Highlights:

- Dogecoin price is showing bullish muscle, soaring 6% to $0.25.

- On-chain metrics indicate heightened accumulation as bearish momentum wanes.

- The technical outlook suggests increased bullish momentum, with bulls targeting $0.30 in the short term.

The Dogecoin price is bouncing back from support, showing strength as it pumps 6% to $0.25. The daily trading volume has increased by 21% to $3.09 billion, indicating growing investor confidence. The meme coin is now experiencing intense hype in the market, having soared 10% in a week and 20% over the past month. With the growing hype, can the Dog-themed meme coin rally to $0.40 in Q4?

Recent statistics indicate that the Dogecoin market has undergone a shift due to accumulation and trader sentiment. According to the on-chain metric, Santiment, it reveals that wallets holding between 1M to 10M DOGE (yellow line) have been growing their holdings continuously since mid-May, amounting to around 10.72B DOGE. This is a positive sign that mid-tier whales are continuing to show interest in DOGE.

The 10M–100M DOGE tier (blue line) exhibits accumulation behavior in June and July, preceding the mid-July DOGE price spike. This is a typical indicator of evaluation behaviour before a bullish run.

On the other hand, the wallets holding 100k–1M DOGE (red line) decreased sharply since April. They are now stabilising around 8.88B DOGE. This indicates that smaller holders are participating less. Smaller holders are often referred to as less-informed retail investors. This divergence supports the theory that “smart money” is positioning for more upside.

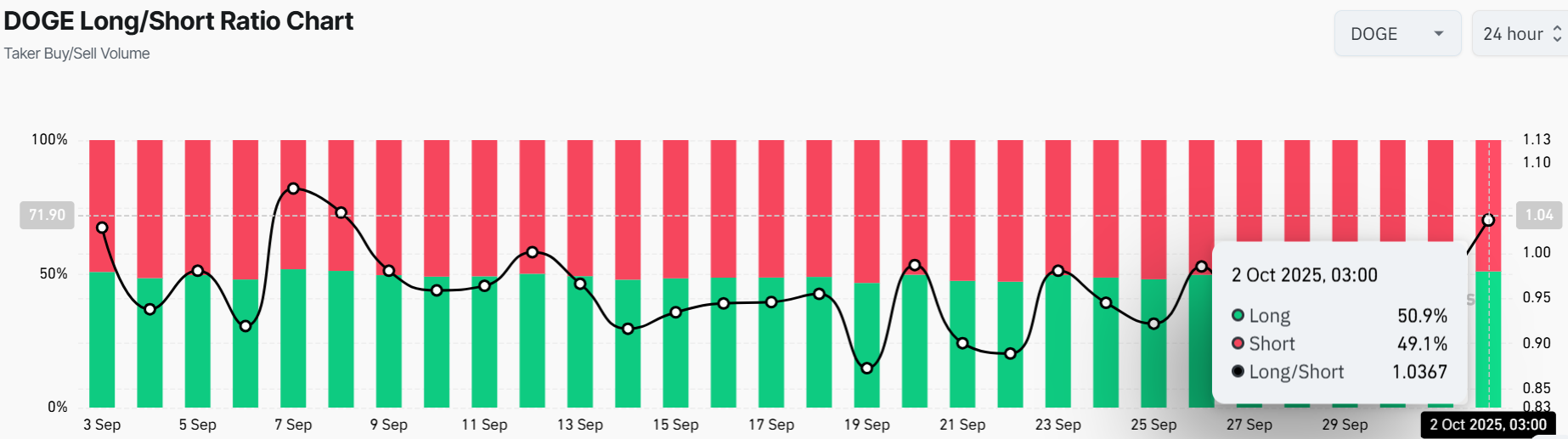

DOGE Traders Turn Slightly Bullish as Long Positions Rise

On the other hand, the DOGE long/short ratio boosts bullish sentiment. As of October 2, 2025, the long-to-short ratio has been raised to 1.04, comprising 50.9% from long positions. After the September 21 lows, derivatives traders have gone from largely neutral to slightly bullish over the past week.

DOGE Price Outlook: Bulls Target $0.30 In the Short Term

According to technical analysis, the Dogecoin price is breaking out of a bullish ascending triangle formation. Currently, the bulls are in control, as the DOGE price surges above the $0.23 (50-day) and $0.20 (200-day) SMAs. If the bulls build momentum and break above the upper trendline of the pattern, a bullish continuation towards $0.30 could be imminent.

With the RSI at 56.32, the coin has room to grow before it enters overbought territory. The RSI indicates a balanced position, suggesting a continuous rise with no significant price pressure yet. On the other hand, the MACD indicates a looming bullish crossover, which will be confirmed once the blue line crosses above the signal line.

If the price holds above the key support zones, the Dogecoin price could retest the local high around $0.30. Beyond that, the Dogecoin price could soar toward $0.40-$0.484 by Q4. Conversely, if it fails, there might be a crash back to $0.23 safety net or lower. Meanwhile, DOGE trading volume has spiked 19%, indicating bullish activity could extend, as there is intense trading activity.

In the short term, the Dogecoin price is expected to rise to around $0.30 over the next few days. In the long term, if the 50 SMA holds and volume spikes, there could be a push back to $0.40-$0.48 by late October.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.