Highlights:

- Bitplanet has purchased 92.67 BTC for $10.9 million to launch its long-anticipated Bitcoin treasury plan.

- The company paid an average of $117,647 per BTC, as it became the first public firm to acquire BTC via a licensed domestic exchange.

- Bitplanet reiterated its commitment to continue acquiring Bitcoin and plans to become an institutional-grade one firm.

South Korean investment firm Biplanet has launched its Bitcoin (BTC) treasury plan with a new purchase worth $10.9 million for 93 BTC. The company announced the acquisition in an X post on October 27, amid the crypto market’s recent rebound. According to the tweet, Bitplanet paid an average of $117,647 per BTC.

The investment firm also noted that it has spent the past month building one of the most reliable and compliant Bitcoin treasuries in Korea. Additionally, Bitplanet became the first public firm to acquire BTC via a licensed domestic trading platform. The company also reiterated its commitment to continue acquiring Bitcoin and plans to become an institutional-grade one firm.

Bitplanet stated:

“We will continue our daily BTC purchase program through fully regulated channels. Our goal is to become not just Korea’s number 1 BTC standard company, but the only truly institutional-grade one.”

For the past month, @Bitplanet_KR has been quietly building the most reliable and compliant Bitcoin treasury infrastructure in Korea — culminating in becoming the first public company to purchase Bitcoin directly through a licensed domestic crypto exchange. As of October 26,… pic.twitter.com/hEmpvh9fUL

— Bitplanet Inc. (@Bitplanet_KR) October 26, 2025

Bitplanet’s $40M Treasury Plan

On August 28, Crypto2Community reported that Bitplanet has launched a $40 million Bitcoin treasury to become Korea’s first institutional BTC company. The plan unveiled at Bitcoin Asia 2025 aims to increase South Koreans’ interest in Bitcoin and other institutional-grade digital assets.

Bitplanet plans to deploy the $40 million funding once the company officially launches. Before the launch, an investor group led by Asia Strategy Partners bought 62% of SGA, a publicly listed firm. Following the purchase, SGA rebranded to Bitplanet, implying that it will now focus on building a Bitcoin-based financial strategy.

During his keynote speech at Bitcoin Asia 2025, Paul Lee, Lobo Ventures Managing Partner, stated:

“We are starting this initiative with no debt, and all of it is financed by equity, which will afford us financial flexibility and long-term resilience.”

Bitplanet, a South Korean public company, has launched a regulated Bitcoin treasury program aiming to accumulate 10,000 BTC. With an initial purchase of 93 BTC and $40 million allocated, Bitplanet operates under strict compliance with South Korea's Digital Asset Basic Act, backed… pic.twitter.com/jniJTc31rY

— Fama Crypto (@Famacrypt) October 27, 2025

Crypto Market Rebounds as Bitplanet Buys 92.67 BTC

At the time of writing, the market is up 2.8% in the past 24 hours with a market capitalization of $3.97 trillion and a trading volume of $164.088 billion. Bitcoin remains the most dominant crypto at 57.7% dominance, while Ethereum followed closely with 12.6%.

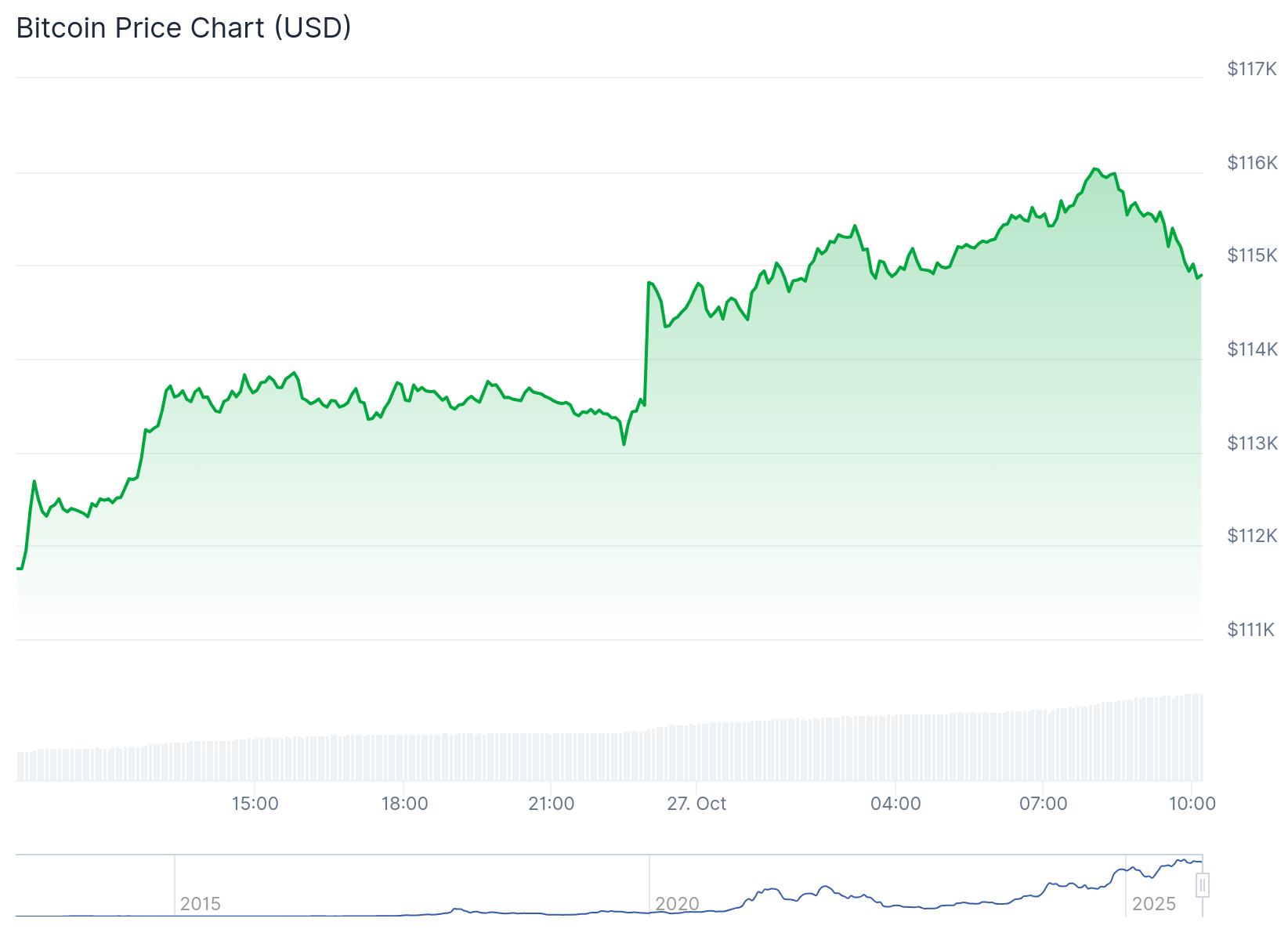

BTC is trading at $114,920 following a 2.8% upswing in the past 24 hours. Within the same timeframe, BTC fluctuated between $111,755 and $116,032 with a trading volume of $62.8 billion. Other extended-period price change variables, including BTC’s 7-day-to-date and month-to-date, reflected increments of about 3.4% and 5%, respectively.

On Coincodex, Bitcoin’s supply inflation was low at 0.89%, with a medium volatility at 4.82%. Remarkably, sentiment tilted towards bullish while “Fear & Greed Index” remained neutral at 52. BTC has outperformed 85% of the top 100 cryptocurrencies in the past year. The flagship crypto is trading above its 200-day Simple Moving Average (SMA) with 18 profitable days in the past month. BTC also has high liquidity based on its market cap.

Massive Funds Flow into Bitcoin from Altcoins

On October 24, 10x Research reported that around $800 billion worth of retail funds flowed from altcoins into Bitcoin and other corporate crypto treasuries. 10x Research attributed the trend to a decrease in liquidity and investors’ confidence in altcoins. The shift has weakened market participants’ hope for an altcoin boom season, raising concerns about the tokens’ sustainability value. 10x Research also noted that the new trend preceded the market crash that erased $19 billion from the crypto market on October 11, 2025.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.