Highlights:

- BlackRock drives $270 million across Bitcoin and Ethereum ETFs, extending their winning streak to the second straight day.

- Bitcoin ETFs added $222.62 million, with BlackRock contributing $246.11 million.

- BlackRock Ethereum ETF was the only ETH fund that recorded net inflows on September 19.

Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds continued their impressive runs with a combined $270.37 million net inflows on September 19. This followed the $376 million net inflows recorded by the funds on September 18.

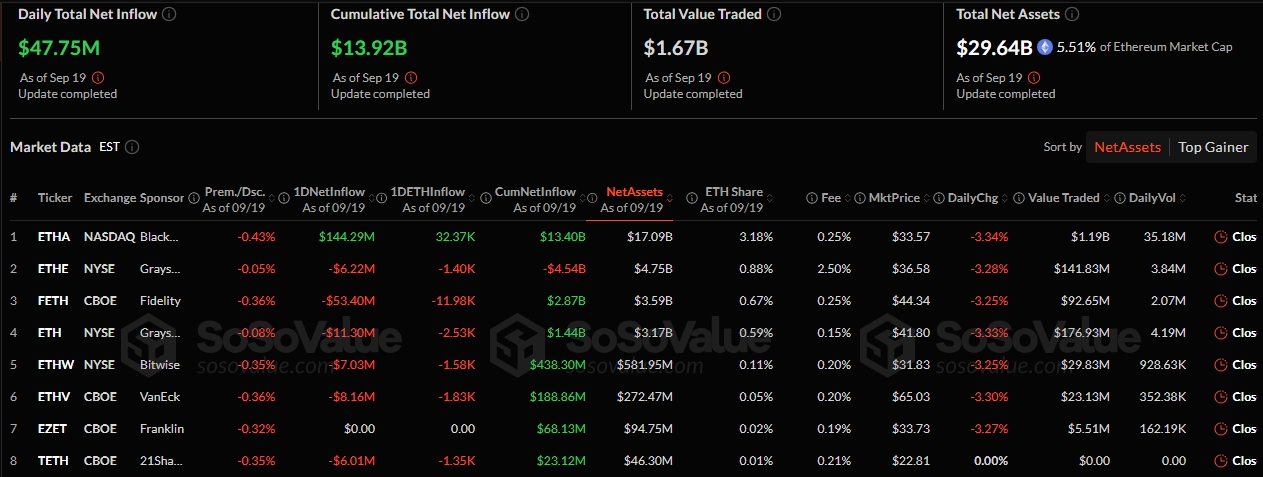

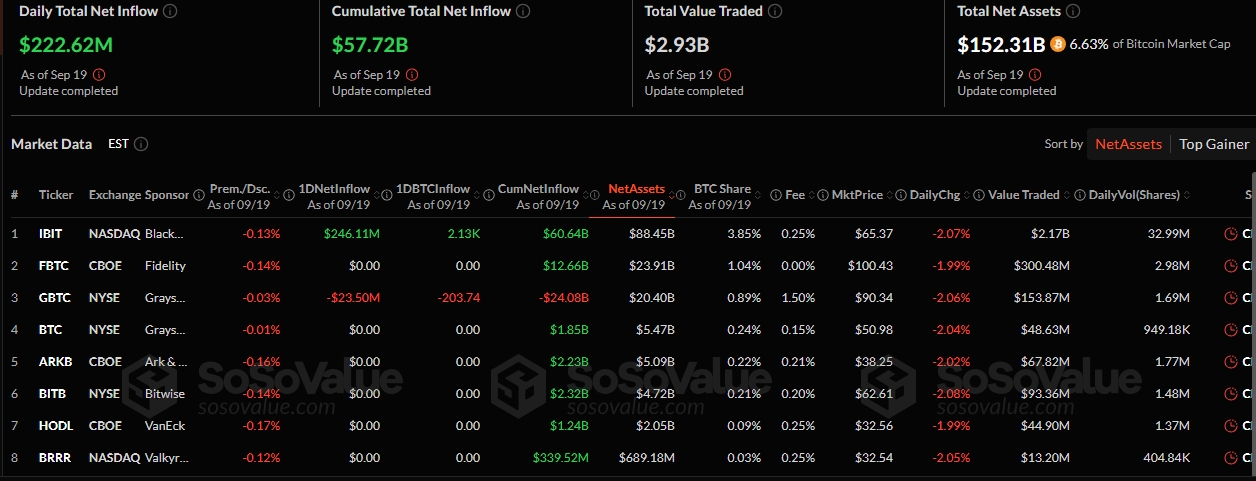

According to SosoValue’s most recent data, BlackRock led the inflows chart across Bitcoin and Ethereum funds with a combined $388.91 million inflows. Bitcoin ETFs added $222.62 million in net inflows, while their Ethereum counterparts attracted $47.75 million. These net inflows extended the funds’ net inflows streak to a second consecutive day.

On Sept 19, U.S. spot Bitcoin ETFs recorded $223M net inflows, with only BlackRock’s IBIT posting inflows of $246M. Spot Ethereum ETFs saw $47.75M net inflows, driven solely by BlackRock’s ETHA, which recorded $144M in single-day inflows.https://t.co/Hj2Gs48E6C pic.twitter.com/Hurbhy0P3F

— Wu Blockchain (@WuBlockchain) September 20, 2025

BlackRock Salvages Ethereum ETFs Amid Significant Losses from Other Funds

Yesterday, eight Ethereum funds were active, leaving Franklin Ethereum ETF (EZET) as the only fund with zero flows. Among the active ETFs, only BlackRock Ethereum ETF (ETHA) attracted cash inflows, valued at about $144.29 million. Fidelity Ethereum ETF (FETH) and Grayscale Mini Ethereum ETF (ETH) topped the outflows with $53.4 million and $11.3 million, respectively.

Other ETFs that recorded outflows were VanEck Ethereum ETF (ETHV), Bitwise Ethereum ETF (ETHW), Grayscale Ethereum ETF (ETHE), 21Shares Ethereum ETF (TETH), and Invesco Ethereum ETF (QETH). These funds forfeited $31.85 million in combined net outflow.

Overall, Ethereum ETFs’ cumulative metrics recorded slight upticks, except for the total net assets valuation, which dropped from $30.54 billion to $29.64 billion. This new valuation represents 5.51% of Ethereum’s market cap. In contrast, total net inflows rose from $13.87 billion to $13.92 billion, while the total value traded increased from $1.54 billion to $1.68 billion.

Ethereum Drops Below $4,500 Amid Bitcoin and Ethereum ETFs Combined Inflows

Ethereum is trading at $4,468, following a 1.3% decline in the past 24 hours. It also fluctuated between $4,443.55 and $4,541.88 with a trading volume of $22.96 billion. Ethereum’s weekly price change metric is 5.6% down, oscillating between $4,443.55 and $4,724.03. Meanwhile, sentiment has remained bullish with low supply inflation at 0.3%, medium volatility at 3.09%, and 13.38% dominance.

Bitcoin ETFs Record Reduced Market Activity Levels

Unlike Ethereum, only two Bitcoin ETFs were active on September 19. BlackRock Bitcoin ETF (IBIT) added $246.11 million, while Grayscale Bitcoin ETF (GBTC) lost $23.5 million. Despite yesterday’s net inflow, Bitcoin ETFs’ total value traded and net asset valuation dropped by significant margins.

The former fell from $3.45 billion to $2.93 billion, while the latter dropped from $155.05 billion to $152.31 billion. The current net assets valuation represents 6.63% of Bitcoin’s market cap. On the other hand, the total net inflow rose from $57.49 billion to $57.72 billion.

BTC’s Price Drops Slightly

Despite Bitcoin and Ethereum ETFs’ net inflows, Bitcoin is changing hands at $115,787 following a 0.7% decline in the past 24 hours. BTC’s 7-day-to-date data also showed a 0.3% decline, with price extremes oscillating between $114,696 and $117,851. In contrast, Bitcoin’s long-term data, including month-to-date and year-to-date metrics, reflected increments of about 2.1% and 82.5%, respectively.

Meanwhile, Michael Saylor predicted that Bitcoin is on the verge of outperforming the S&P 500 forever. The co-founder noted that the stock index could lose 29% valuation every year relative to Bitcoin. He also emphasised the role of inflation and central bank policies in the devaluation of traditional currencies, adding that Bitcoin’s fixed supply and decentralised design help it circumvent these limitations.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.