Highlights:

- The BNB price has broken out in a splendid bullish muscle, to a new ATH at $1114.

- Its DeFi TVL has spiked, with active addresses surpassing 2 million, indicating that BNB is gaining traction.

- The bullish outlook suggests further upside, potentially reaching around $1200-$1300 in the near future.

The BNB price has hit a new ATH at $1114, leading the market crypto rally. However, it has currently shown a slight pullback to $1107, still up 6%. Its daily trading volume has increased by 52% to $4.61 billion, indicating intense trading activity.

ATH szn in full swing 🫡

1 BNB = $1111 pic.twitter.com/69l8eEPgY3

— BNB Chain (@BNBCHAIN) October 3, 2025

The BNB Chain, previously known as Binance Smart Chain (BSC), is experiencing heightened network growth. Its technical outlook and on-chain data metrics suggest further upside if the ‘Uptober’ rally delivers.

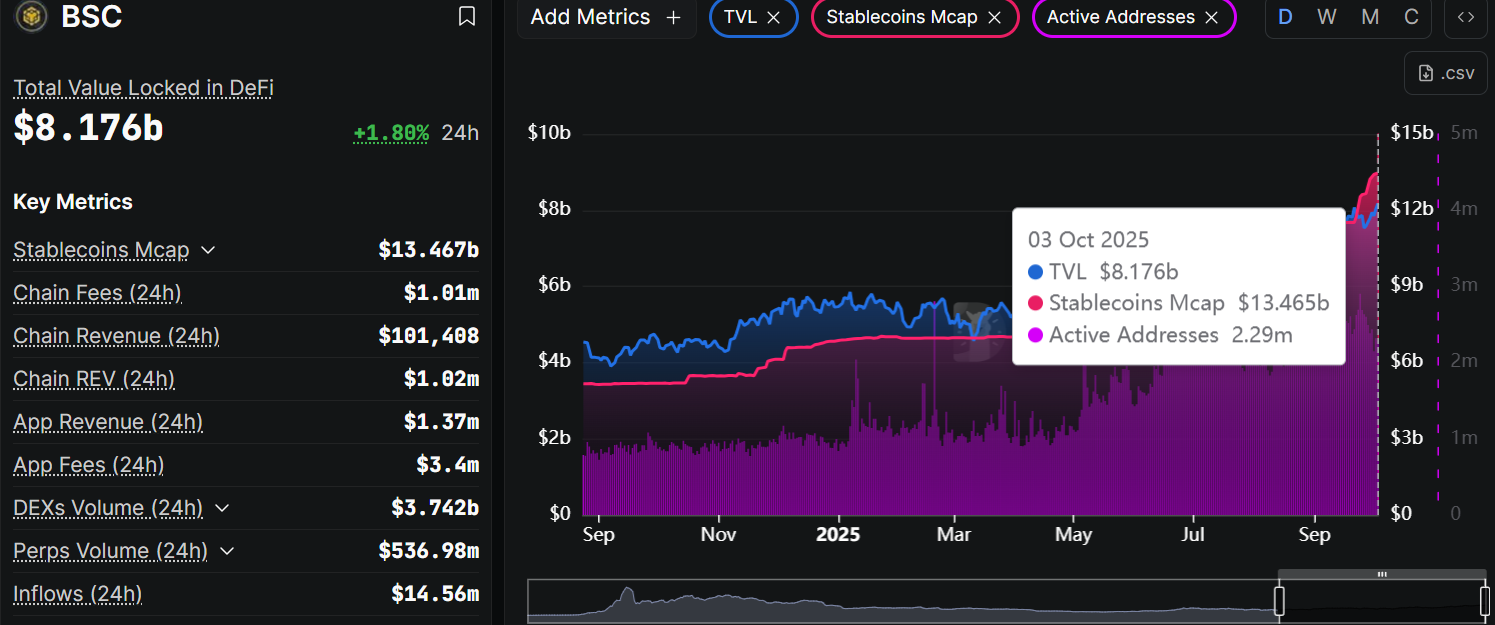

Meanwhile, data shows Binance Smart Chain’s (BSC) DeFi ecosystem is experiencing a strong growth comeback after the previous slump. BSC’s Total Value Locked (TVL) reached $8.176 billion by October 3, 2025, indicating a solid growth rate of 1.80% over the last 24 hours. The rise in liquidity demonstrates the BSC ecosystem’s growing power, as well as its ability to maintain substantial liquidity despite market volatility.

One metric that stands out is the Stablecoins Market Cap, which is $13.467 billion. It means stablecoins are adding hefty amounts to BSC’s liquidity. The rise of stablecoin liquidity can boost DeFi platforms on BNB and those decentralized applications running on BSC. This is due to the solidifying of BSC’s reputation as a leading DeFi blockchain. Moreover, the touch of BSC’s active addresses has now exceeded 2.29 million, demonstrating their effectiveness in gaining traction above the 2 million mark.

In addition, the chain boasts impressive numbers in other categories, including App Revenue of $1.37 million and DEX Volume of $3.742 billion in the last 24 hours. The increase in these numbers indicates a rise in dApps being used on the network, as well as the overall health of its DEXs. Due to the users’ involvement in DeFi apps along with the growth of its TVL, BSC is one of the major players in this space.

BNB Price Outlook: Can the Bulls Sustain the Momentum Towards $2000?

The BNB/USD daily chart shows the altcoin trading at a solid $1108 after a recent spike, breaking through a rising channel. This breakout is no fluke. Volume is surging, with a 52% increase signaling that traders are all in. The 50 Simple Moving Average (SMA) at $919 is acting as solid support, while the price is attempting a rally above the new ATH at $1114.

Looking at the indicators, the Relative Strength Index (RSI) at 70.40 is firmly in overbought territory. In this case, traders will want to watch for a potential pullback if it hits 80+. Still, the upward tick shows strong buying pressure, signaling traders aren’t sleeping on the crypto.

Looking at the bigger picture, the BNB price’s recent 15% drop on September 26, 2025, was reversed into an 18% rally, showing resilience. The high of $1114 is the next psychological barrier. If it is broken, the BNB price could spark a FOMO frenzy towards $ 1,200-$ 1,300 soon. However, if the bears claw back, support at $1012 might catch the fall.

In the long term, if this breakout rally holds, there might be a rally towards $2000 by the end of Q4. In the meantime, traders will want to watch the RSI, as overheating could signal a potential breather.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.