Highlights:

- The Virtial Protocol price has slid below $1.50, trimming the intra-day gains.

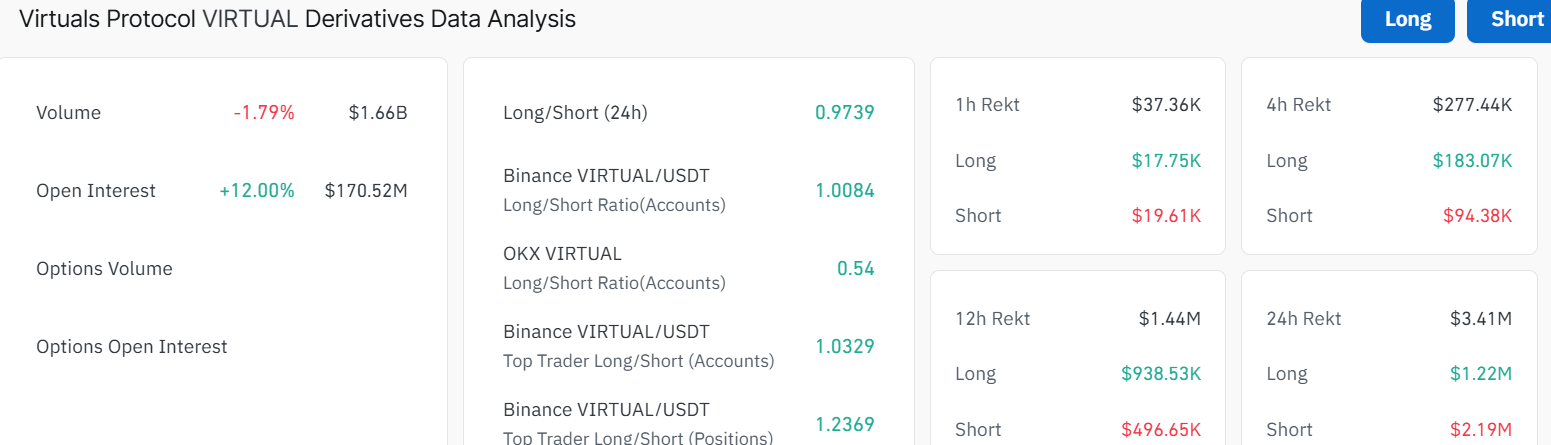

- Coinglass data shows a spike in open interest to $170 million, indicating growing retail interest.

- The funding rate turns positive as bulls target $2.00 mark soon, despite the overbought RSI.

The Virtual Protocol price has declined below the $1.50 mark, as bulls attempt to maintain a huge 20% price gain over the last 24 hours. Virtuals Protocol has been increasing at its highest point since mid-August due to the high rate of retail demand. The futures Open Interest (OI) of VIRTUAL has gone through the roof, reaching about $170 million, which was the peak level since the beginning of August, according to CoinGlass data.

The VIRTUAL token has been on an unprecedented upward curve, with open interest surging, and more users entering the market. This increase in open interest indicates a gain of 12% in the last 24 hours, which is an indication of growing confidence in the short-term outlook of the token.

In addition to the increase in the open interest, the VIRTUAL long/short ratio is 0.9739, indicating a close balance between the long and the short side and slightly on the long side. In the short term, it may imply that traders are optimistically cautious but waiting to get a stronger force before they commit their full force either way.

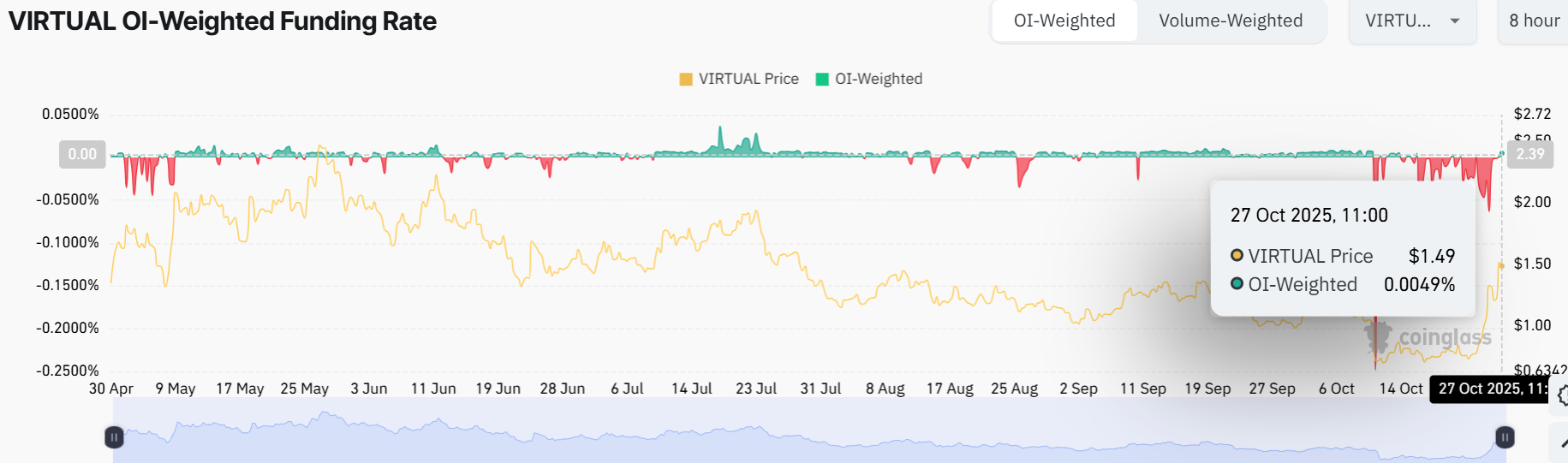

The funding rate of VIRTUAL has also moved towards the positive side, as the funding rate is at 0.0049%. This is a healthy market sentiment with no high short-term pressure from the longs or shorts. The funding rate has persistently changed to a high position above zero, indicating a slightly bullish picture. This is notably in tandem with the recent price movement.

Virtual Protocol Price Bulls Target $1.96-$2.00 Mark Soon

The VIRTUAL/USDT 1-day price chart shows the 50 Simple Moving Average (SMA) hovering around $1.07 and the 200-day at $1.38. The Virtual protocol price has been trending above both moving averages, indicating a bullish outlook. The price spiked to $1.62 before pulling back to $1.49 near the 200-day SMA, showing some profit-taking action.

Digging into the indicators, the Relative Strength Index (RSI) at 70.03 is in the overbought territory. The RSI has been climbing steadily, and its position above the 70+ indicates a potential cooling off, which may see early profiteering taking place.

Meanwhile, the Moving Average Convergence Divergence (MACD) shows the MACD line (blue) bouncing from the signal line. This is a bullish crossover, calling for traders and investors to rally behind the Virtual protocol price but with caution, as the RSI hits overbought.

Price action-wise, that $1.62 peak is now resistance. If the Virtual price can crack it, the asset could soar to $1.96-$2.00. Conversely, if it fails and early profiteering kicks in, $1.38 (200 SMA) might act as support. The 20% pump suggests that traders and investors are optimistic about the Virtual protocol price, but that pullback suggests a breather, likely instigated by profit takers.

Over the next month, the price of VIRTUAL could hit $2.14-$2.44 if it breaks the $1.62 with substantial volume. However, a drop below $1.38 might tank it to $1.07.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.