Highlights:

- Galaxy Digital adds another 1.2 million SOL tokens valued at about $306 million.

- Lookonchain reported the purchase, noting that it happened via 13 transactions and was completed within 24 hours.

- In the past five days, Galaxy Digital has acquired 6.5 million SOL worth over $1 billion.

One of the world’s leading digital assets and Solana treasury firm, Galaxy Digital, has expanded its SOL holdings with an additional $306 million purchase for 1.2 million SOL tokens. Renowned crypto transactions tracker Lookonchain reported the latest accumulation in a tweet on its verified X handle on September 14.

According to the X post, Galaxy Digital completed its most recent purchase over 24 hours, increasing its total SOL acquisitions in five days to 6.5 million tokens, valued at about $1.55 billion. Notably, the Solana treasury company purchased the tokens via 13 transactions across centralised exchanges, including Bybit, Coinbase, and Binance.

Galaxy Digital bought another 1.2M $SOL($306M) in the past 24 hours.

Their total buys over the past 5 days have now reached ~6.5M $SOL($1.55B).https://t.co/f4FXOfK0vJ pic.twitter.com/NQ9da23mzm

— Lookonchain (@lookonchain) September 15, 2025

Lookonchain noted that this latest purchase comes a few days after the Solana treasury firm had purchased 325,000 SOL for $78 million. Meanwhile, on September 13, the on-chain transactions tracker reported that Galaxy Digital moved 4,719,937 SOL out of nearly 5 million tokens purchased within three days to Coinbase Prime.

Lookonchain stated:

“Galaxy Digital has bought nearly 5 million SOL ($1.16 billion) in the past 3 days, of which 4,719,937 SOL ($1.11 billion) has been moved to Coinbase Prime for custody. Their wallet still holds 219,830 SOL ($53.5 million).”

Galaxy Digital Maintains Fifth Spot in Public Companies Holding SOL Ranking

SSR data revealed that 17 entities hold 11.74 million SOL, worth approximately $2.86 billion. The accumulated tokens represent 2.08% of Solana’s total circulating supply. Out of these held tokens, two companies have staked 585,059 SOL, valued at approximately $104.1 million, generating an average yield of 6.86%.

Over the past week, Solana treasury firms purchased over 11 million tokens daily. The highest acquisitions happened on September 13 and 14, with firms purchasing 11.65 million SOL and 11.74 million SOL, respectively. Public companies, including Sharp Technology, Inc., DeFi Development Corp, and Upexi, Inc., have the highest number of SOL tokens in their treasury. They own 2.14 million SOL, worth $521.2 million, 2.028 million SOL, valued at about $493.9 million, and 2 million SOL, worth $487.1 million, respectively.

Forward Industries, a corporate treasury ranked fourth, with 1.45 million SOL valued at $352 million. Galaxy Digital followed closely in fifth spot with 1.35 million SOL valued at around $328.8 million. Other companies with over 1 million SOL in their treasury included Mercurity Fintech and iSpecimen Inc. They own 1.083 million SOL worth $263.9 million and 1 million SOL worth $243.6 million, respectively.

🚨 Breaking:$STSS (Sharps Technology, Inc.) @stsssol just announced a $400M acquisition of Solana.

This marks their first SOL purchase, instantly making them THE LARGEST digital asset treasury on Solana according to the official Solana treasury site.

Insane move. pic.twitter.com/9pTkcnoOdS

— jussy (@jussy_world) September 2, 2025

Company’s Stock Spikes as Galaxy Digital Adds 1.2M SOL

The past week’s data showed that Galaxy Digital’s stock recorded more spikes than declines. Between September 8 and 9, the stocks soared by 9.74%, dropped 1.88% on September 10, before spiking 10.7% on September 11. The stock closed September 12 up 2.46% at $29.58, after hitting a high of $30.29.

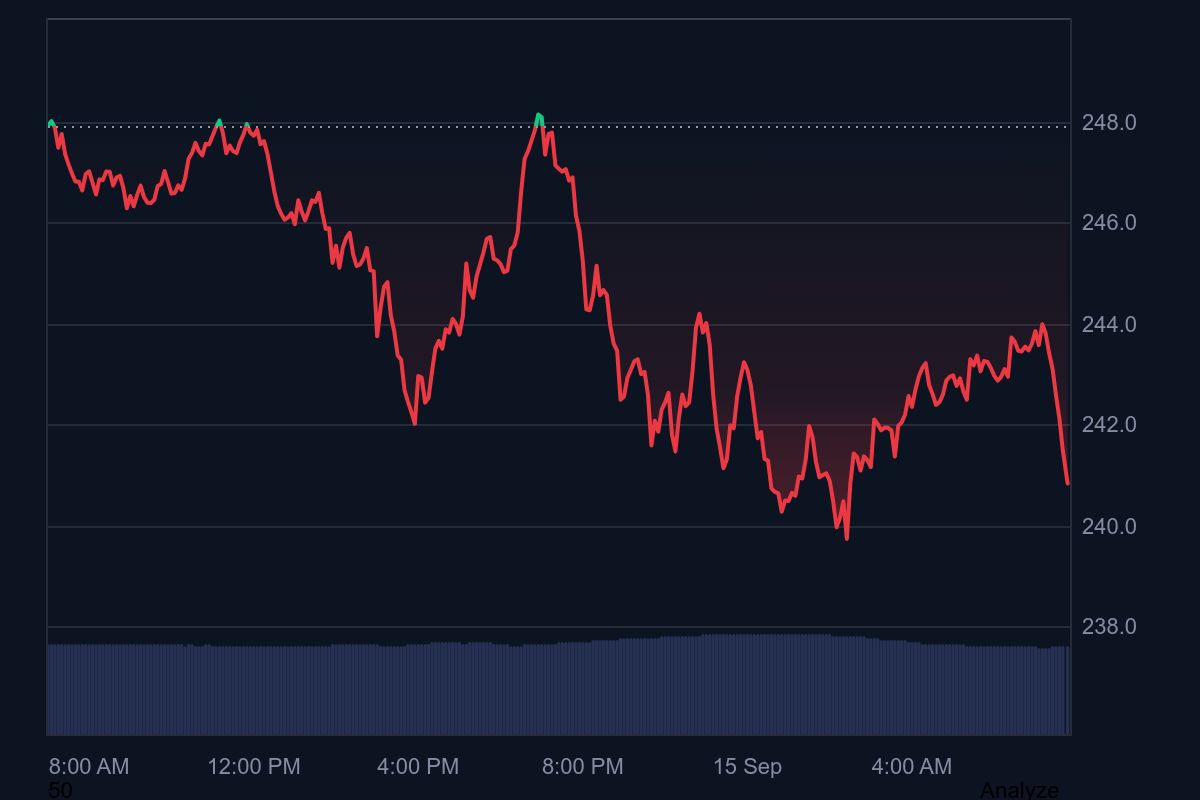

Despite the consistent accumulations, Solana dropped 2.35% in the past 24 hours, trading at $240.8, with price extremes fluctuating between $239.97 and $248.19. The 7-day-to-date price change variable is up by 16.1%, oscillating between $207.18 and $248.58.

On Coincodex, Solana’s supply inflation was high at 16.02% with a 3.22% dominance. Volatility was also high at 7.98% with a bullish sentiment. However, the “Fear & Greed Index,” which reflects investors’ attitude towards an asset, was neutral. Risk assessment showed that Solana has outperformed 90% of the top 100-ranked cryptocurrencies. However, Bitcoin (BTC) and Ethereum (ETH) continue to outperform the token.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.