Highlights:

- Despite a 30% decrease in trading volume, XRP’s price holds steady at $2.86.

- XRP must maintain a price level of $2.80 or higher to avoid more downside, according to crypto analyst Ali Martinez.

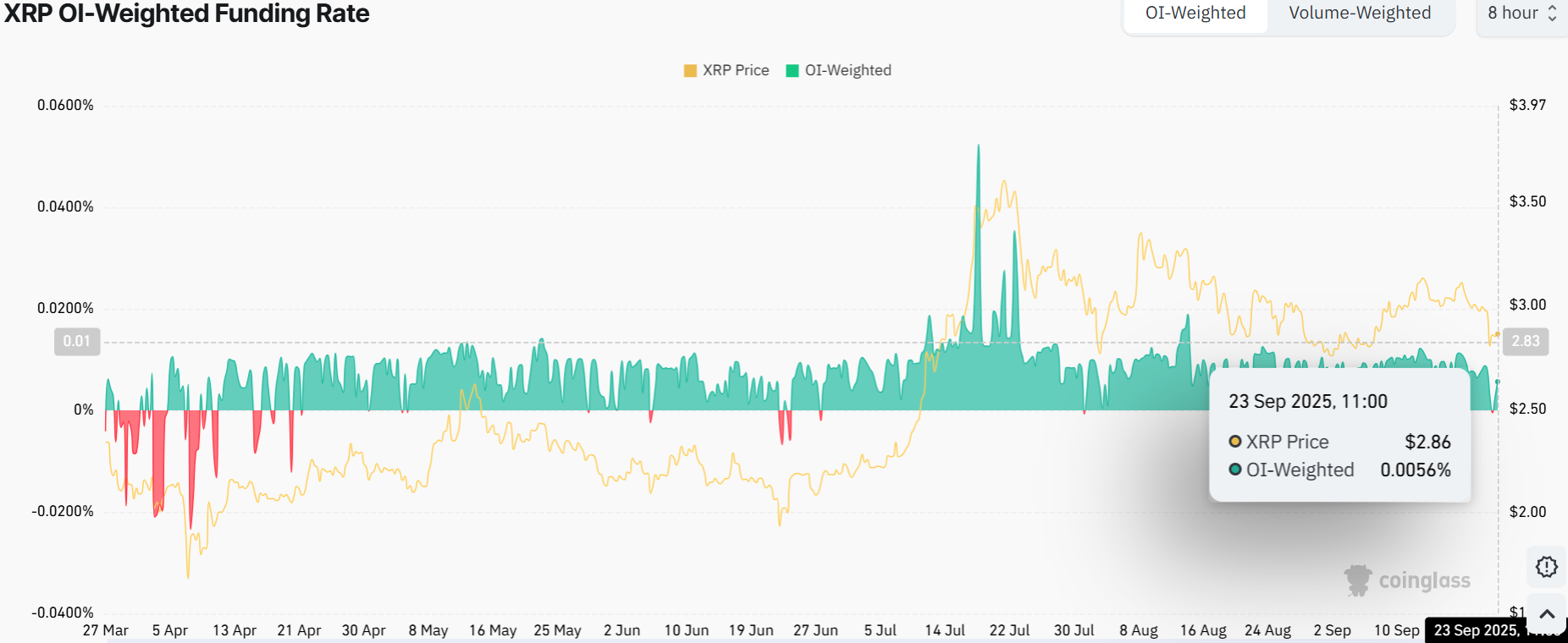

- XRP derivatives market is looking strong with a positive funding rate of $0.0056%.

The XRP price is showing stability around $ 2.86 mark. Meanwhile, XRP needs to hold above the $2.80 level, otherwise, Ali Martinez believes a crash will ensue. The XRP UTXO Realized Price Distribution (URPD) chart indicates that $2.80 is the key support level. This area represents a price zone where much activity occurred in prior transactions, and, therefore, the market participants may defend the price in these zones. Failure to do so will weaken the outlook and could imply further losses.

$2.80 is the most important support level for $XRP! pic.twitter.com/6sCz11GR91

— Ali (@ali_charts) September 23, 2025

The chart he shared shows that XRP’s price has fluctuated throughout the last several months, consistently testing the support at $2.80. For this reason, many traders are on alert for how the asset reacts around this price point. If the price can remain at this level, it could be an indication for the market to stay bullish.

XRP’s Derivatives Market Sentiment

XRP’s price is presently at $2.86. The OI-weighted funding rate reflects positive market sentiment. The price of XRP made significant moves during the bull run. As such, market activity increased. These price spikes caused some notable spikes. As of September 23, 2025, the funding rate is 0.0056%.

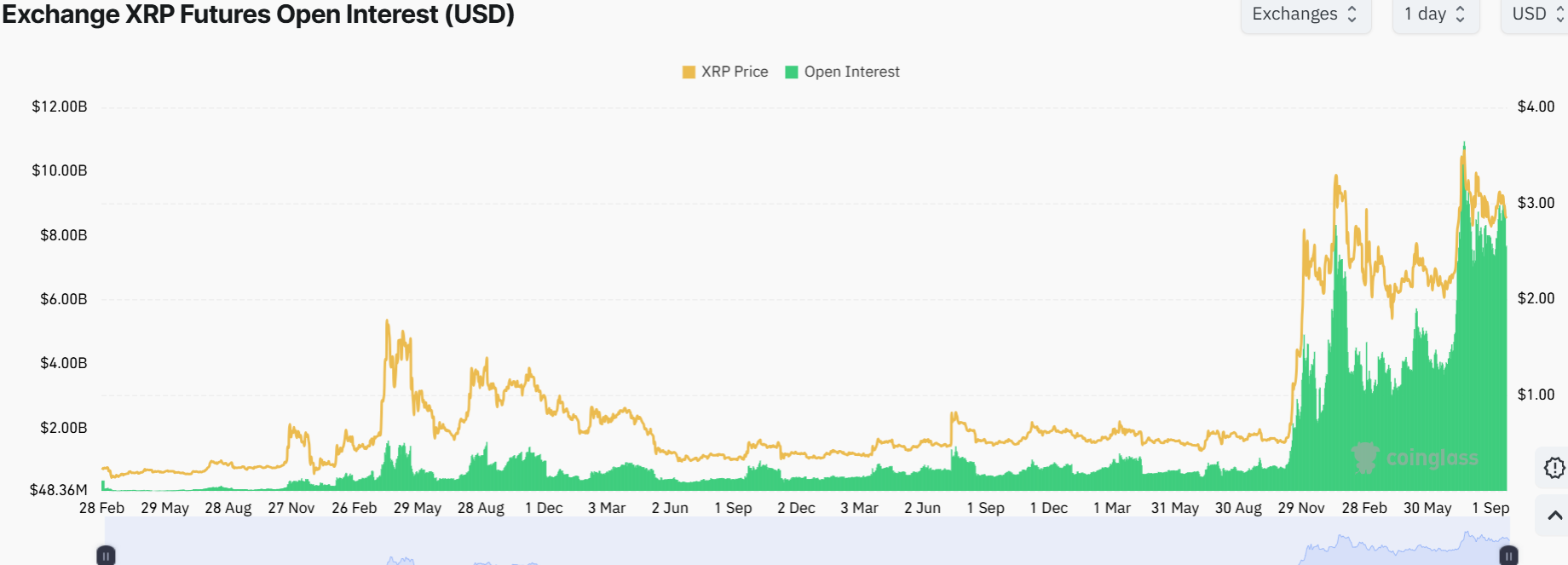

Latest data reveal that XRP’s futures open interest has been rising, reflecting growing investor confidence in the token. The chart shows that the open interest of XRP has been up since mid-2023, and this trend has continued till late September 2025.

Open interest helps in tracking the activity and strength of the market. Furthermore, open interest is the total value of open contracts. A rise in open interest typically indicates a bullish sentiment, whereas a drop in open interest can indicate that the market is weakening.

A closer look at the XRP price daily chart reveals that the token has entered a period of consolidation. The bulls have found strong support around the $2.53 area, while they push to overcome the $2.99 resistance.

Diving into the technicals, the RSI has dipped below the 50-mean level at 42.05. This suggests a neutral market outlook, and the price may fluctuate in either direction. On the other hand, the MACD indicator cautions traders that a sell signal has emerged. This is evident as the blue MACD line has crossed below the signal line.

XRP Price Prediction: Can the Bulls Overcome $2.99 Resistance?

Currently, if the bulls hold their ground, there could be a push back to $2.99 or even to $3.00 again. In the short term, investors may expect volatility as the price could dip to $2.76 if fear dominates. Long-term, however, XRP’s utility in the Ripple ecosystem could drive it past $3.50 by Q3.

The chart’s momentum indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), indicate neutral to bearish conditions, so a further decline from here wouldn’t be surprising. Investors should closely watch the $2.80 level, as a break below this point could signal a potential red flag. However, a break above the $2.99 could push the XRP price to greener pastures.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.