Highlights:

- Metaplanet launches Income Corp. in the United States as part of its investment efforts.

- The company’s Board of Directors has approved the new initiative that will also focus on Bitcoin-linked derivative activities.

- Metaplanet CEO also announced the successful closure of its public offering that raised substantial funds for the company.

Japanese-based crypto investment firm, Metaplanet, has announced a significant step to boost its Bitcoin expansion strategy. According to a September 17 tweet, Simon Gerovich, the company’s Chief Executive Officer (CEO), noted that the company’s Board of Directors has approved the creation of a new United States subsidiary, named Metaplanet Income Corp.

The new establishment is based in Miami, designed to drive Metaplanet’s Bitcoin Income Generation Business. Describing the initiative’s purpose, Gerovich emphasised the significance of capital inflows for companies.

The CEO stated:

“This business has become our engine of growth, generating consistent revenue and net income. We are cash flow positive, producing significant internal cash flow to support future initiatives.”

Income Corp. will focus on Income Generation

Metaplanet launched its Bitcoin Income Generation Business in the fourth quarter (Q4) and has since been generating steady profits. Beyond income generation, the Income Corp. will also focus on Bitcoin-linked derivatives. Overall, the initiative aims to separate Metaplanet’s Bitcoin Income Generation Business from its main Bitcoin treasury operations. It will also improve the company’s governance, transparency, and risk management.

Metaplanet has established Metaplanet Income Corp. in the U.S. to further expand our Bitcoin Income Generation Business. This business has become our engine of growth, generating consistent revenue and net income. We are cash flow positive, producing significant internal cash… https://t.co/WvWkK5ZWzv

— Simon Gerovich (@gerovich) September 17, 2025

Other Details About Metaplanet’s New Subsidiary

According to a publication on X, the subsidiary will launch with $15 million as its initial capital. Metaplanet Holdings Inc. will serve as its 100% shareholder, while Simon Gerovich, Dylan LeClair, and Darren Winia will act as Directors. Speaking on financial implications, Metaplanet noted that the Income Corp. will not impact its consolidated financial results for this year. The company added that it will update the public on any significant changes that could arise from its latest initiative.

Metaplanet Announces Closure of its Successful Public Offering

Metaplanet also recently closed its latest public offering with strong interest from some of the world’s leading investors. Notably, the offering attracted diverse funds, including fund complexes, hedge funds, and sovereign wealth funds.

Gerovich stated:

“Nearly 100 investors joined our roadshow, many hearing the Metaplanet story for the first time. More than 70 ultimately invested, creating a truly global and long-term oriented shareholder base.”

While he failed to mention the amount raised from the offering exercises, the CEO described it as intense yet rewarding. He also noted that the planning period for public offering involved back-to-back calls with investors. Within 24 hours, Metaplanet secured early commitments from leading institutional investors. Additionally, Gerovich noted that the raised capital strengthened the company’s balance sheet. Also, it attracted higher-quality global investors who will drive Metaplanet’s Bitcoin expansion project.

With the successful closing of our public offering today, we are proud to welcome a world-class base of leading global institutional investors—including some of the largest mutual fund complexes, sovereign wealth funds, and hedge funds. Their participation is a powerful… https://t.co/hnGPOpIPz4

— Simon Gerovich (@gerovich) September 17, 2025

Metaplanet Bitcoin Holdings Surpasses 20K BTC

On September 8, Crypto2Community reported that Metaplanet’s holdings have reached 20,136 BTC after a $15.2 million purchase for 136 tokens. The company purchased each token at an average cost of $111,666, increasing its entire Bitcoin holdings valuation to $2.08 billion.

On BitcoinTreasuriesNet, Metaplanet ranked as the sixth-largest publicly traded Bitcoin company. However, it remains the largest Japanese corporate Bitcoin holdings firm. Other companies in the top five global ranking were United States firms.

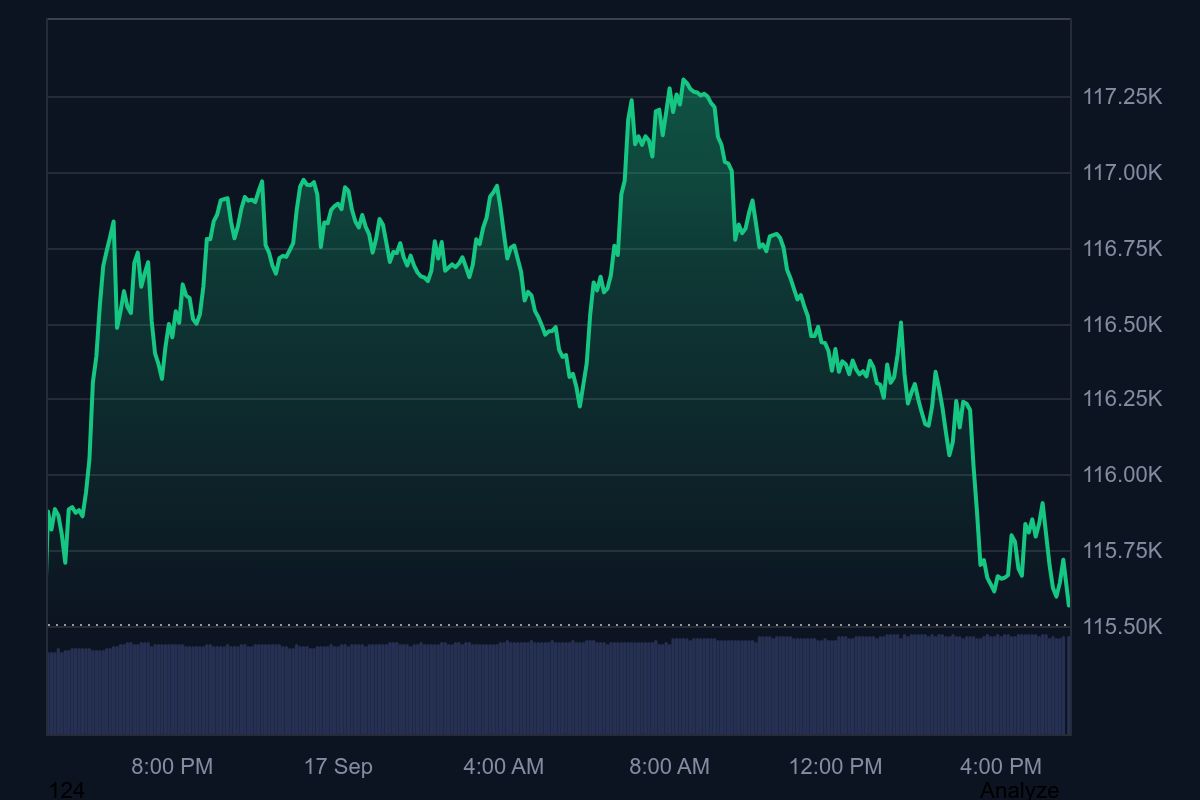

BTC Slips Slightly as Metaplanet Launches Income Corp. to Boost Bitcoin Holdings

Bitcoin is changing hands at $115,600 following a 0.2% decline in the past 24 hours. Within the timeframe, the flagship crypto has fluctuated between $115,570 and $117,292. Despite the slight drop, BTC’s sentiment remained bullish with low supply inflation at 0.85% and medium volatility at 2.06%.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.