Highlights:

- The Hyperliquid price rebounds 7% to $40, as its trading volume skyrockets 35%.

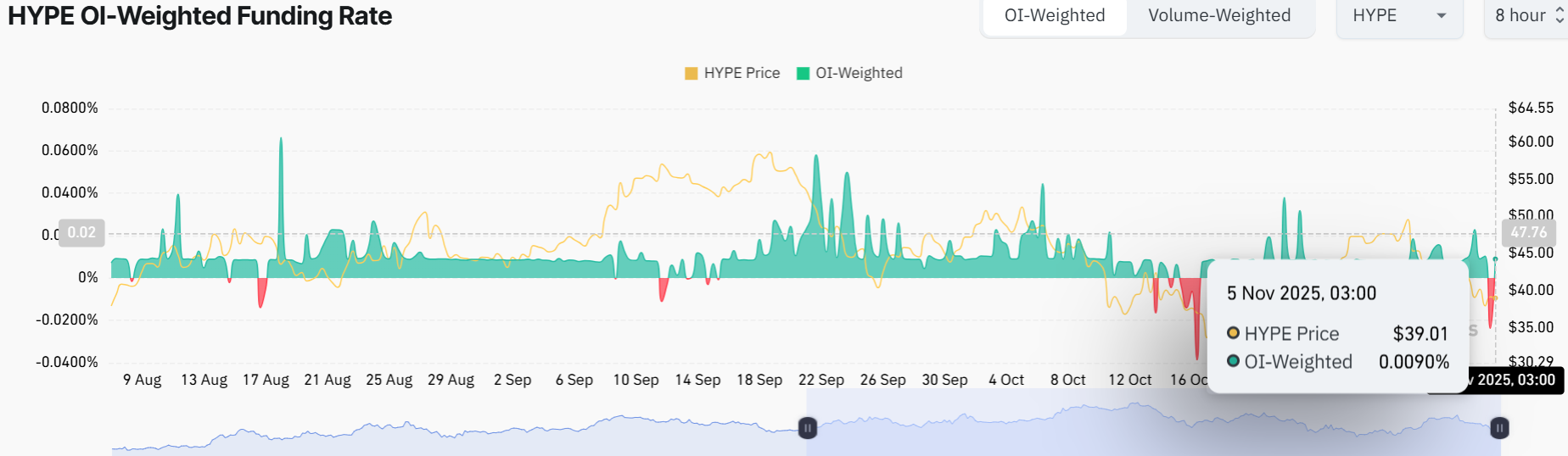

- The HYPE funding rate has flipped positive, indicating a potential rise in Hyperliquid price.

- The technical outlook shows a potential spike to $50 if the $443 resistance gives way.

The Hyperliquid price is showing signs of recovery, soaring 7% to $40 as of writing. The daily trading volume has notably skyrocketed 35%, indicating renewed investor confidence in the market. The on-chain and derivatives data also point to improving market conditions where the funding rates are positive. This indicates an increase in confidence amongst large holders.

The derivatives data also gives Hyperliquid a recovery rally. The data provided by Coinglass on OI-Weighted Funding Rate indicates that the count of traders who bet that the price of HYPE will fall even further is less than those who expect the price to rise. The measure has flipped from negative to positive with a standing of 0.0090% as of Wednesday, where longs pay shorts. In the past, when the rate of funding changed to a positive rate instead of a negative rate, Hyperliquid’s price experienced a sharp rise in its price.

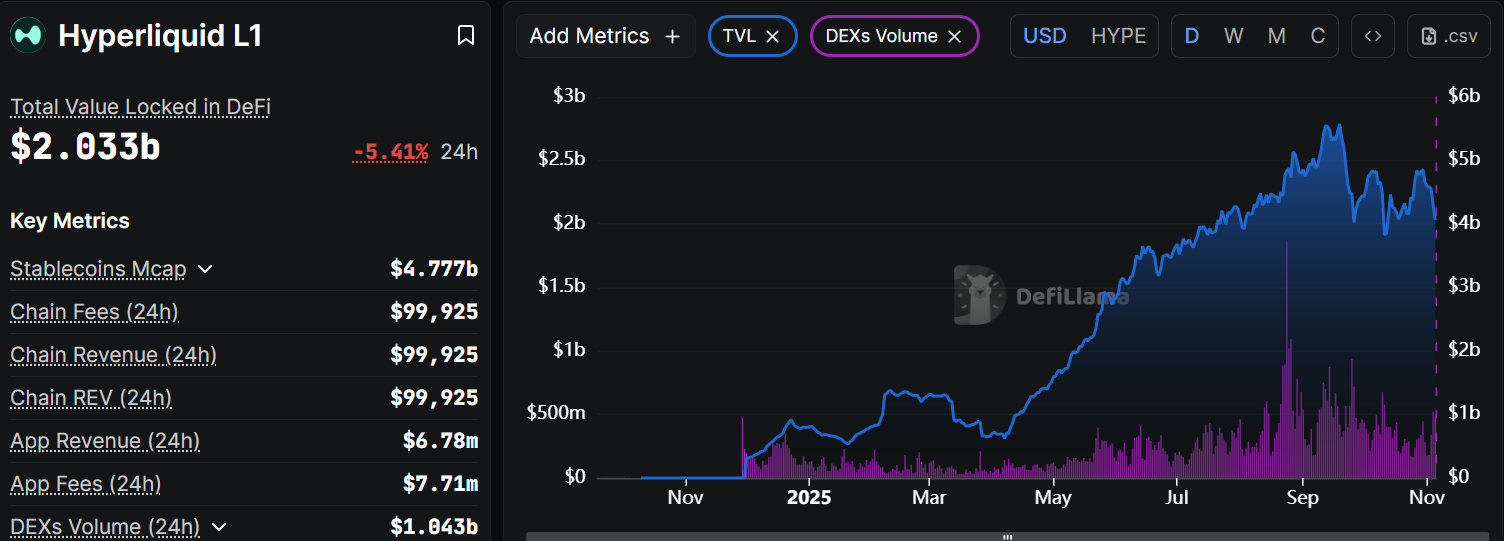

The highly hyped decentralized finance (DeFi) network Hyperliquid L1 has received focus due to its growing Total Value Locked (TVL) in DeFi at 2 billion. Although the platform experienced a decline of 5.41% in the last 24 hours, the performance of the platform was especially strong in September 2025, when TVL soared to more than $5 billion. Such an influx underscores how the platform is gaining momentum in the DeFi arena, with such robust metrics as a stablecoin market cap of up to $4.77 billion and striking trading volumes.

Hyperliquid Price Targets $50 But Risks Remain

The HYPE/USD trading pair shows the price hovering around $40.41 after a recent dip that saw it at around $35. The 50-day Simple Moving Average (SMA) is trending downward, signaling some bearish tendencies, concerning for those of us who love a good pump. Right now, the Hyperliquid price is bouncing between key support at $35 and resistance at $43. If it breaks above that resistance with volume, we could see a legit moonshot.

The Relative Strength Index (RSI) has rebounded from the oversold territory, currently at 47.85. A climb above 50 would mean that the bulls are regaining control, for a rally towards $50. The Moving Average Convergence Divergence has notably crossed above the signal line, showing a bullish crossover. This calls for traders and investors to rally behind the HYPE token as a rally to the upside is imminent.

Looking ahead, if the bullish momentum holds, we could see Hyperliquid price test above the $43 resistance at $50 by the end of November. However, volatility is the name of the game. If the resistance zone proves too strong, a pullback to $35 isn’t off the table. If the price dips near $35 support, it could be a good place to score a bargain. For the cautious investors, waiting for a confirmed break above $43 with solid volume before FOMO-ing in would be a wise play.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.