Highlights:

- The Aave price is attempting a recovery, currently at $196.

- The protocol is nearing its all-time loans of care of over $1 trillion despite the recent drop in prices.

- On-chain and derivatives data are positive, as funding rates are positive.

The Aave price is showing signs of recovery, currently trading at $196. The daily trading volume has notably soared 25% indicating heightened investor confidence. The Decentralized Finance (DeFi) lending protocol is nearing the mark of $1 trillion in all-time loans, which is a point of healthy network usage and permanent demand.

Recently, Aave declared that the protocol is on the brink of achieving the milestone of all-time loans of up to 1 trillion. This is a large milestone that indicates that the network is active and the project is resilient amid the bigger market pressure.

Aave is nearing $1 trillion all-time loans.

Higher. pic.twitter.com/AcKWjV0CGk

— Aave (@aave) November 4, 2025

Aave Derivatives Outlook Shows a Bullish Bias

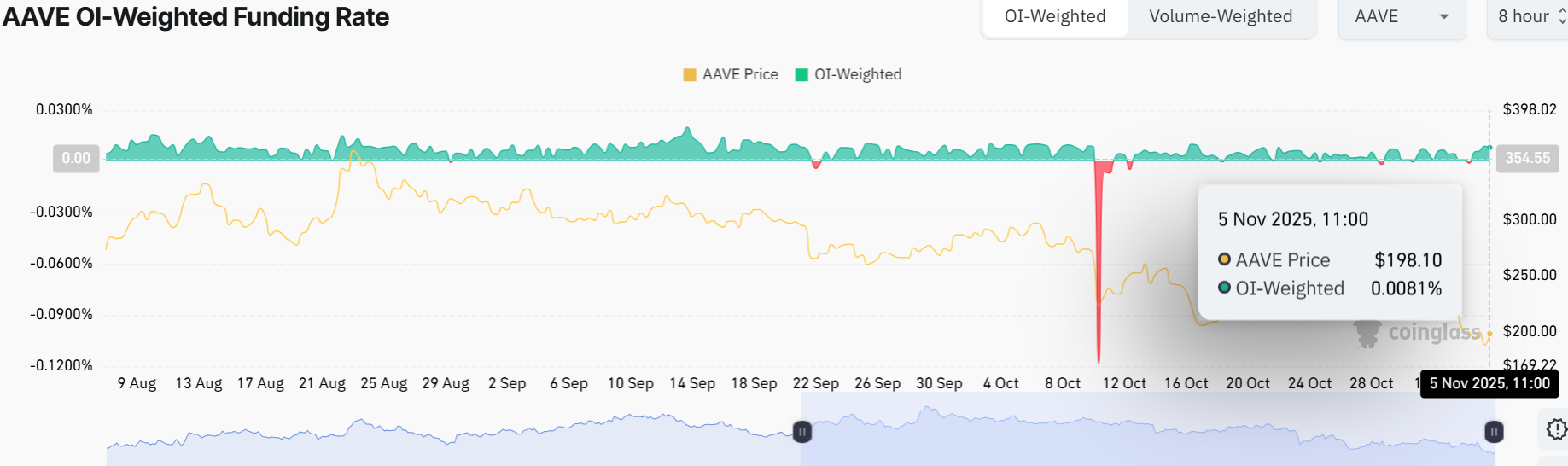

Aave is also experiencing a recovery rally that is backed by derivatives data. According to the Coinglass OI-Weighted Funding Rate statistics, the number of traders who bet that the price of AAVE will fall is even less than those who believe the price will rise.

The measure has reversed to a positive rate and is at 0.0089% on Wednesday, which means longs are paying shorts. The chart below indicates that the price of Aave has shot up when the funding rates have reversed to a positive value.

The AAVE/USD 1-day chart shows that the AAVE price is bearish currently. The 200-period Simple Moving Average (SMA) at $264 has turned into a resistance wall, with AAVE bouncing off it several times. Meanwhile, the 50 SMA at $252 is also acting as a shaky resistance level, having been breached several times in the past month.

Currently, the Aave price is trading within a falling wedge pattern, as the bulls attempt to rebound. In the meantime, if the bulls flip the $252 resistance into support, a significant rally to the next resistance at $264.

Diving into the indicators, the Relative Strength Index (RSI) at 38.20 is flirting with oversold territory, hinting that selling pressure might cool off soon. However, if it dips below 30, there could be a quick bearish surge that could send the AAVE to $182 before a bounce-back rally.

Aave Price Attempts Recovery Above Resistance Zones

Meanwhile, the Moving Average Convergence Divergence (MACD) shows a bearish crossover on November 3, with the signal line slicing below the MACD line (blue). That combo signals Aave is in sell-off mode. In the short term, Aave may test the $182 support level if the bears continue their campaign. A break below the current immediate support could drag it to $160, where bargain hunters might swoop in.

However, if bulls reclaim the $252, the Aave price could see a rebound toward $264, especially if market sentiment flips, and the entire market turns green again. The $252-264 zone will be a key point to watch. If buyers hold it, Aave will be back in a bullish trend.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.