Highlights:

- The Ethena price is showing signs of recovery, after surging 5% to $0.61.

- Ethena has partnered with Sui to launch suiUSDe and USDi.

- Ethena price may need to break above the $0.67 resistance to confirm a bullish reversal.

The Ethena price has experienced a 5% bullish recovery to $0.61. There has been a dramatic 45 percent rise in the daily trading volume to $496 million. Ethena Labs has partnered with Sui Network for the development of decentralized finance, thereby allowing the project to grow. The two firms will launch SuiUSD and USDi, which are dollar-backed stable assets, to support the Sui Network. This will increase DeFi capabilities and payment functions for one of the fastest-growing blockchains.

Introducing suiUSDe and USDi: two native dollar assets for the $30b+ @SuiNetwork built on our Stablecoin-as-a-Service stack.

These products will power DeFi and payments on Sui, while embedding Ethena directly within one of the fastest growing networks on earth.

Both suiUSDe &… pic.twitter.com/I4ptM6lcRw

— Ethena Labs (@ethena_labs) October 1, 2025

The integration of Ethena’s Stablecoin-as-a-Service (SaaS) solution will result in a solid DeFi ecosystem on Sui, offering liquidity and stability. Ethena Labs’ move is essential as it aims to capitalize on the expanding Sui Network’s benefits, particularly in terms of speed and scalability. The introduction of both suiUSDe and USDi will introduce new DeFi applications and expand access to stablecoin solutions, allowing for convenient payment solutions.

Ethena Derivatives Market Outlook

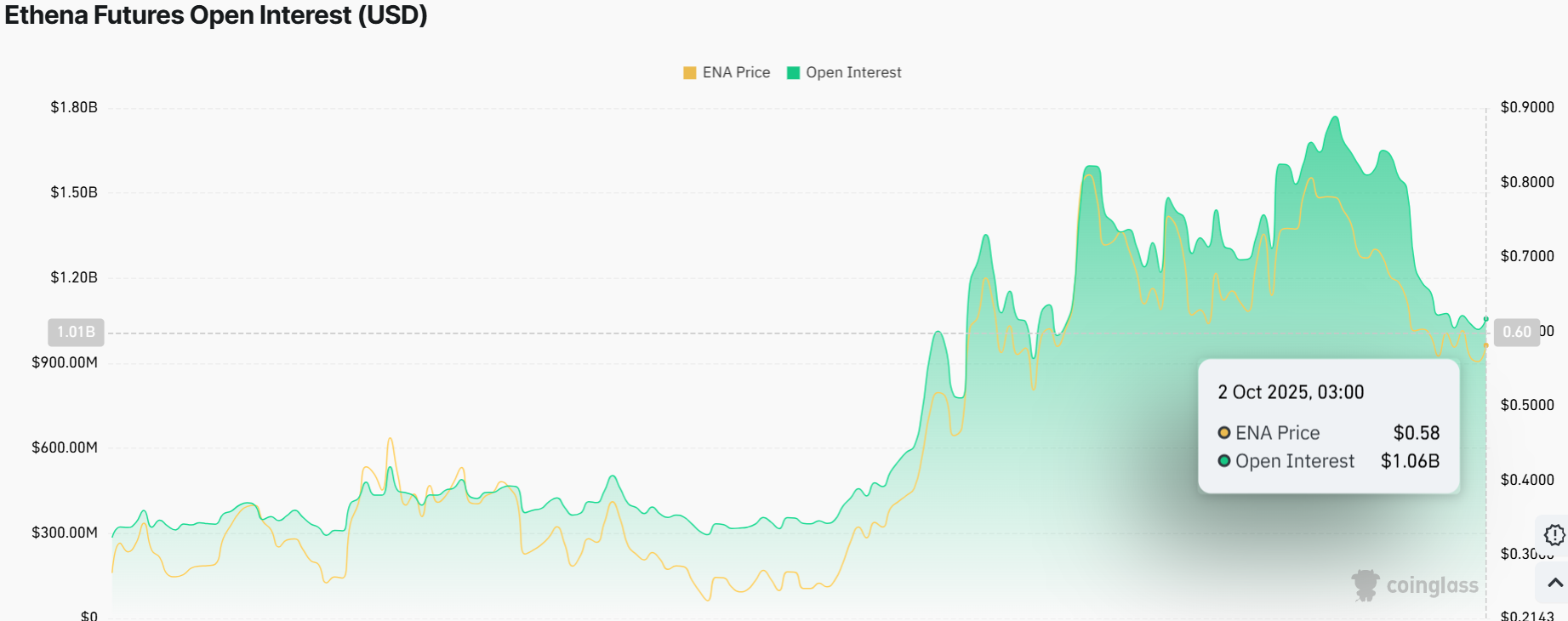

A quick look at the futures market of Ethena (ENA) what stands out is that open interest has recently jumped quite a lot. As of October 2, 2025, the open interest for ENA futures stands at an impressive $1.06B, continuing its upward trajectory.

The open interest indicates a level of acceptance in the market. The Ethena price is increasing, and so is open interest. This indicates that speculative traders are entering the market with leveraged trades. Despite some fluctuations, the overall sentiment on the market appears to be maintaining a bullish grip. It appears that traders are feeling quite bullish about the asset following its recent price growth and stablecoin adoption on Sui.

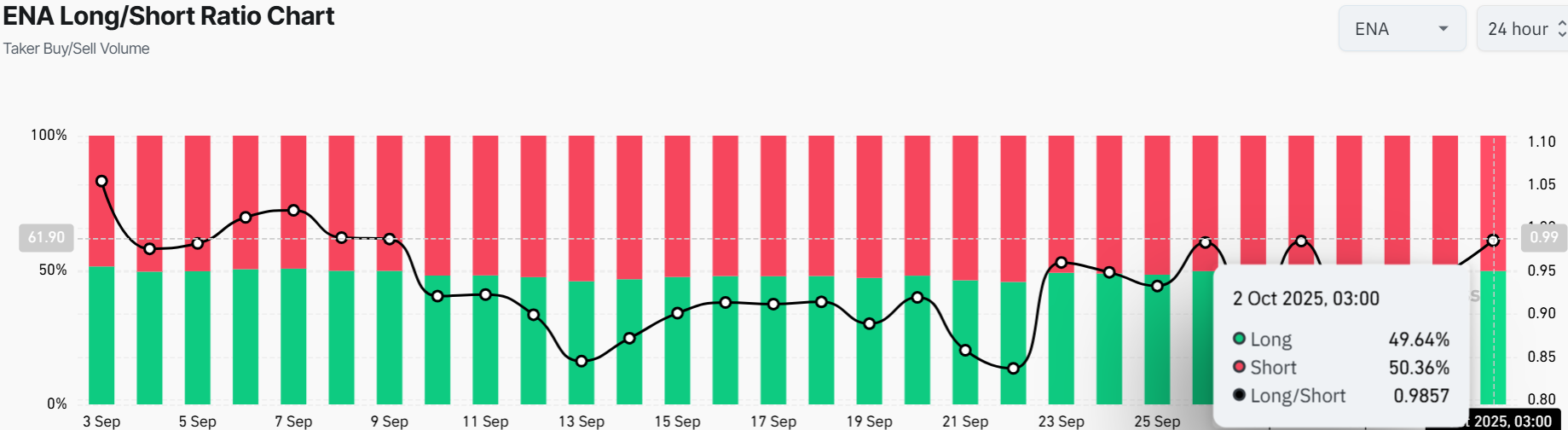

Notably, the ENA Long/Short Ratio is almost equal at 49.64%, accounting for the longs, as the shorts make up the rest, at 50.36%. Currently, the long/short ratio sits at 0.9857. This indicates that the market is fairly neutral, yet has a slight bias towards the long side. However, the rising open interest suggests that traders are putting money to work to drive upward momentum as the ecosystem continues to mature.

Ethena Price Breakout Needed to Confirm Recovery

The ENA/USD 1-day chart may be ready for a comeback after weeks of struggling to recover. Recent price movements and a descending chart pattern suggest that the Ethena price could be preparing for a breakout. The daily chart indicates that ENA has been stuck in a downward trend within a bearish channel. During this period, the price continued to fall but eventually found strong support around the $0.54 level.

This support zone has helped prevent further drops and created a possible launchpad for the next upward move. The bulls are now targeting the immediate resistance around $0.67 to spark a bullish rally.

The Relative Strength Index (RSI), which measures price momentum, is currently at 46.86. In the meantime, Ethena price may need to stay above the $0.54 support and break past the immediate resistance zone at $0.67 to confirm a true bullish reversal.

Conversely, if the $0.67 resistance proves too strong, it could see Ethena price retest the $0.54 support zone, delaying any hopes of a rally. For now, the chart shows some promising signs, but a clear breakout is needed to confirm that ENA is back on the path to recovery.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.