Highlights:

- The Ethena price has slipped below the $0.50 physiological zone, down 4% today.

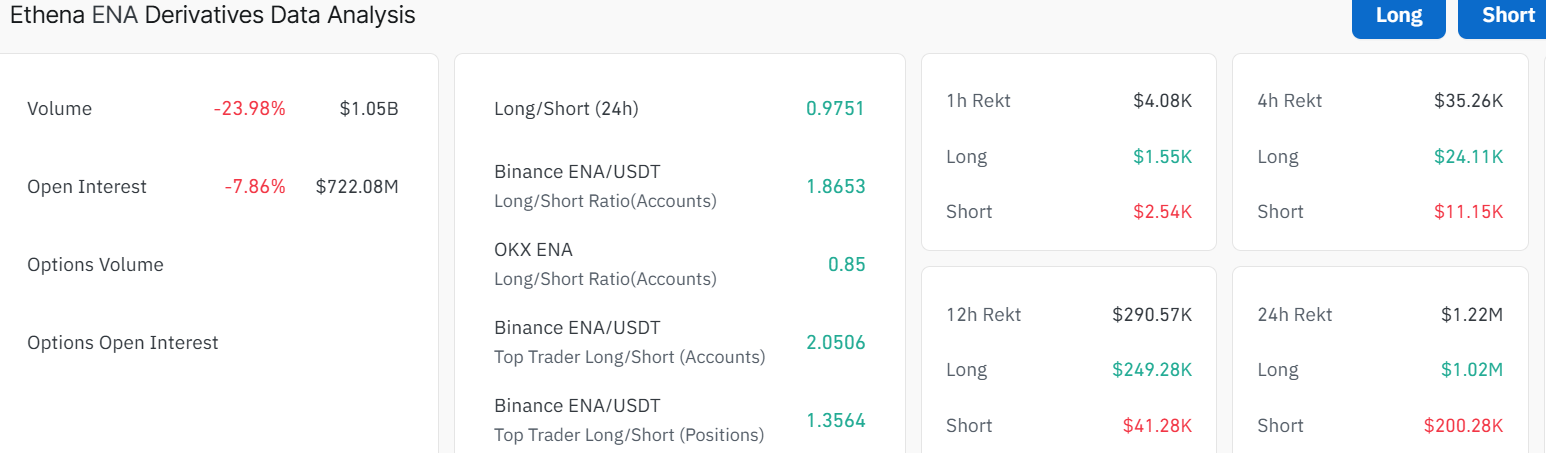

- CoinGlass data shows a dip in open interest and volume, signaling a drop in retail demand.

- The technical outlook portrays a bearish outlook, as the Ethena price is likely headed to $0.45 support.

The Ethena price is trading below the $0.50 psychological level, extending today’s losses by 4%. Currently, the ENA token is exchanging hands at $0.49, with the on-chain and retail demand showing a decrease. Accompanying the drop is its daily trading volume, which has plummeted 34% to $299 million. This recent plunge shows a drop in market activity in the Ethena market.

Ethena On-Chain Activity and Retail Demand Drop

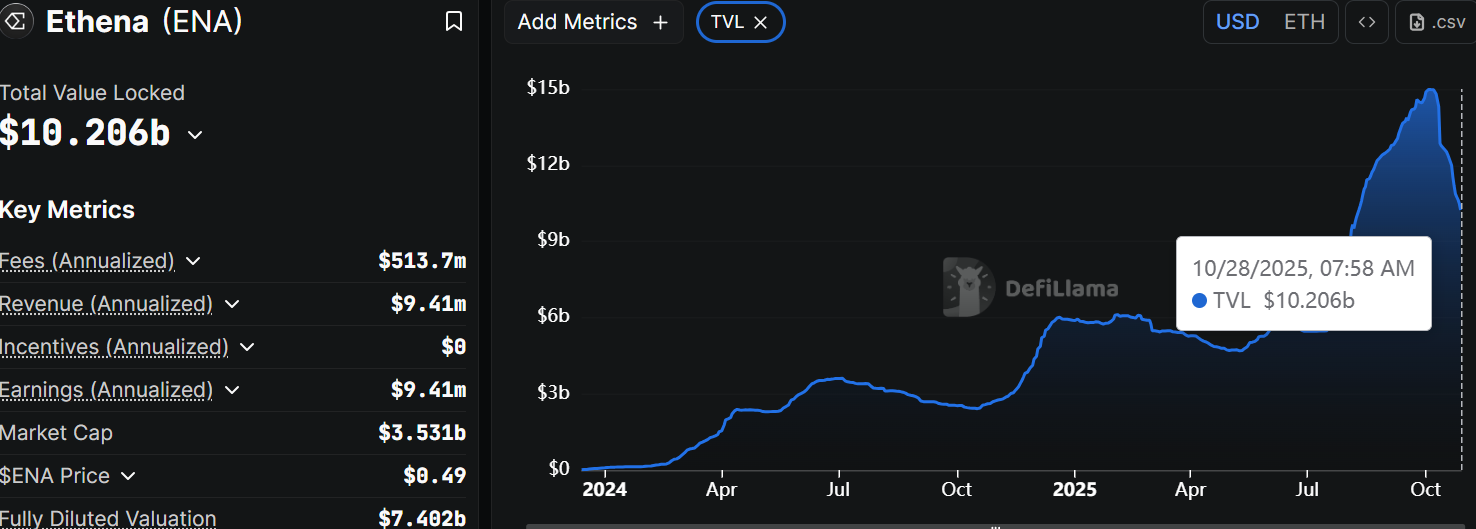

The Ethena price(ENA) has been experiencing a difficult time in the market, and the interest level and the volume of trading have declined significantly. On October 28, 2025, the Total Value Locked (TVL) of Ethena stands at $10.206 billion, a significant decline from $14.818 billion on October 10.

A long-term outflow of capital out of Ethena poses a threat to tighter liquidity and lower charges, which may further push the demand for ENA down. Although the company remains a massive player in the DeFi market, the trend is concerning in recent times.

The open interest has decreased by 7.86% and stands at $722.08 million. This can be attributed to the general shrinkage in market interest. Combined with a decrease in volume of 23.98% the decreased trading activity suggests that it is less frequently traded. This also implies that the Ethena market is warning of possible price volatility.

Is Ethena Price Headed to $0.45 Support?

Ethena price is already in the middle of a bearish flag trend in its ENA/USD daily chart. The token has been experiencing pressure to the downside. ENA remains inside a bearish flag pattern. While this is an indication of a continued downtrend pattern, if a breakout doesn’t happen, the price could print lower lows.

The Ethena price currently trades below the 50 Simple Moving Average (SMA)($0.57), which signals the asset is bearish in the short-to-mid term. However, with the immediate support around the 200-day SMA($0.46), the bulls could regain control if it holds strong.

The Relative Strength Index (RSI) is at 49.22 and is consolidating. This signals that if the bulls regain stamina, a move to the upside may be evident. However, with the bearish flag pattern, traders should be cautious. Meanwhile, the Moving Average Convergence Divergence (MACD) is bullish, with the MACD line (blue) soaring above the signal line (orange).

If the Ethena price fails to break above the current resistance($0.57), it may drop to the $0.46 support, which aligns with the 200 SMA. Below that, the ENA price could find lower support around $0.35.

Conversely, if bulls succeed in pushing the price beyond the resistance ($0.57), then Ethena’s price could skyrocket back to $0.64-$0.72. In the short term, the Ethena price may continue to consolidate within the pattern or break down before the bulls initiate a rally. Long term, if a breakout happens, ENA may surge to $0.72 by the end of November.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.