Highlights:

- Bitcoin and Ethereum spot ETFs attracted over $1.2 billion in net inflows on October 3.

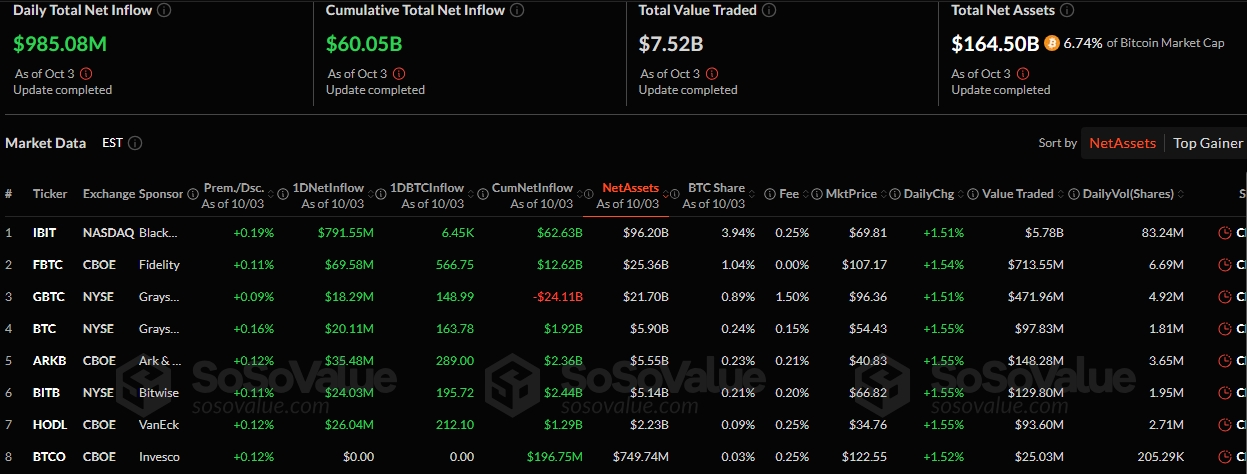

- Bitcoin ETFs gained $985.08 million, with BlackRock contributing over $700 million.

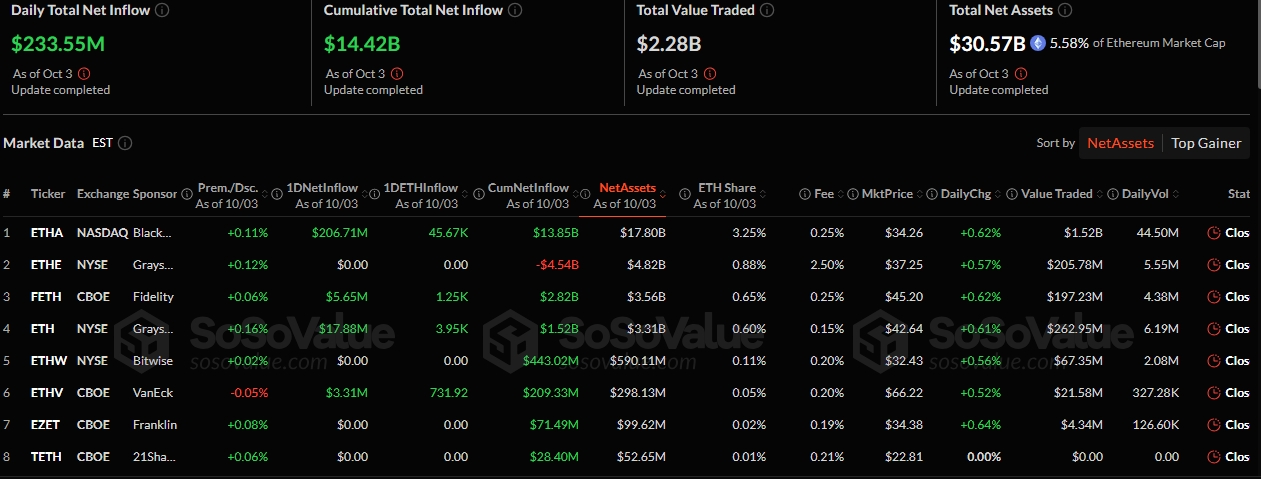

- Ethereum ETFs added $233.55 million in net inflows, extending their profitable streak to the fifth straight day.

On October 3, Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs) recorded $1.22 billion in combined net inflows. SosoValue, a leading on-chain ETF tracker, reported that Bitcoin ETFs added $985.08 million, while Ethereum funds gained $233.55 million.

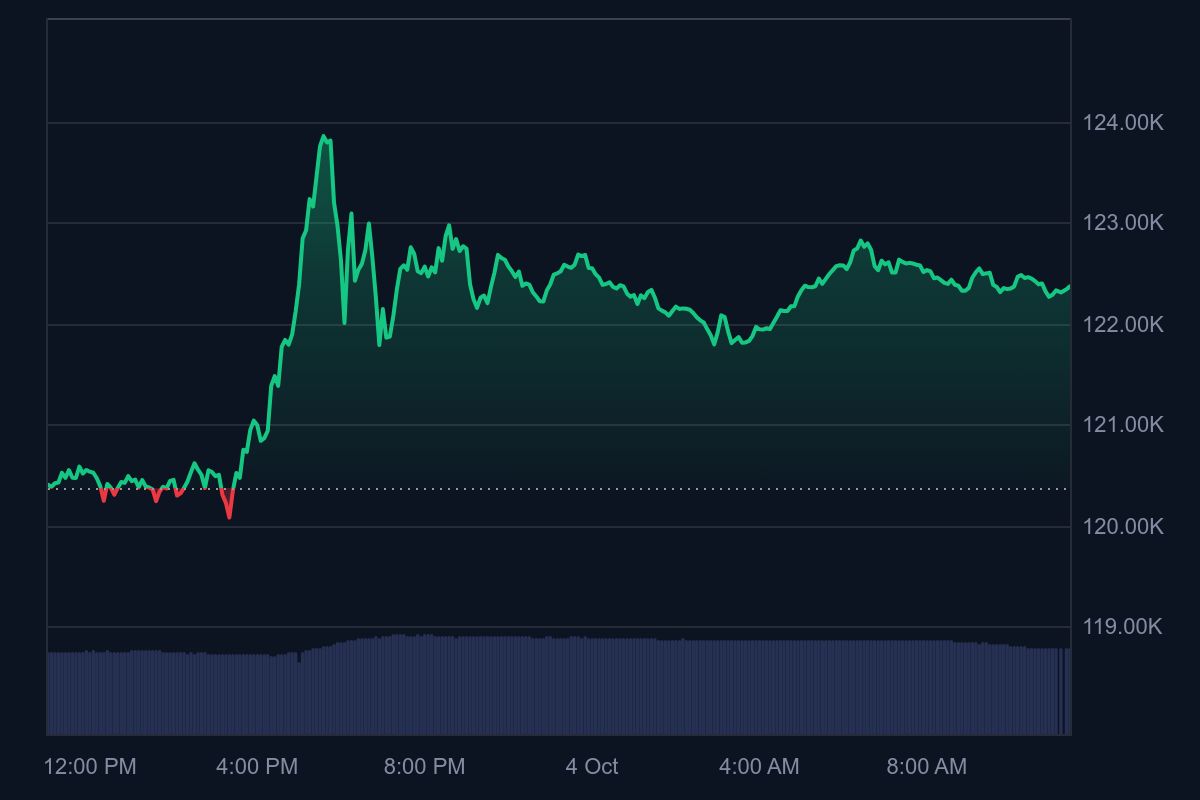

The net inflows extended Bitcoin and Ethereum ETFs’ daily inflows to the fifth consecutive day, implying that they recorded net profits throughout the week. The impressive trend coincided with the crypto market’s recent resurgence that saw BTC break above $120,000 while ETH stabilised well above $4,000.

On October 3, Bitcoin spot ETFs recorded total net inflows of $985 million, marking five consecutive days of net inflows. Ethereum spot ETFs saw total net inflows of $234 million, also extending their streak to five consecutive days.https://t.co/Hj2Gs49bWa pic.twitter.com/X0vbUoOL9w

— Wu Blockchain (@WuBlockchain) October 4, 2025

BlackRock Drives Bitcoin ETFs Inflow with Over $700M

Yesterday, seven Bitcoin funds were active, while the remaining, including the Invesco Bitcoin ETF (BTCO) and the Valkyrie Bitcoin ETF (BRRR), recorded zero flows. All the active ETFs attracted inflows, led by BlackRock and Fidelity. BlackRock Bitcoin ETF (IBIT) gained $791.55 million, while Fidelity Bitcoin ETF (FBTC) added $69.58 million.

ARK 21Shares Bitcoin ETF (ARKB), VanEck Bitcoin ETF (HODL), and Bitwise Bitcoin ETF (BITB) also attracted $35.48 million, $26.04 million, and $24.03 million, respectively. Other ETFs that recorded inflows included Grayscale Mini Bitcoin ETF (BTC) and Grayscale Bitcoin ETF (BTC). These funds added $20.11 million and $18.29 million, respectively.

As a result of yesterday’s net inflow, Bitcoin ETFs’ cumulative net inflows and total value traded reached new highs. The former climbed from $59.07 billion to $60.05 billion, while the latter rose from $5.59 billion to $7.52 billion. The total net assets valuation recorded the highest jump, increasing from $161.03 billion to $164.5 billion. This new valuation now represents 6.74% of Bitcoin’s $2.44 trillion market cap.

Ethereum ETFs Latest Flow Statistics

On September 3, four out of nine Ethereum ETFs were active while the remaining, including Grayscale Ethereum ETF (ETHE) and Bitwise Ethereum ETF (ETHW), had neither inflows nor outflows. Like Bitcoin, BlackRock Ethereum ETF (ETHA) led the inflows chart with $206.71 million.

Other profitable funds included the Grayscale Mini Ethereum ETF (ETH), with $17.88 million; the Fidelity Ethereum ETF (FETH), with $5.65 million; and the VanEck Ethereum ETF (ETHV), with $3.31 million.

Overall, cumulative net inflow, total value traded, and net assets rose to new heights. The net inflow reached $14.42 billion, up from $14.19 billion, while the value traded rose from $2.24 billion to $2.29 billion. Similarly, the total net assets valuation increased from $30.19 billion to $30.57 billion.

Sustained Bitcoin and Ethereum ETF Inflows Spark Positive Price Movements

At the time of writing, Bitcoin is changing hands at about $122,381, following a 1.8% upswing in the past 24 hours. Within the same timeframe, it fluctuated between $120,045 and $123,855 with a trading volume of $74.68 billion. In the past week, BTC spiked 11.8%, oscillating between $109,304 and $122,986. This price range highlights a remarkable recovery in a short timeframe.

Similarly, Ethereum is up 0.5% in the past 24 hours and is trading at $4,489. ETH’s 7-day-to-date price change variable reflected an 11.9% upswing, with price extremes fluctuating between $3,981.17 and $4,545.93. Other extended period data showed that ETH spiked 2.7% month-to-date and 88.5% year-to-date.

Meanwhile, Citigroup, an American investment bank, recently rolled out new price targets for Bitcoin and Ethereum. Mathew Sigel, Citibank’s research head, shared the new price forecast on X. The tweet noted that Bitcoin could soar to about $132,000 by the end of this year, while Ethereum’s value could reach $4,500. The banking giant also predicted a 12-month price target for Bitcoin and Ethereum. It stated that Bitcoin could trade around $231,000 in a bullish outlook, while Ethereum’s valuation could soar to $7,300.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.