Highlights:

- Ethereum and Bitcoin ETFs rebound with $376 million in combined net inflow.

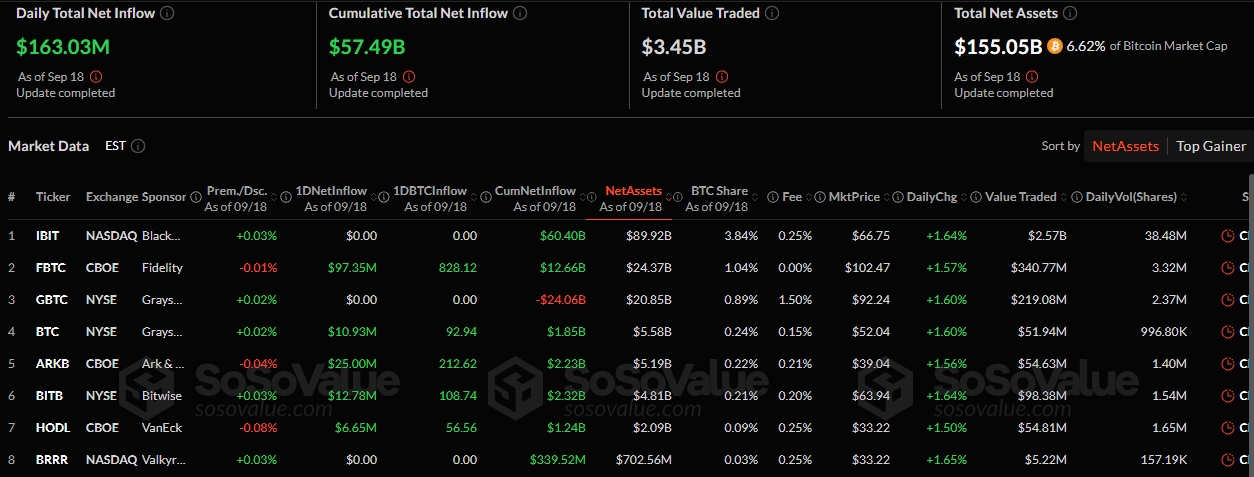

- Ethereum led the inflows with $213.07 million. Bitcoin followed with $163.03 million.

- BlackRock had zero flows across Ethereum and Bitcoin funds.

On September 18, Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs) attracted $376 million in combined net inflows, bouncing back from the $53.2 million combined net outflows on September 17. According to SosoValue’s most recent flow data, Ethereum led the ETFs flow with $213.07 million in net inflows, while its Bitcoin counterpart added $163.03 million.

On September 18 (ET), Ethereum spot ETFs recorded a total net inflow of $213 million, with none of the nine ETFs seeing net outflows. Bitcoin spot ETFs saw a total net inflow of $163 million, with all twelve ETFs also reporting no net outflows.https://t.co/Tvs2oCS03I pic.twitter.com/lwaV9iOcHr

— Wu Blockchain (@WuBlockchain) September 19, 2025

BlackRock Blanks as Ethereum ETFs Record Net Inflows

Yesterday, six ETFs were active as the remaining three, including BlackRock Ethereum ETF (ETHA), VanEck Ethereum ETF (ETHV), 21Shares Ethereum ETF (TETH), and Invesco Ethereum ETF (QETH), recorded neither inflows nor outflows. Fidelity Ethereum ETF (FETH), Grayscale Mini Ethereum ETF (ETH), and Bitwise Ethereum ETF (ETHW) led the inflows with $159.38 million, $22.9 million, and $17.47 million, respectively.

Grayscale Ethereum ETF (ETHE) and Franklin Ethereum ETF (EZET) also added $9.83 million and $3.49 million, respectively. As a result of the inflows, the total net inflows increased from $13.66 billion to $13.87 billion, while the total net assets rose from $29.72 billion to $30.54 billion. In contrast, the total value traded dropped from $2.35 billion to $1.54 billion.

ETH Records Slight Drop Amid Ethereum and Bitcoin ETFs Rebound

At the time of writing, Ethereum’s price is down 1.3% in the past 24 hours, trading at $4,521. It also fluctuated between $4,522.50 and $4,636.49 with a 24-hour trading volume of $26.54 billion. Despite the slight price drop, Ethereum’s sentiment has remained bullish with a neutral “Fear & Greed Index.” Supply inflation remains low at 0.3%, with a medium volatility at 3.24%, and a 13.43% dominance.

Fidelity Tops Bitcoin ETFs’ Latest Inflows

Seven Bitcoin ETFs traded on September 18, signifying increased market activity levels. Like Ethereum, BlackRock Bitcoin ETF (IBIT) also recorded zero flows. Other Bitcoin ETFs that had neither inflows nor outflows included Grayscale Bitcoin ETF (GBTC), Valkyrie Bitcoin ETF (BRRR), and WisdomTree Bitcoin ETF (BTCW).

Fidelity Bitcoin ETF (FBTC) led the inflow with $97.35 million. Other ETFs that recorded over $10 million in inflows were ARK 21Shares Bitcoin ETF (ARKB), Bitwise Bitcoin ETF (BITB), and Grayscale Mini Bitcoin ETF (BTC). These funds added $25 million, $12.78 million, and $10.93 million, respectively.

Other profitable ETFs included the Franklin Bitcoin ETF (EZBC), the VanEck Bitcoin ETF (HODL), and the Invesco Bitcoin ETF (BTCO). They added $6.8 million, $6.65 million, and $3.51 million, respectively. Overall, Bitcoin funds’ cumulative metrics, except for the total value traded, saw slight upticks. The total net inflow increased from $57.33 billion to $57.49 billion, while net asset valuation reached $155.05 billion after adding $2.6 billion. However, the total value traded dropped $4.24 billion to $3.45 billion.

BTC Dips Slightly Despite Ethereum and Bitcoin ETFs Inflows

At the time of writing, Bitcoin is priced at $116,487, following a slight 0.6% decline in the past 24 hours. Within the same timeframe, BTC has fluctuated between $116,483 and $117,888 with a trading volume of $36.7 billion. BTC’s other extended period price change variables reflected upswings, suggesting that the current decline might be short-lived.

Meanwhile, institutions and individual investors have continued to show strong interest in BTC as a sustainable store of value. On September 17, Crypto2Community reported that a Bitcoin wallet resurfaced after 23 years of inactivity, transferring $116 million worth of BTC to four new addresses. On September 18, Japanese crypto firm Metaplanet launched Income Corp. in Miami, United States. The new initiative aims to boost the company’s Bitcoin acquisition business.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.