Highlights:

- Bitcoin price has kicked off October with a 2% surge to $116,200.

- Metaplanet has acquired an additional 5268 BTC, bringing its total holdings to 30,823 BTC.

- On-chain metrics show a positive outlook with bulls targeting 130,000 by the end of October.

The Bitcoin price has kicked off October with a bullish grip, surging 2% to $116,200. However, its daily trading volume is still down 2% to $61.45 billion, indicating a decline in market liquidity. Recently, Metaplanet has gained greater exposure to Bitcoin in the crypto market as it acquired an additional 5,268 BTC, bringing its total to a massive 30,823 BTC.

$BTC Buys: Metaplanet acquires an additional 5,268 Bitcoin, bringing its total holdings to 30,823 BTC. pic.twitter.com/AlHmlQrMF8

— CoinGecko (@coingecko) October 1, 2025

Metaplanet’s decision to increase its Bitcoin holdings shows that there are still investors and companies that are confident in Bitcoin’s long-term value. Bitcoin’s price has been a topic of conversation in recent months, creating opportunities for traders to explore both long and short positions. With the recent breakout, can Bitcoin price rally to $130,000 in October?

Meanwhile, the crypto world isn’t the only sector seeing volatility. The US government shutdown may create additional uncertainty for the economy. Although shutdowns are often viewed as government slowdowns, Kyle Doops states that they usually generate market volatility.

Shutdowns slow government, not markets but the uncertainty always stirs up volatility. https://t.co/3yA4EG9eSb pic.twitter.com/pWCAMN9rUV

— Kyledoops (@kyledoops) October 1, 2025

BTC Derivatives Market Outlook

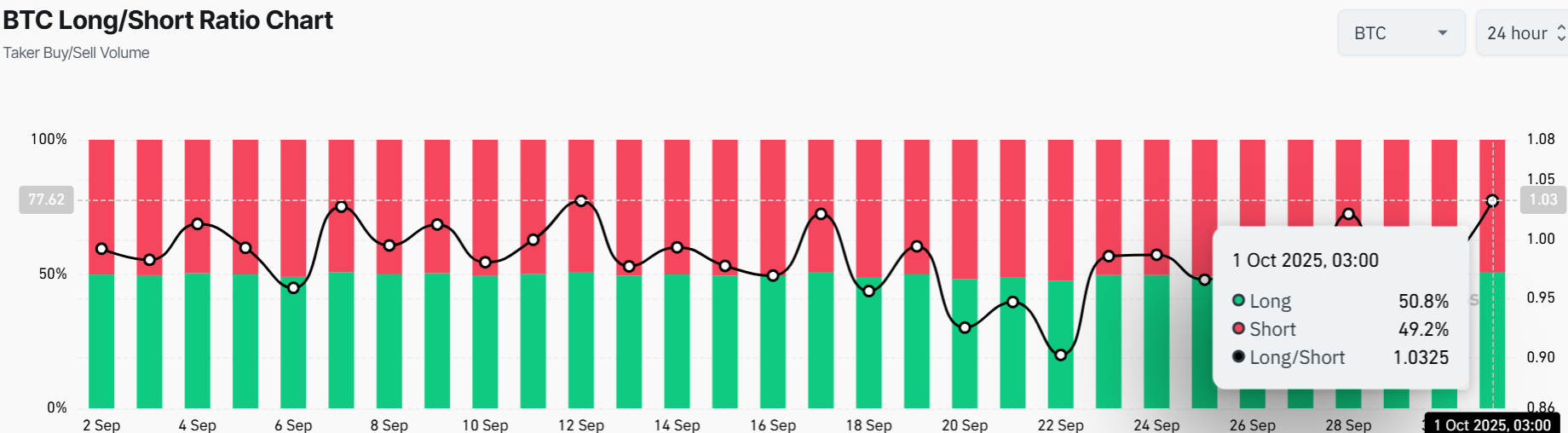

The Bitcoin long-short ratio chart, updated as of October 1, 2025, reflects that the ratio is almost even, at 51.26% long versus 48.74% short. This indicates very slow improvement, but with the long-to-short ratio standing at 1.0517, it indicates that the bulls are having the upper hand.

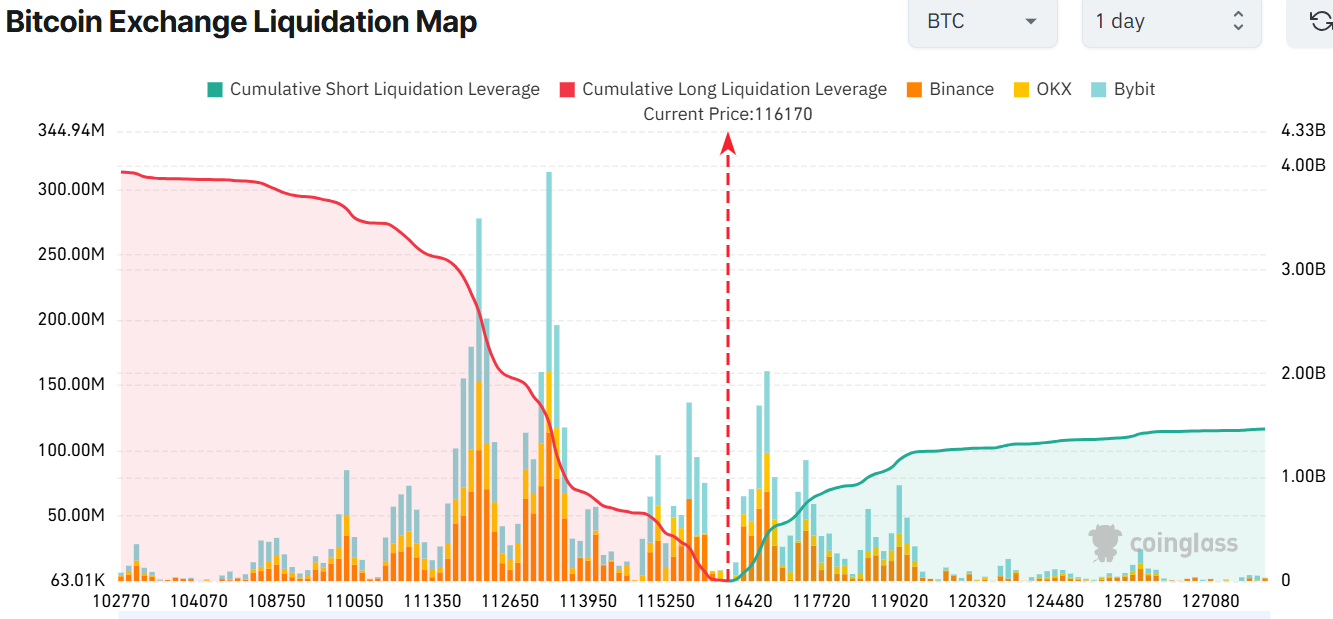

Data from the Coinglass Liquidation Map shows that there was more cumulative long liquidation leverage ($3.94 billion) compared to shorts ($1.46 billion) in the last 24 hours. This variation suggests that bullish sentiment is creeping back in the current BTC market. This is because traders anticipate the price may rise further in the coming weeks.

Bitcoin Price Prediction: Is $130K Plausible in October?

The BTC/USD chart shows the 1-day price action with a 50-day Simple Moving Average (SMA) at $113,538 and a 200-day SMA at $104,896. Further, with the support zones holding strong, a rally to $130K could be plausible this October. Currently, the bulls are targeting a break above the falling wedge, which often signals a bullish breakout.

The Relative Strength Index (RSI) sits at 58.12, showing growing buying pressure in the market. Zooming out, the falling wedge pattern signals potential upside for the Bitcoin price. The upside target lies near $130,000, marking it as the next big flex point, with a measured move suggesting a possible $20,000+ pump if BTC breaks through.

The 2% pump likely came from the recent Metaplanet BTC acquisition. The Bitcoin price has strong support at $ 113,538 (50-day SMA), and if that level breaks, it could drop to around $109,000. In the short term, expect some fluctuations as traders react to the recent government shutdown. Conversely, Bitcoin price could rise to $130,000–$140,000 by the end of October. Investors should watch the RSI. If it goes above 70, it might be time to take profits.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.