Highlights:

- The Lista DAO price is showing splendid bullish muscle, spiking 45% to $0.55.

- Lista has joined BNB Smart Chain Festive, where users can receive a share of $250,000 USDC.

- The LISTA technical outlook shows overbought conditions, cautioning traders of a potential pullback.

The Lista DAO price is showing strong bullish momentum, soaring 45% to $0.55. The daily trading volume has notably spiked by 563%, indicating heightened trading activity. Lista DAO ($LISTA) is garnering interest among investors in response to its participation in an ongoing festival by Binance for trading Smart Chain altcoins, where users can receive a share of $250,000 USDC. Through this promotion, it aims to provide volume and visibility to the token by trading $LISTA pairs (USDT, USDC, BNB, TRY).

Use $LISTA to join the action

Trade $LISTA pairs (USDT / USDC / BNB / TRY) in @Binance Altcoin Trading Festival to compete for a share of $250K USDC in rewards.

Actions speak louder than words, use your LISTA volume to do the talking now! https://t.co/mlLU1arzr4

— Lista DAO (@lista_dao) October 8, 2025

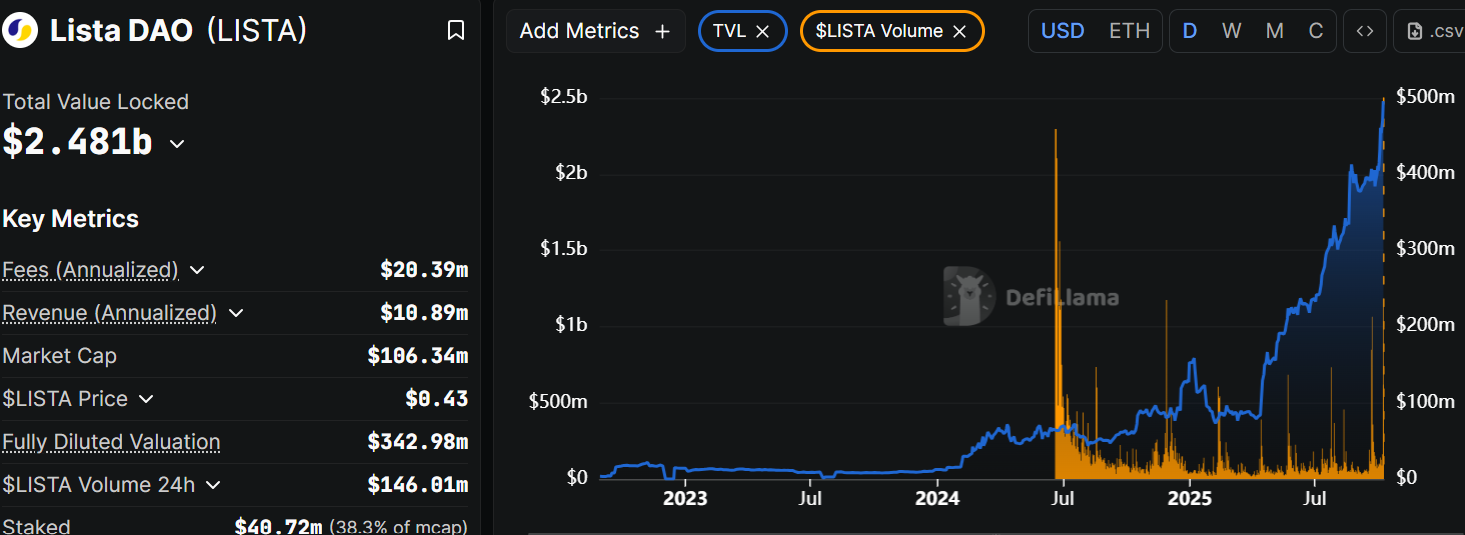

As a result of the event, the Listo DAO has strengthened its DeFi position. Lista is gaining recognition as a potential altcoin with strong fundamentals, as it has a total value locked of $2.481 billion and a market capitalization of $106.34 million. Current metrics indicate an annualized revenue of $10.89 million, with fees totalling $20.39 million. Notably, 38.3% of the market cap is staked, demonstrating an active community that supports token stability and liquidity in general.

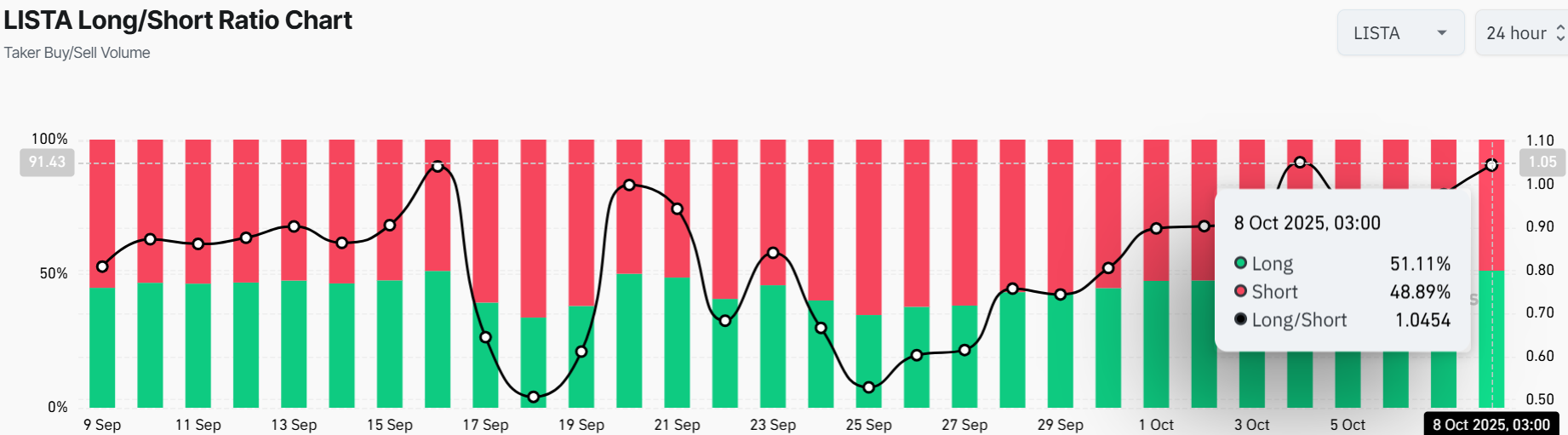

On the other hand, investor confidence is also reflected in the long/short ratio, which indicates that 51.11% of positions are long and 48.89% are short. This nearly symmetrical distribution, with a slight long bias, is indicative of traders’ cautious optimism towards and confidence in $LISTA’s continued growth, as well as its volatility. Meanwhile, the long-to-short ratio at 1.0454 suggests that bullish sentiment is increasing in the LISTA market.

Lista Dao Price Cautions of Overbought Conditions

The LISTA/USD daily chart shows the price at $0.55, representing a solid climb in a parabolic curve. The 50-day and 200-day Simple Moving Averages (SMA) hover around $0.29 and $0.23, respectively, and the Lista DAO price is trending a good distance above them. If these key support zones hold strong with strong volume, the Lista Dao price could soar to $0.60 before a pullback kicks in.

The Relative Strength Index (RSI) is sitting at 81.39, which is in the overbought territory. This suggests that there is intense buying pressure. However, its move above 70+ cautions traders not to be too greedy. Notably, the Moving Average Convergence Divergence (MACD) indicates a bullish crossover around October 1, and has been soaring ever since, signalling building momentum.

Looking ahead, the Lista Dao price could still be a play for bold investors eyeing a short-term scalp, targeting that resistance level for a quick exit. However, with RSI in the danger zone and a 45% run already in the bag, the risk of a pullback is real. Historical data suggest that LISTA might consolidate around the $0.40 to $0.35 range if profit-taking occurs.

In the long term, investors may want to hold off unless they see a retest of support with higher volume. Patience could pay off big. The trend on the chart is a mix of hype and caution. Investors who are late to the party should consider waiting for a dip or a clearer signal to enter.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.