Highlights:

- The Spark price is stealing the spotlight, surging 9% to $0.052.

- The recent surge comes amid PayPal’s partnership to grow PYUSD supply.

- The SPARK open interest has spiked, indicating growing investor confidence as bulls target $0.061 resistance.

The Spark price is stealing the spotlight, rising 9% to $0.052, as traders capitalize on its strong momentum. Notably, the daily trading volume has risen 863% to $384 million, indicating heightened investor confidence. Spark has partnered with PayPal to increase the supply of PYUSD by $1 billion in the coming weeks. This partnership addresses a growing demand for PYUSD and demonstrates the effectiveness of Spark’s stablecoin framework. The integration of this growth in the cryptocurrency market is expected to further enhance Spark’s position in this competitive market.

Spark joins forces with @PayPal to grow PYUSD supply by $1 billion within the coming weeks.

Having already reached 200m deposits, this milestone reflects both the demand for PYUSD and the effectiveness of Spark’s stablecoin bootstrapping framework. pic.twitter.com/kNri70hRGv

— Spark (@sparkdotfi) September 25, 2025

Spark and PayPal’s partnership will establish a valuable stablecoin in the ecosystem. Spark has reached 200 million deposits, indicating an increase in the use of PayPal’s own stablecoin, PYUSD. The PayPal stablecoin (PYUSD) supply just underwent a billion-dollar boost in response to surging demand. This new influx will scale both Spark’s financial ecosystem and PayPal’s broader crypto ambitions.

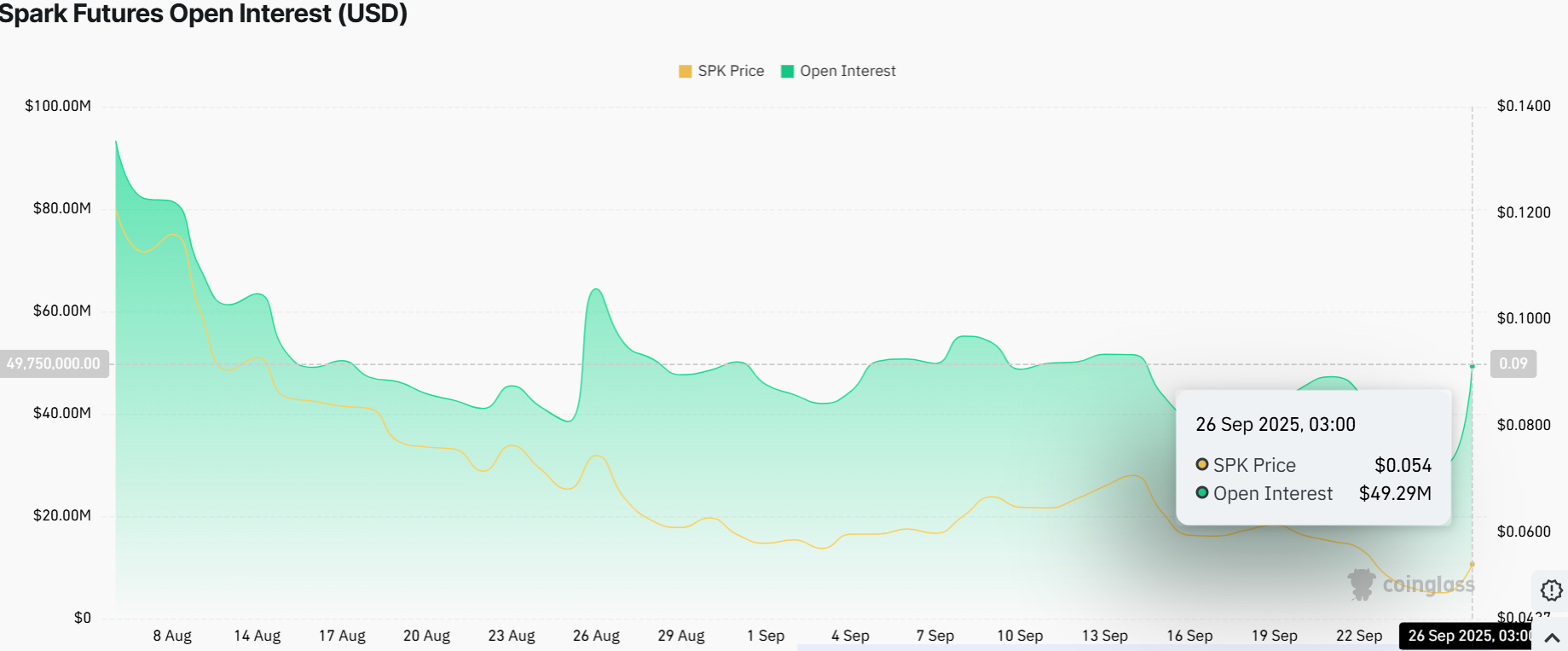

Spark Market Sentiment as Open Interest Surges

The chart for Spark Futures Open Interest shows a change in the market. The Open Interest recorded at $49.29 million, while the SPK price is trading at around $0.054. The future contracts in the market are relatively cautious but are not static.

The trend line shows that the SPK price has been in a significant decline over the last few weeks. However, there have been attempts to stabilize its value. As can be seen from the chart, market interest in Spark’s strategy is building up. The overall growth of the PYUSD ecosystem may further solidify Spark’s position as investor sentiment begins to return. This aligns with the bullish trend in the Spark price.

Additionally, an analysis of the total open interest reveals a phase of low volatility. However, the arrival of new money from the PayPal agreement could spike a price surge. Due to the accumulation of interest, traders are watching for a breakout in either direction.

Spark Price Outlook: Can Bulls Maintain the Momentum?

A quick look at the SPK/USD 4-hour chart shows that the token is trading within a falling wedge. Despite the 9% rally, the Spark price remains below the $0.055 (50-day) and $0.061 (200-day) SMAs, which cushion against further upside. Until the bulls overcome these immediate resistance levels, further downside is imminent in the Spark price.

The Relative Strength Index (RSI) at 51.47 indicates neutral territory, after plunging from the overbought territory. There’s no overextension yet, so there is room for more gains if the hype train rolls.

Spark’s recent price spike appears to be driven by excitement over the news of the PayPal collaboration. Right now, the Spark price could rally if it breaks through the resistance zones at $0.055 and $0.061. However, if the resistance zones prove too strong, the Spark price could fall to $0.048 as a safety net.

In the short term, traders can expect some fluctuations. The RSI suggests that a pullback could occur soon, possibly retesting the $0.04 support level. However, looking at the bigger picture, if Spark stays above the 50-day SMA, it could hit $0.061 by mid-October.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.