Highlights:

- The Bitcoin Cash price is building strength with a fresh year-to-date high of $648.

- This surge comes following the Fed’s rate cut to 25bps.

- BCH open interest and long/short ratio signal a positive outlook as buyers target $700 and beyond.

The Bitcoin Cash price is catching everyone’s attention with a fresh year-to-date high of $648. Currently, the token is up 5% to $638, with the trading volume spiking 168% to $1.38 billion. Meanwhile, the Federal Reserve recently cut interest rates by 25 bps, a development with implications for several cryptocurrencies.

CryptoQuant reports suggest that over $2.1 billion worth of USDT and USDC inflows have occurred into Binance in a short period. The development is noteworthy as it indicates a growing institutional interest in cryptocurrency. This is particularly notable given that whale deposits on the exchange now average $214,000, compared with $63,000 in July.

With the Fed's decision to cut interest rates by 25 bps, CryptoQuant data shows Binance attracting over $2.1 billion in USDT and USDC inflows. Whale deposits now average $214,000 vs. $63,000 in July, suggesting growing institutional activity.

Altcoin deposits are also booming:… pic.twitter.com/5q0ONVBuAL

— Ali (@ali_charts) September 18, 2025

Altcoin deposits likewise evidence this trend of increased institutional activity. For instance, Binance has received 25,000 altcoin deposits while Coinbase has only seen 6,000. A combination of institutional interest and rising altcoin activity has made Binance the exchange of choice for those who want to profit from the increased volatility and liquidity.

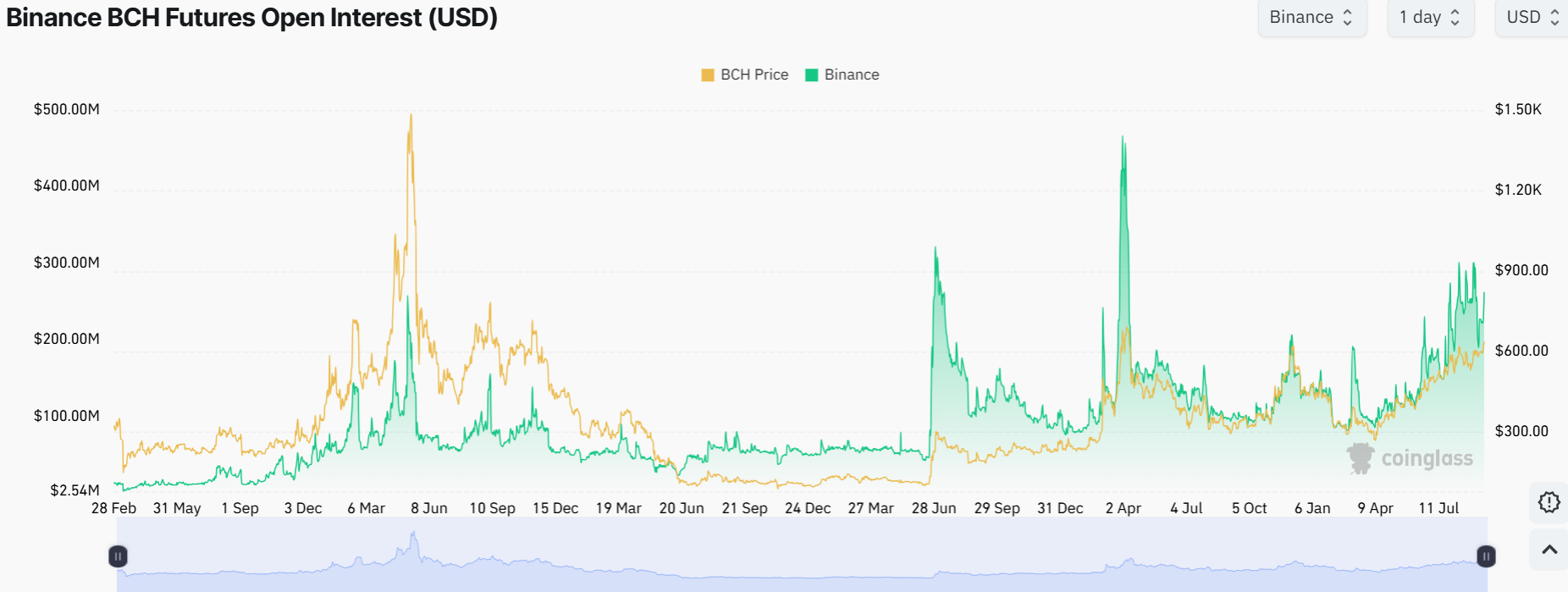

BCH Futures Open Interest and Market Sentiment Analysis

Recently, there was significant movement in the Bitcoin Cash futures market, as the Binance BCH Futures Open Interest reached new highs and the BCH price spiked. The data showed that the price of BCH was fluctuating all year, but during late spring and early summer, the open interest suddenly spiked considerably. This coincides with a period during which BCH receives more attention due to market trends and an increase in the number of traders using futures trading.

BCH futures open interest has increased by over $300 million due to higher institutional participation. This could be due to traders anticipating volatility. There seems to be a correlation between price action (the yellow line) and open interest (the green line). An increase in speculation leads to a rise in price.

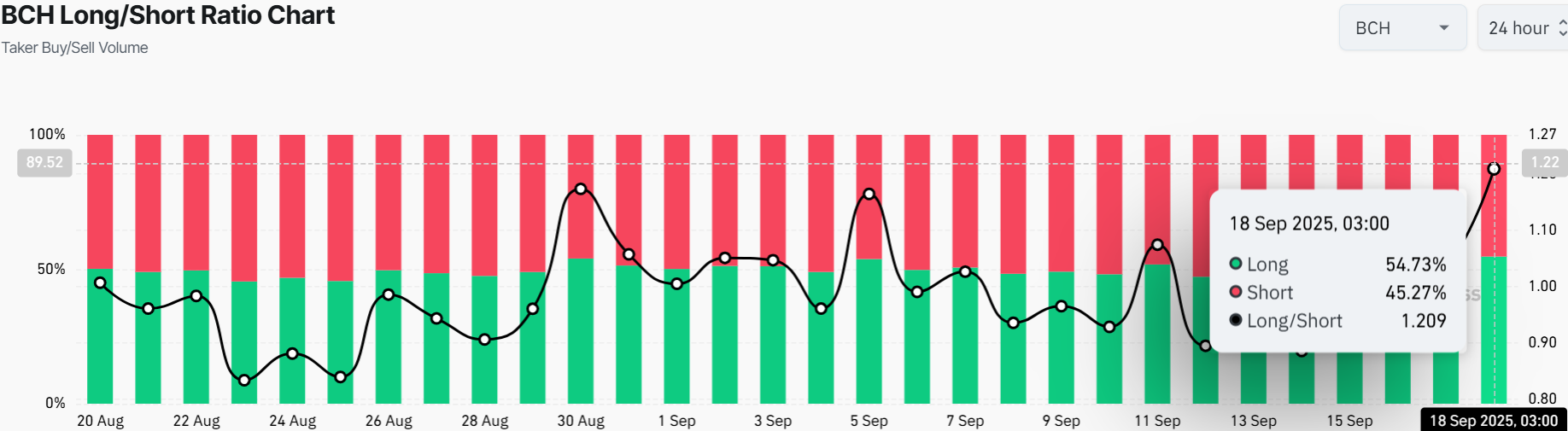

The market sentiment for BCH is bullish, mainly because the number of long positions continues to rise. The BCH Long/Short Ratio indicates that longs are prevailing, with 54.73% of traders holding long positions and 45.27% short as of September 18, 2025.

Traders are having a positive outlook on BCH as it approaches resistance and hope that it breaks key technical levels. Longs have been increasingly growing over the past year, clearly evidencing why the Bitcoin Cash price will further succeed.

Bitcoin Cash Price Bulls Aim for $700 Level and Beyond

The Bitcoin Cash price technical outlook further supports this optimistic sentiment. BCH’s continual rise above the 50-day and 200-day moving averages shows that price action is bullish. So far, BCH has surged by over 46%, driving investor excitement. The bulls have firmly established strong support around $577 and $450, bolstering the bullish trend.

According to the BCH/USD daily chart, the Relative Strength Index (RSI) stands at 65.47, indicating that the Bitcoin Cash price is experiencing intense buying pressure. However, it is still in a position to rise. The MACD (Moving Average Convergence Divergence) is also undergoing a bullish crossover, which indicates more upside for BCH.

Looking ahead, if Bitcoin Cash price holds above support zones, there could be a test of the next resistance at $763 in the coming weeks. However, a pullback to $591 support zone could be a prime entry point for investors. However, a drop below this level might signal a retreat to $577 safety net. For now, the chart’s green light suggests riding this wave, but extreme caution is necessary.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.