Highlights:

- The STBL price remains stable at $0.48, marking a 12% gain in a day.

- The surge comes following STBL KuCoin listing.

- The funding rate remains positive, showing positive momentum in the STBL market.

The STBL price remains stable at $0.48, representing a 12% increase. Accompanying the price movement is its daily trading volume, which has spiked 28% to $335 million. The recent surge comes as the new stablecoin meta-protocol, STBL, obtains an official listing on the KuCoin exchange as part of the company’s RWA on Sep 25. Having STBLs on one of the largest exchanges likely increases STBLs’ visibility, which in turn increases exposure and leads to greater acceptance.

KuCoin fam, get ready! 🔥$STBL is officially listing on @kucoincom!

📅 Trading starts: Sept 25, 2025, 08:00 UTC

💰 Pair: STBL/USDT

🔗 Deposits open now (BSC-BEP20)Official Announcement: https://t.co/jp9jDJGCfp https://t.co/oDfkpO3pDk

— STBL (@stbl_official) September 25, 2025

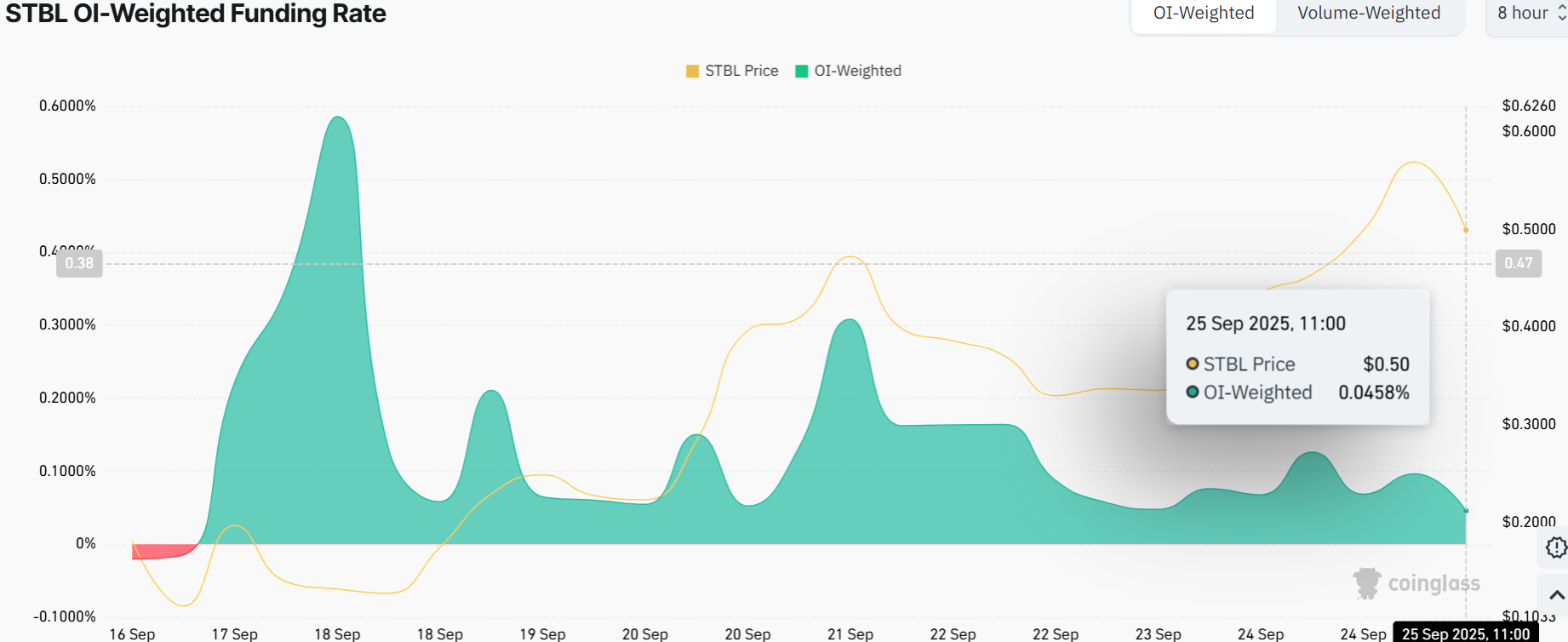

The inclusion of STBL into KuCoin enhances user participation, which in turn boosts the liquidity of stablecoins and holds promise for further growth. The increasing demand for more financially stable and secure cryptocurrencies has grown as the market progresses. Traders are very interested, as evidenced by the consistent rise in STBL at the open interest-weighted funding rate. Currently, the funding rate is positive a 0.0458%, indicating positive momentum.

If the funding rate is positive and not extremely high, it means that the longs are paying the shorts. This usually occurs when the market is rallying.

How High Can STBL Price Go?

The STBL price has increased significantly. According to the latest data, the token is now trading at $0.4876, sitting above the $0.4189 support level, coinciding with the 50-day SMA. The price action at present is consolidating inside an ascending channel, but could indicate that STBL is gearing up for a breakout or correction.

Diving into the technical outlook, an RSI of 52.06 indicates a neutral position in the STBL market. This gives the bulls room to move to the upside if the bears lose stamina in the market. The MACD indicator exhibits negative momentum as the histogram turns red. Moreover, the blue MACD line is sitting firmly below the signal line, cautioning that more downside is imminent in the STBL price.

Can Bulls Rally Towards $0.80?

The STBL/USD 2-hour chart indicates a potential target of around $0.80 if a breakout occurs with strong momentum. For now, the key level to watch is the resistance at $0.60. A daily close above this level could confirm a breakout and open the door for higher targets, such as $0.70 or even $0.80. Until then, the setup still favours the bulls, with limited downside and high potential rewards if the breakout is successful.

In short, the STBL price is holding firm at support and starting to show signs of turning upward. If the breakout happens, it could mark the start of a new bullish trend. Traders and investors are watching closely for confirmation in the days ahead. Conversely, if the bears capitalize on the sell signal from the MACD indicator, a plunge towards $0.41 support zone will be imminent. A drop below this mark will invalidate the bullish thesis, calling for further downside in the market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.