Highlights:

- The XRP price has tumbled 6% today to $2.25, amid market-wide sell-off.

- The XRP Whales have sold about 900,000 XRP over the past 5 days.

- The technical outlook shows a bearish sentiment, as bears target $2.20 support zone.

The XRP price has remained suppressed below $2.30, currently at $2.25, marking a 6% drop. However, its daily trading volume has soared 99% indicating growing investor confidence in the market. The wider cryptocurrency market is under intense pressure due to risk-off, and a consistent sell-off is triggered. In the meantime, the XRP demand has been held back substantially. This comes as over 900,000 XRP have been sold off by whales in the past 5 days.

900,000 $XRP sold by whales in just 5 days! pic.twitter.com/28404KMy24

— Ali (@ali_charts) November 3, 2025

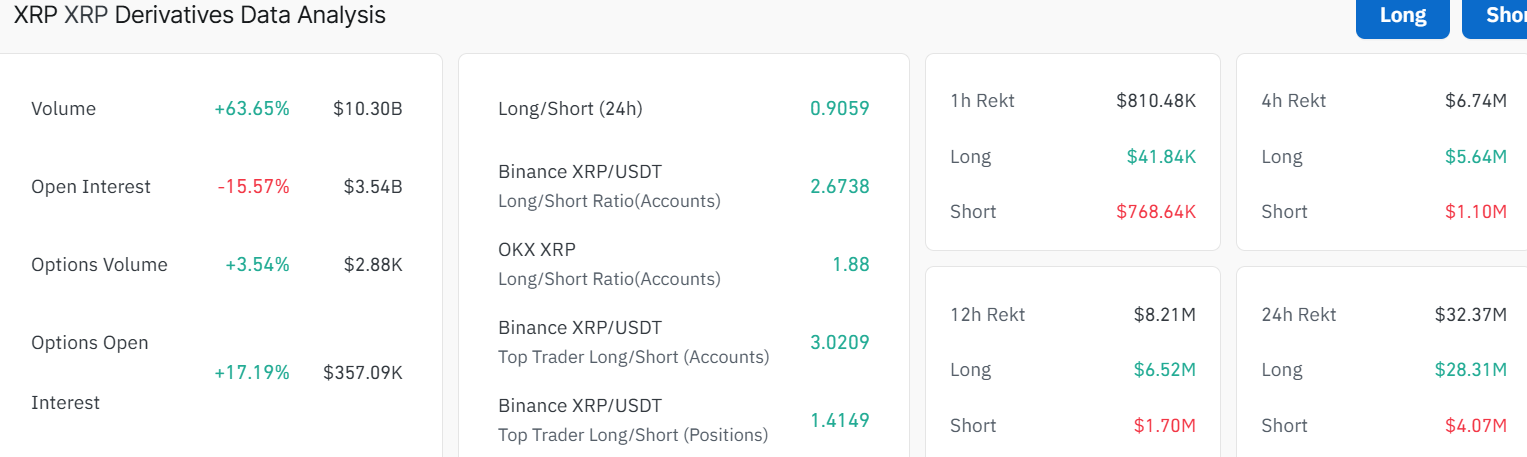

A declining technical structure, aggravated by declining retail demand, is emphasized in XRP. The current data of CoinGlass shows the XRP Open Interest (OI) sits at $3.54 billion, a 15% decrease in the past day. This is compared to a high of $9.09 billion, the highest point in October.

In case the risk is being decreased to a greater extent among investors, the current downtrend might increase at a faster pace to reach $2.20, a support point that had been tested on October 17.

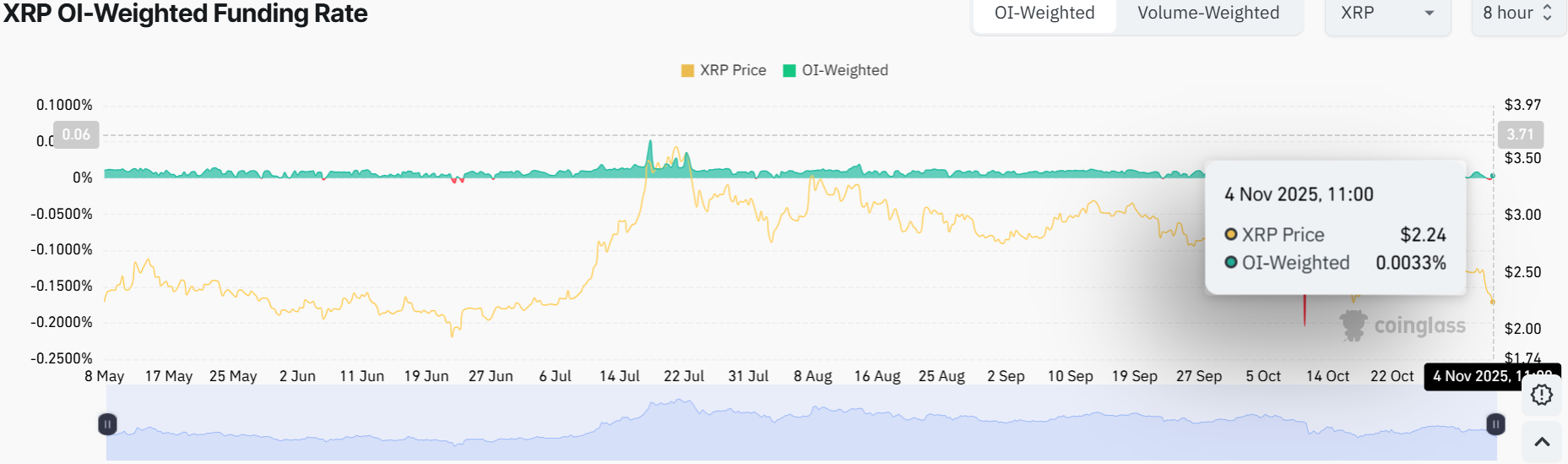

The XRP OI-weighted funding rate remains at 0.0033%. The decline is an indication that traders are deliberately unwinding their long positions and paring down short positions. In other words, this will deny XRP the tailwind to maintain its recovery.

Is XRP Price Set for a Rebound to $2.59?

The XRP/USD 4-hour chart shows that XRP is bearish currently. The 200-period Simple Moving Average (SMA) at $2.59 has turned into a resistance wall, with XRP bouncing off it several times. Meanwhile, the 50 SMA at $2.51 is also acting as a shaky resistance level, having been breached several times in the past month.

The bears are having the upper hand and may continue the downward trend if the bulls don’t regain control. In the meantime, the immediate support zone lies at $2.20, which was tested on October 17.

Diving into the indicators, the Relative Strength Index (RSI) at 26.78 is flirting with oversold territory, hinting that selling pressure is intense. With this outlook, XRP may continue dipping before a bounce-back rally sets in. Meanwhile, the Moving Average Convergence Divergence (MACD) shows a bearish crossover on November 3, with the signal line slicing below the MACD line (blue).

XRP Short-Term Support and Resistance Levels

In the short term, XRP price may test the $2.20 support level if the bears continue their campaign. A break below the current immediate support could drag it to the recent low of $1.94, where bargain hunters might swoop in.

However, if bulls reclaim the $2.51 resistance zone, the XRP price could see a rebound toward $2.59-$2.60. This is especially true if market sentiment flips, and the entire market turns green again. The $2.51 and $2.59 zone will be a key point to watch. If buyers hold it, XRP will be back in a bullish trend. The recent dip may be a short-term correction, with the potential to recover to $2.60 by the end of November if the crypto market regains momentum.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.