidence. The recent spike followed the certification of Nasdaq of Canary Capital to trade on the Spot XRP ETF (XRPC).

The ETF will commence trading when the U.S. market opens today, and it will list XRP alongside other recognized crypto assets, such as Bitcoin and Ethereum, in the regulated ETF market. This will expose it to investors with easy access as well as increase its visibility among the mainstream investment vehicles.

🚨NEW: As of 5:30 PM ET, @CanaryFunds’ $XRP ETF is officially effective after @Nasdaq certified the listing, clearing $XRPC for launch tomorrow at market open. pic.twitter.com/h3hxVMDhWP

— Eleanor Terrett (@EleanorTerrett) November 12, 2025

Moreover, the US President has signed a bill, officially ending the US government shutdown. However, this has not caused any major boost in the wider crypto market, as major altcoins are still swinging in the red.

BREAKING: 🇺🇸 President Trump signs bill officially ending the US government shutdown.

— Watcher.Guru (@WatcherGuru) November 13, 2025

XRP Derivatives Market Outlook

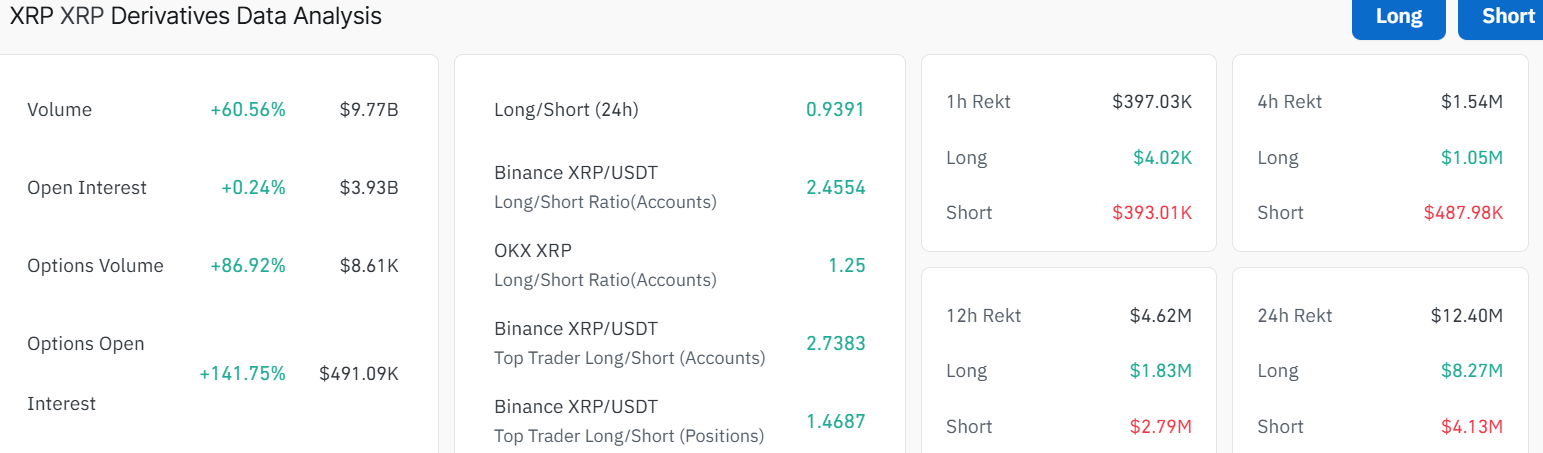

A quick look into the derivatives market, the XRP volume and open interest have spiked, indicating growing interest. The volume is up 60% to $9.77B suggesting intense trading activity in the XRP market. On the other hand, the open interest has spiked 0.24% to $3.93B. Further, the options volume and options open interest are up 86% and 141%, respectively.

As traders entered the futures market, the long-to-short ratio was in good balance at 0.9391. The ratio shows a great interest in the market but also indicates a warning since the traders are still keeping an eye on the price fluctuations.

XRP Price Aims for a Breakout Above the Parallel Channel

The chart shows the XRP price trading at a solid $2.51, up 3.6% in the last 24 hours. The 50 Simple Moving Average (SMA) sits at $2.57, and the 200 SMA at $2.63, acting as immediate resistance zones. The altcoin is trading well within the falling parallel channel, as the bulls aim for a breakout above the upper trendline.

The Relative Strength Index (RSI) at 52.49 is hovering around the neutral territory, not overbought yet, leaving room for more upside. The Moving Average Convergence Divergence (MACD) shows a bullish crossover, with the signal line (orange) dipping below the MACD line (blue), hinting at accelerating momentum.

Looking at the chart’s trendlines, the recent uptrend, paired with those green upticks highlighting a strong support zone, suggests the altcoin has potential. A bold move will see the bulls flip the 50-day SMA $2.57 into a support zone. As ETFs overcome regulatory difficulties, the market confidence in the XRP price appears to be at its highest point.

The ETF approval opens the door to more institutional participation, which may result in further acceleration in XRP towards $3.00-$3.08 in the next few months. Conversely, risks still exist. If the resistance zones prove too strong, the XRP price may find a deeper support around $2.00.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.