Highlights:

- Citigroup predicts that Bitcoin can reach $ 231,000 in a bullish scenario and drop to $82,000 in unfavourable market conditions.

- The banking firm also forecast that Ethereum could soar as high as $5,400 in a bullish outlook, while it could drop to $2,000 in a bearish setting.

- Citigroup noted that investors’ interest in the token remains one of the primary determinants of price movements.

American investment bank Citigroup updated its Bitcoin (BTC) and Ethereum (ETH) price prediction targets. Mathew Sigel, the bank’s head of research, shared the new price forecast in a tweet on October 2. According to the X post, Citigroup now expects Bitcoin to end 2025 trading at $132,000, while Ethereum’s worth could reach approximately $4,500.

Other Longer Timeframe Price Predictions

Beyond the short-term prediction, Citigroup published 12-month price targets for the two most valuable cryptocurrencies depending on different market conditions. The banking firm predicted that BTC could fall to $82,000 in a bearish scenario, reach around $181,000 under normal conditions, and climb as high as $231,000 in a bullish outlook.

For Ethereum, Citigroup predicted that it could dip to $2,000 in a bearish scenario, trade near $5,400 in the base case, and rally to $7,300 in a bullish setup. These price targets reflect significant price appreciation potential amid market uncertainties and other risks associated with trading digital assets.

Citi introduces new 12-month price targets for digital assets:

Bear Base Bull

BTC $82k $181k $231k

ETH $2k $5.4k $7.3k pic.twitter.com/AlpWPaK2YW— matthew sigel, recovering CFA (@matthew_sigel) October 2, 2025

BTC and ETH Current Market Standings

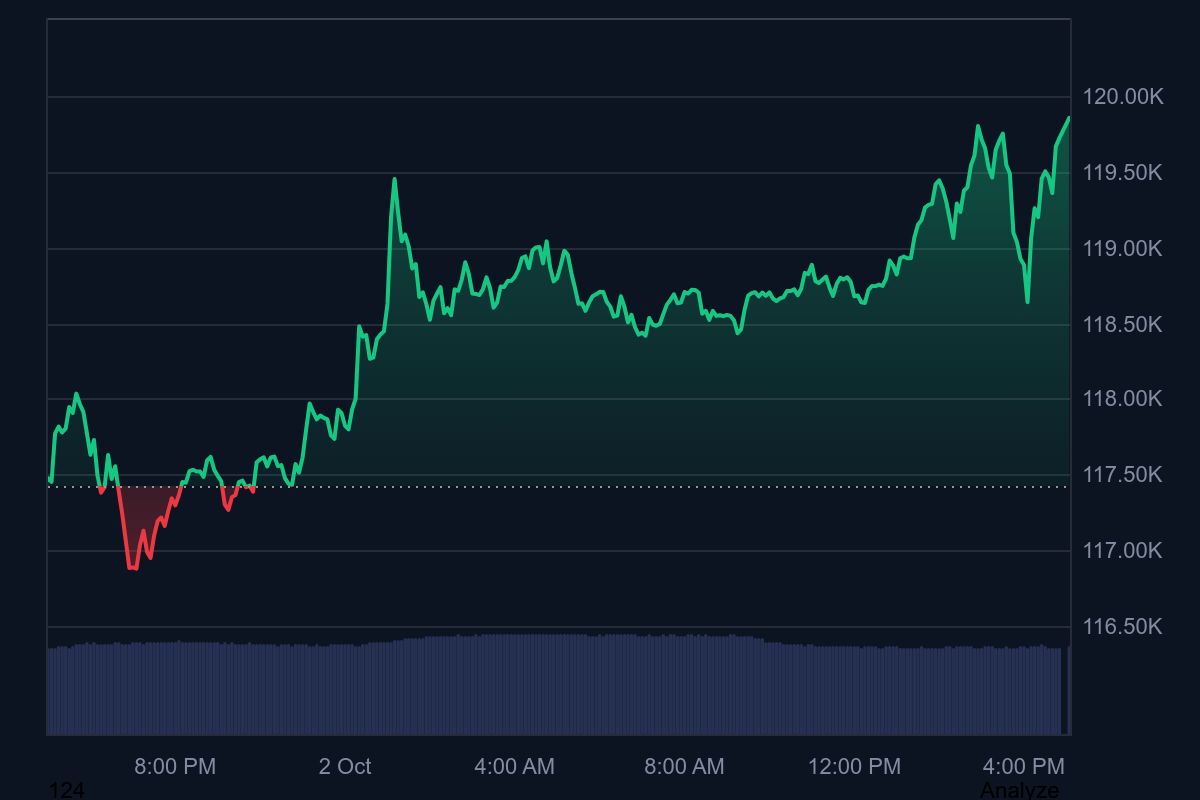

Meanwhile, at the time of press, Bitcoin is changing hands at $118,764, reflecting a 1.3% upswing in the past 24 hours. Within the same timeframe, the flagship cryptocurrency fluctuated between $116,853 and $119,815 with a trading volume of $66.79 billion and a market cap of $2.37 trillion.

Bitcoin’s 7-day-to-date price change variable showed that the token spiked 6.9%, with price extremes oscillating between $108,964 and $119,593. This price range underscores the remarkable recovery in a short interval. Meanwhile, BTC’s other extended period price change variable reflected price upswings. For context, the token spiked 6.8% month-to-date and 95% year-to-date.

On its part, Ethereum is priced at approximately $4,385, following a 1% upswing in the past 24 hours. Ethereum’s 24-hour trading volume is ranked third at $52.98 billion with a market cap of $530.76 billion. Supply inflation reflected low at 0.28% with a dominance of 13.03% and medium volatility at 4.74%. Sentiment has swung to bullishness, while the “Fear & Greed Index” indicated greed at 64.

Citigroup Highlights Bitcoin and Ethereum Price Drivers

Citigroup noted that investors’ interest remains one of the major determinants of Bitcoin and Ethereum price movements. The banking firm added that both digital assets are recording heightened trading activity fueled by growing adoption among institutional investors and financial advisors.

The banking firm also highlighted possible economic impact, noting that it gives mixed signals for crypto. According to Citigroup, a favourable stock market implies that investors might hesitate to invest in Bitcoin and Ethereum. However, if gold prices experience downtrends, investors might lean towards Bitcoin as an alternative. Citigroup added that for now, Bitcoin appears to be better positioned than Ethereum as it attracts a significant portion of the crypto market capital inflows.

On October 1, Japan’s largest corporate holder of Bitcoin, Metaplanet, announced that it had purchased 5,268 Bitcoin for $615.67 million at an average cost of $116,870 per token. “As of 10/1/2025, we hold 30,823 BTC acquired for ~$3.33 billion at ~$107,912 per Bitcoin,” Simon Gerovich, Metaplanet’s President, stated in an X post.

On September 29, Michael Saylor, Strategy’s founder and chairman, also reported that his company increased its holdings to 640,031 tokens after purchasing 196 BTC for $22.1 million. The company paid an average of $113,048 per token, with its entire holdings totalling approximately $47.35 billion.

Strategy has acquired 196 BTC for ~$22.1 million at ~$113,048 per bitcoin. As of 9/28/2025, we hodl 640,031 $BTC acquired for ~$47.35 billion at ~$73,983 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/NnmLONBsRK

— Michael Saylor (@saylor) September 29, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.