Highlights:

- Coinbase has defended Base network, as Paul Grewal says sequencers process transactions but do not match trades.

- Base is exploring a token launch and aims to add a Solana bridge to boost decentralization.

- Base has secured 4.83 billion TVL with stablecoin liquidity as it strengthens its position in the DeFi market.

Coinbase’s chief legal officer, Paul Grewal, dismissed claims that its Ethereum Layer-2 network, Base, should be labeled an exchange. Speaking in an interview, Grewal explained that Base functions as blockchain infrastructure, not a marketplace for securities trading. He stressed that transaction matching happens inside applications, including automated market makers or centralized order book protocols, not on the Layer-2 level itself.

Should @base be regulated like the Nasdaq exchange?

Here's what @coinbase CLO @iampaulgrewal has to say:

“Base is just a normal blockchain… Yes it’s a layer2. But that doesn’t change its relationship to securities laws.”

“We are not matching buyers and sellers of securities…… pic.twitter.com/Cd4M8kizTZ

— Bankless (@BanklessHQ) September 26, 2025

The U.S. Securities and Exchange Commission defines an exchange as a system that brings buyers and sellers together. This raised questions about whether sequencers, which order transactions, could fall into that category. Commissioner Hester Peirce warned that centralized sequencers might resemble matching engines and attract legal oversight.

Grewal argued that this interpretation creates confusion. He compared sequencers to cloud service providers, which run code but are not responsible for the activities built on top. Ripple’s David Schwartz supported that position, while Ethereum co-founder Vitalik Buterin praised Base for combining centralized sequencing with decentralized Ethereum security.

Base is doing things the right way: an L2 on top of Ethereum, that uses its centralized features to provide stronger UX features, while still being tied into Ethereum's decentralized base layer for security.

Base does not have custody over your funds, they cannot steal funds or… https://t.co/0EMdThg4gU

— vitalik.eth (@VitalikButerin) September 22, 2025

Grewal cautioned that treating sequencers as exchanges could impose heavy compliance demands. He said such restrictions would harm innovation and slow the development of Ethereum’s scaling ecosystem.

Coinbase Defends Base Network While Exploring Token Plans

Coinbase used its BaseCamp 2025 event in Vermont to outline new directions for the Base network. Jesse Pollak, who leads the project, revealed that the team is now exploring the launch of a native token. This represented a shift from earlier statements that ruled out any token for Base. Meanwhile, Coinbase recently launched a $5 million security program that is set to focus on its on-chain products and the smart contracts of the Base network.

Pollak clarified that no decision has been reached on token design, governance, or launch timing. However, he said that the exploration aligns with efforts to expand decentralization and support more opportunities for developers and creators. The remarks followed the recent token release by Consensys’ Linea network, which distributed more than nine billion LINEA tokens.

At the same event, Base announced a new bridge with Solana. The bridge will facilitate interoperability between ERC-20 and SPL tokens and allow more flexibility to users. Pollak termed these steps as crucial to developing more adoption and creating more avenues of cooperation among ecosystems. Grewal emphasized that the Base Network operates as infrastructure. He said compliance burdens should fall on applications, not on the Layer-2 itself. He added that mislabeling sequencers only spreads confusion and slows adoption.

Base Strengthens Its DeFi Position

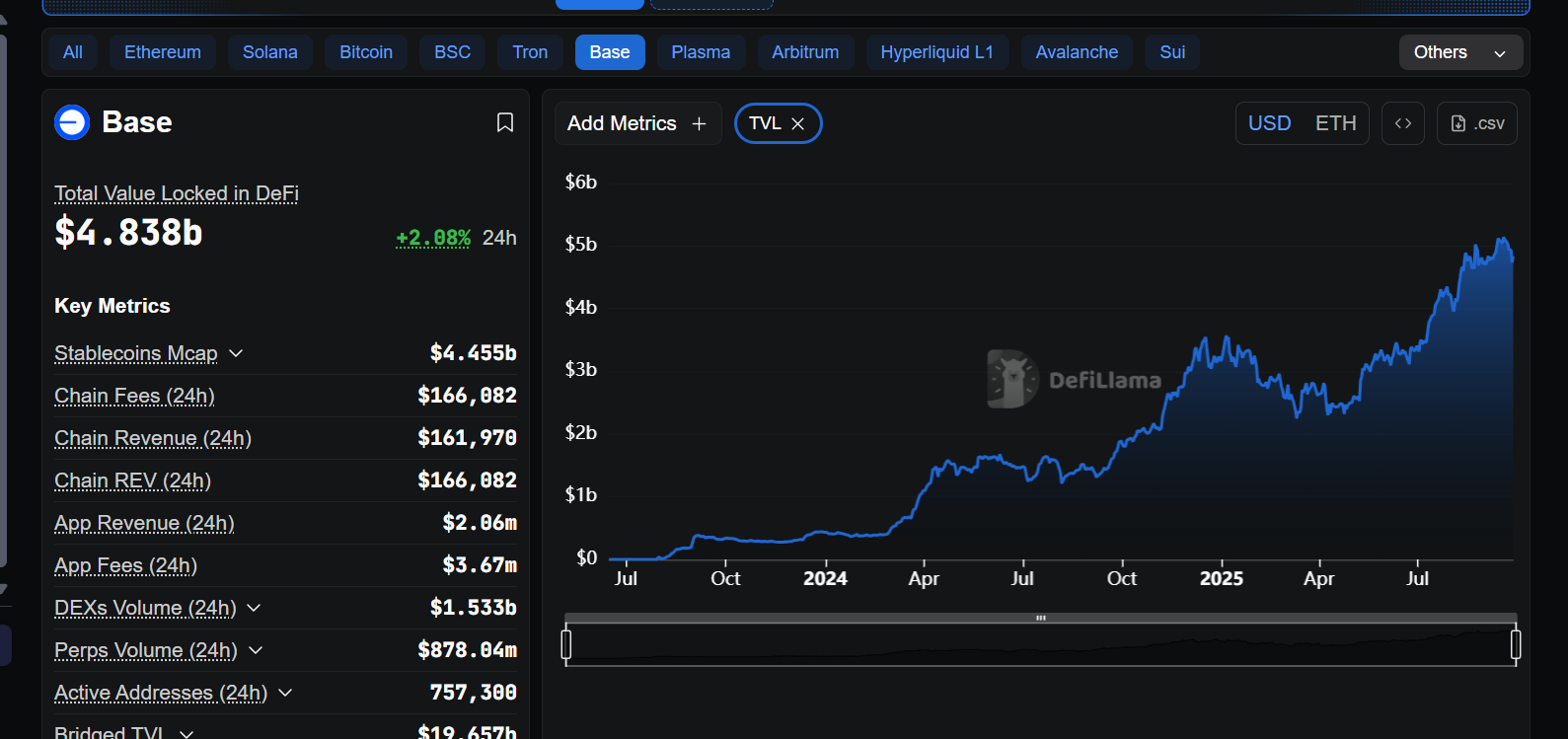

Base continues to gain traction in decentralized finance. The network has a total value locked of $4.83 billion in over 700 protocols. Liquidity is also high, and $4.4 billion of stablecoins are circulating on the network. These assets allow lending, trading, and other DeFi activity.

Ethereum remains dominant in the industry with a locked value of $86.3 billion. Solana comes behind, with Base gaining an increasing market share despite its smaller size. The gradual increase emphasizes the significance of the Coinbase user base and infrastructure. Base has positioned itself as a major player in the growth of the market. Its development demonstrates the ability of Layer-2 networks to compete and overcome innovation objectives as well as legal challenges.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.