Highlights:

- The Aster price rebounds above $1, as bulls target $1.29 resistance.

- Aster’s utility at 80% collateral may lead to more bullish trades in the perpetuals market.

- CoinGlass data shows a drop in volume and open interest, indicating a bearish outlook.

The Aster price is showing a promising outlook, trading at $1.04. The daily trading volume has slipped 24% indicating a drop in market activity. Aster, a perp-oriented Decentralized Exchange (DEX), announced that it expanded the use of its native token, ASTER, as collateral at an 80% loan-to-value ratio. A positive change in traders’ sentiment will be observed with leverage offered on the Aster perpetual.

$ASTER Utility Upgrade 🚀$ASTER is now live as collateral on Aster Perpetual with 80% margin ratio.⚡️

You can also use $ASTER to pay trading fees and enjoy a 5% fee discount.Trade, hedge, and earn. All powered by $ASTER. 💪

👉 https://t.co/3I4jipOylV pic.twitter.com/Jpg1wsXNYs— Aster (@Aster_DEX) November 5, 2025

This implementation is crucial for enhancing capital efficiency, enabling traders to use capital in the form of $ASTER tokens. This is not only as collateral but also to pay trading fees at a lower rate of 5%. These capabilities align with Aster’s objectives of growing its user base and trading on the DeFi platform.

ASTER Derivatives Market Outlook

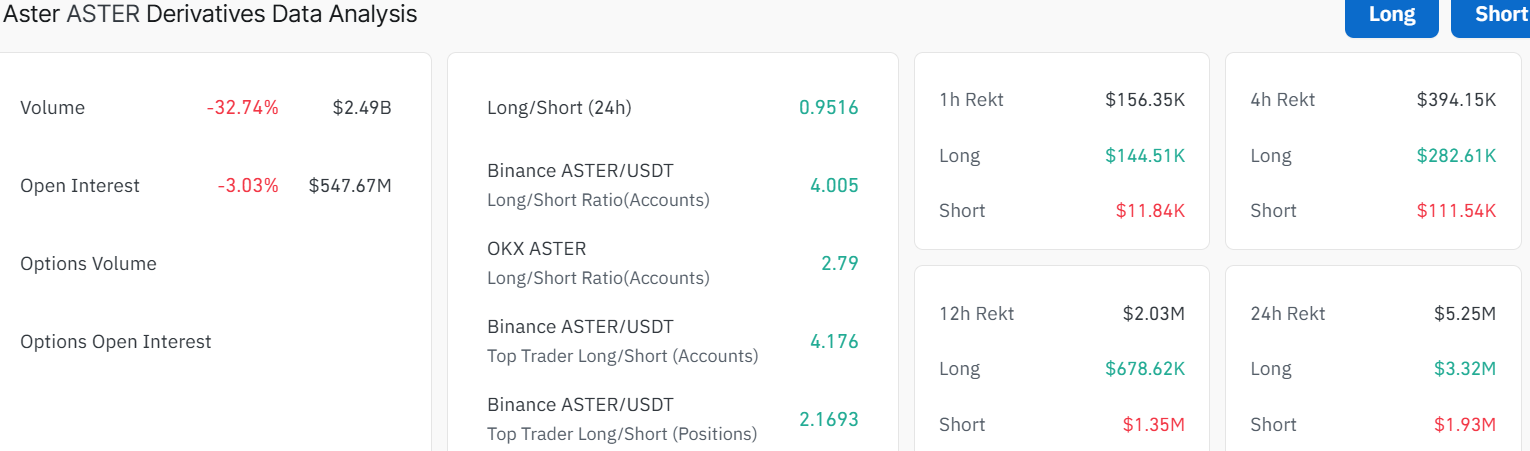

According to CoinGlass statistics, the ASTER futures Open Interest (OI) has slipped by 3.03% over the past 24 hours, suggesting that shorts have accumulated. Notably, its volume has decreased by 32% to $2.49 billion, showing reduced market activity. Aster has also been doing well on the long-to-short ratio. Currently at 0.95, indicating a better-balanced market sentiment with a minor inclination towards long positions.

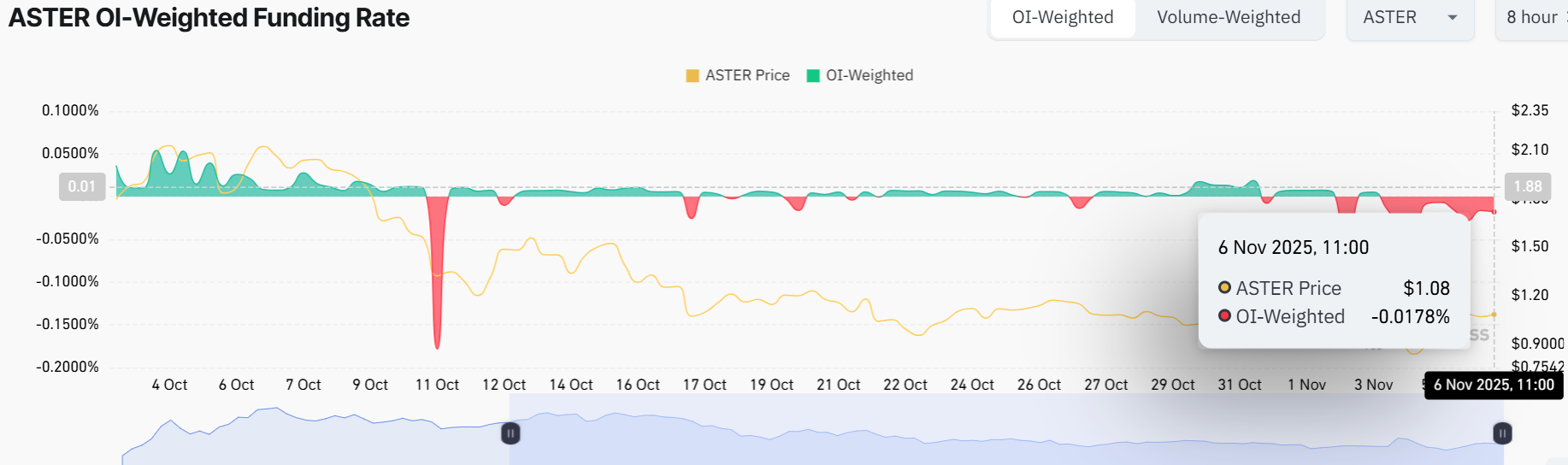

On the other hand, the OI-weighted funding rate has increased to -0.0100% from -0.0423% earlier in the day. This suggests a negative change in traders’ sentiment toward paying a premium on bearish positions.

What Is Next for Aster Price?

The chart shows the Aster price establishing strong support at $1.00 as the bulls attempt a recovery towards higher levels. Today, the bulls are showing their strength as the crypto market attempts to rebound.

The price smashed through the upper resistance at 1.00 and flipped it into support. The 50-day Simple Moving Average (SMA) at $1.00 is trending upward. However, the 200-day SMA (blue line) at $1.29 is cushioning the bulls against further upside.

Zooming in, the Relative Strength Index (RSI) sits at 51.54, neutral territory but still showing some room to run. The Moving Average Convergence Divergence (MACD) is also bullish, with the MACD line (blue) above the signal line, suggesting further upside momentum. If the Aster price holds above $1.29, there could be a push toward $1.50, with a test of $1.80 if the bulls keep pushing. However, if it dips, the $1.00 support is the line in the sand. Should ASTER fail to hold above that, there might be a slide back to $0.82.

The 50 SMA at $1.00 aligns perfectly with the current price, acting like a floor if the price suddenly crashes. The 12% weekly pump indicates that the Aster price is gaining momentum and potential, but traders should tread carefully. In the short term, the FORM price could push above $1.29 resistance within the next few days, with a stretch goal of $1.50 if volume spikes. Long-term, if this trend holds, ASTER could reach $1.80 by the end of November, but it’s all about the support levels holding.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.