Highlights:

- Five spot XRP ETFs from top firms expected to launch before November ends.

- First 1933 Act XRP ETF may go live this week, says Geraci.

- XRP rises to $2.49 as investors are optimistic about U.S. ETF launches.

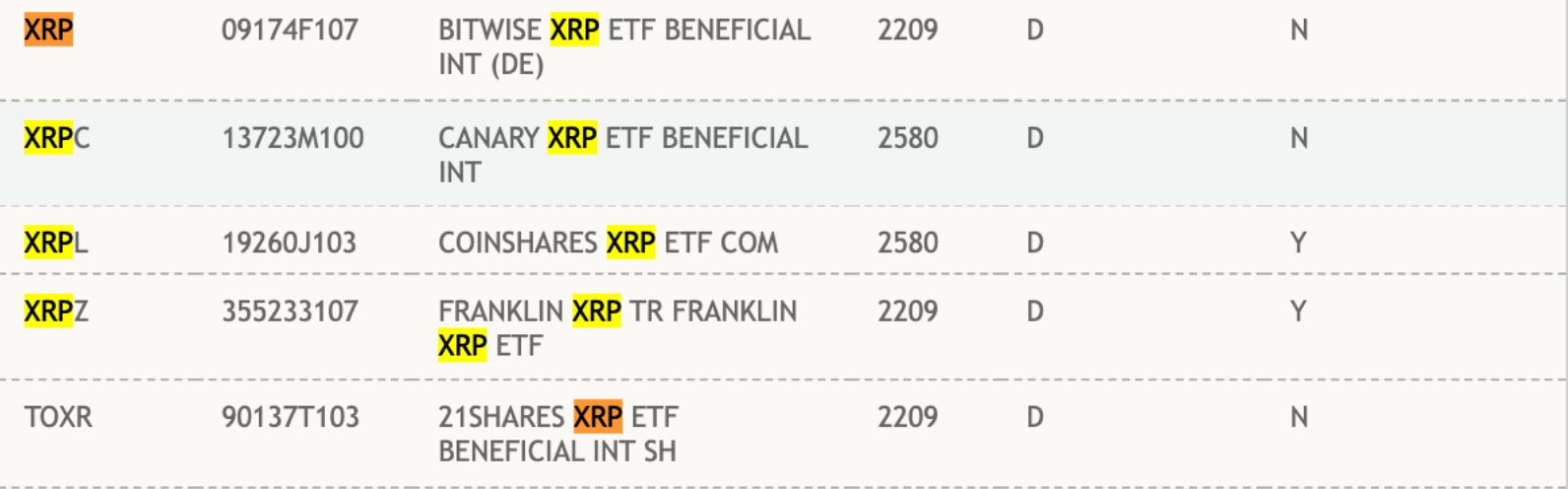

The U.S. market is preparing for a major influx of XRP exchange-traded funds. CoinShares, Franklin Templeton, 21Shares, Canary Capital, and Bitwise are launching five spot XRP ETFs, listed on the DTCC under XRPL, XRPZ, TOXR, XRPC, and Bitwise XRP (XRP). Launches are expected before the end of November.

Analysts believe the timing is ideal as clearer regulations and government action are helping speed up approvals. The DTCC update, released Friday, shows both ETFs ready for processing and pre-launch ETFs still awaiting regulatory approval, which cannot be processed until all requirements are met.

NovaDius Wealth Management president Nate Geraci said that the first spot XRP ETF filed under the Securities Act of 1933 might go live this week. His remarks follow growing optimism as the U.S. government moves toward ending its current shutdown.

Unlike futures-based ETFs, which are usually listed under the Investment Company Act of 1940, this product will operate under a different legal setup. Earlier XRP offerings in the U.S., such as REX-Osprey’s version launched in September, were registered under the 1940 Act, giving them a separate regulatory approach.

Government Shutdown Resolution Supports ETF Launches

Yesterday, the U.S. Senate approved a funding plan to end the 40-day government shutdown with a 60–40 vote. The plan will keep federal agencies funded until January 30, 2026, but it still needs approval from the House before the president can sign it into law.

Experts believe it may take a few more days to complete the process. Once finalized, the U.S. Securities and Exchange Commission (SEC) is expected to move quickly in approving new spot crypto ETF applications. Nate Geraci noted that this could open the door for several spot crypto ETFs to get approval soon. Investors are keeping a close watch on the spot XRP ETF, which could launch soon after the shutdown ends.

Government shutdown ending = spot crypto ETF floodgates opening…

In meantime, could see first ‘33 Act spot xrp ETF launch this week.

— Nate Geraci (@NateGeraci) November 10, 2025

Canary Capital Targets November 13 Launch

The planned timeline coincides with Canary Capital’s spot XRP ETF, which aims to launch on November 13 pending SEC approval. This would make it the first XRP ETF in the country registered under the Securities Act of 1933.

Canary Capital updated its filing on October 24 to include the 8(a) clause, which allows the ETF to become automatically effective after 20 days. The firm previously used the same method to launch spot ETFs tied to Litecoin and Hedera. After those successful launches, Canary aims to follow the same path with XRP. Experts say that if the SEC raises no objections, trading for the Canary XRP ETF could officially begin around mid-November.

🚨SCOOP: @CanaryFunds has filed an updated S-1 for its $XRP spot ETF, removing the “delaying amendment” that stops a registration from going auto-effective and gives the @SECGov control over timing.

This sets Canary’s $XRP ETF up for a launch date of November 13, assuming the… pic.twitter.com/MKvEN23t5P

— Eleanor Terrett (@EleanorTerrett) October 30, 2025

XRP is trading at $2.49, up 10% over the past 24 hours, with a market value of $150.04 billion and daily trading volume of $4.71 billion. The token’s steady gains reflect investor optimism over potential U.S. ETF approval.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.